Is Cryptocurrency Worth Investing In?

Cryptocurrency has been making headlines for years now, and it’s still a hot topic today. But what exactly is cryptocurrency, and is it worth investing in? In this article, we’ll take a closer look at cryptocurrency and help you decide if it’s right for your investment portfolio.

Understanding Cryptocurrency

Cryptocurrency is a digital or virtual currency that uses cryptography for security. It’s decentralized, meaning it’s not controlled by any government or financial institution. Instead, it’s based on a network of computers that verify and record transactions.

The Pros and Cons of Investing in Cryptocurrency

As with any investment, there are both pros and cons to investing in cryptocurrency. Here are a few of the key factors to consider:

Pros:

- High potential returns: Cryptocurrency has the potential to generate significant returns, as the market is still relatively young and there’s a lot of room for growth.

- Diversification: Cryptocurrency can help you diversify your investment portfolio and reduce your overall risk.

- Transparency: Cryptocurrency transactions are transparent and recorded on a public ledger, so you can always track your investments.

Cons:

- Volatility: Cryptocurrency is a very volatile investment, and prices can fluctuate wildly in a short period of time.

- Security risks: Cryptocurrency exchanges and wallets have been targeted by hackers, so it’s important to take steps to protect your investments.

- Lack of regulation: Cryptocurrency is not regulated by any government or financial institution, which can make it a risky investment.

Is Cryptocurrency Right for You?

Ultimately, the decision of whether or not to invest in cryptocurrency is a personal one. There are both potential benefits and risks to consider, and it’s important to do your research before you make a decision. If you’re considering investing in cryptocurrency, be sure to:

- Educate yourself: Learn as much as you can about cryptocurrency before you invest. There are a lot of resources available online and from financial advisors.

- Start small: Don’t invest more than you can afford to lose. Cryptocurrency is a volatile investment, so it’s important to be prepared for the possibility of losing your money.

- Diversify your investments: Don’t put all your eggs in one basket. Cryptocurrency should be one part of a diversified investment portfolio.

Is Cryptocurrency Worth Investing In?

Cryptocurrency has become a hot topic of discussion in recent times due to its potential for significant returns. However, like any investment, it also carries its share of risks. Before you decide whether or not to invest in cryptocurrency, it’s crucial to understand both its potential benefits and drawbacks thoroughly.

To help you make an informed decision, let’s dive into some key considerations regarding the risks and rewards involved in cryptocurrency investing.

Risks of Investing in Cryptocurrency

While cryptocurrency offers the alluring prospect of high returns, it’s important to be aware of the potential pitfalls associated with this type of investment. Here are some of the primary risks to consider:

Volatility

Cryptocurrency markets are notoriously volatile. Prices can fluctuate drastically in short periods, leading to significant losses or gains. This volatility makes it difficult to predict future value and can result in investors losing a substantial portion of their capital.

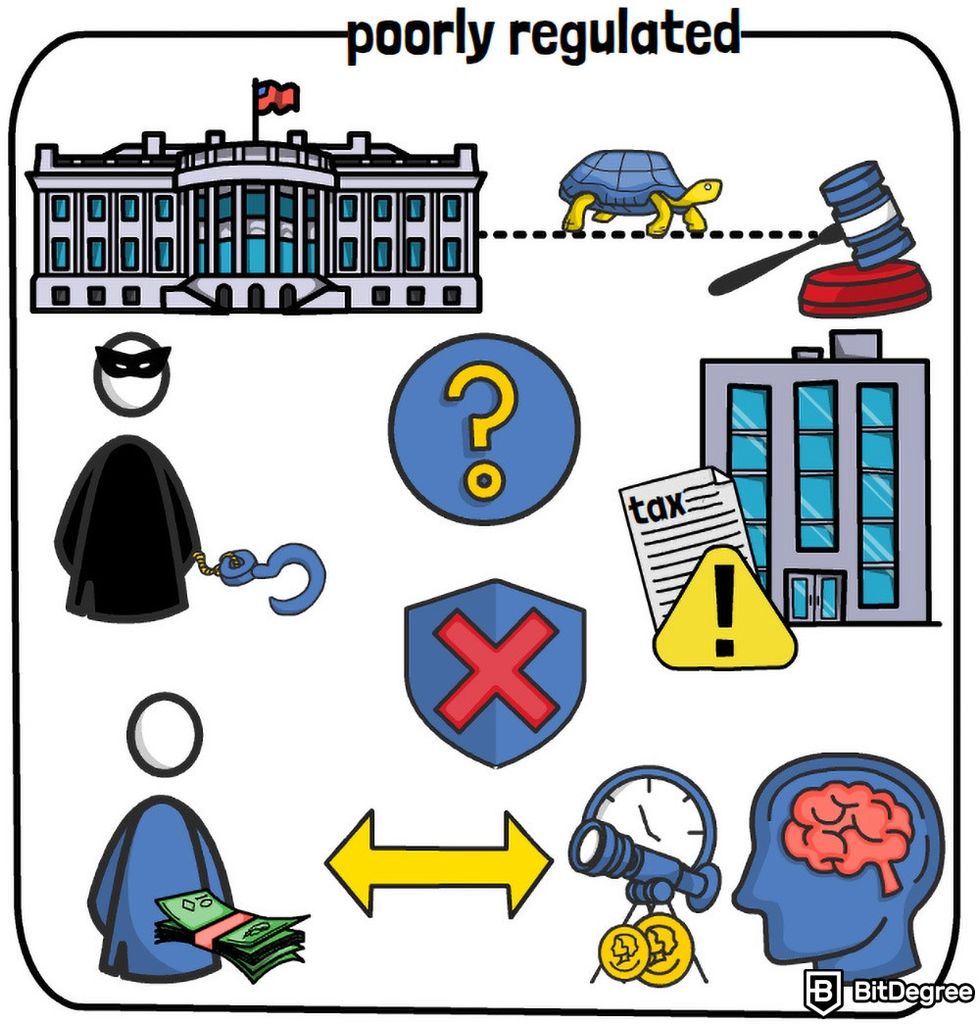

Unregulated

Unlike traditional investments such as stocks or bonds, cryptocurrency is largely unregulated. This lack of regulation means investors have limited protection against fraud, hacking, and other malicious activities. The absence of a regulatory framework increases the risks associated with cryptocurrency investing.

Susceptibility to Fraud and Hacking

Cryptocurrency transactions are conducted online, making them vulnerable to hacking and fraud. Cybercriminals often target cryptocurrency exchanges and wallets, leading to millions of dollars in stolen funds. Additionally, the anonymity associated with cryptocurrency can make it difficult to identify and prosecute perpetrators.

Lack of Intrinsic Value

Unlike traditional investments, such as real estate or precious metals, cryptocurrency does not have any inherent or tangible value. Its value is primarily driven by speculation and demand, making it susceptible to bubbles and market crashes. The lack of intrinsic value increases the risk of significant losses during market downturns.

Environmental Impact

Cryptocurrency mining, the process by which new coins are created, consumes significant amounts of energy, leading to concerns about its environmental impact. This energy consumption raises ethical questions for some investors and could potentially hinder the growth and adoption of cryptocurrency in the long run.

Is Cryptocurrency Worth Investing In? A Comprehensive Guide

In recent years, cryptocurrency has become a hot topic in the investment world. With its meteoric rise in popularity, it’s natural to wonder if it’s worth diving into this digital currency realm. But before you take the plunge, it’s crucial to arm yourself with knowledge and uncover the many factors that determine the viability of a cryptocurrency investment.

Factors to Consider Before Investing

1. Market Research: Digging Deep

Just like any investment, it’s vital to conduct thorough market research before investing in cryptocurrency. Familiarize yourself with the various cryptocurrencies available, their use cases, and the underlying technology powering them. This groundwork will help you make informed decisions and navigate the ever-evolving cryptocurrency landscape.

2. Risk Assessment: Knowing What You’re Getting Into

Cryptocurrency investments are inherently volatile, so it’s imperative to understand the potential risks involved. Market swings can be significant and unpredictable, and you should only invest what you can afford to lose. Remember, it’s better to be cautious than get caught holding a depreciating asset.

3. Investment Goals: Setting Your Sights

Before dipping your toes in the cryptocurrency waters, it’s essential to establish clear investment goals. Are you looking for short-term gains or long-term growth? By having a defined plan, you can tailor your investment strategy and make decisions that align with your financial objectives.

4. Diversification: Don’t Put All Your Eggs in One Basket

As the adage goes, don’t put all your eggs in one basket. Diversifying your investments is crucial to managing risk and increasing the chances of profitability. Consider spreading your funds across multiple cryptocurrencies or assets like stocks and bonds. This strategy can help minimize the impact of any losses from a particular investment.

No responses yet