Portfolio Risk Management: The Art of Minimizing Investment Uncertainty

Investing can be a rollercoaster ride, with ups, downs, and plenty of twists and turns along the way. And while you can’t completely avoid the risks that come with investing, you can manage them wisely to minimize your chances of losing money. That’s where portfolio risk management comes in, like a financial safety net helping you navigate the choppy waters of the market.

Understanding Portfolio Risk Management

Picture this: you’re walking on a tightrope high above the ground. You’re going to want to take steps to minimize the chances of falling, right? The same goes for investing. Portfolio risk management is all about balancing the risks and rewards of your investments wisely. It’s like spreading your eggs across several baskets, so if one basket falls, you don’t lose everything.

By diversifying your portfolio, you can reduce the impact of losses in any one investment. For example, if you invest in a mix of stocks, bonds, and real estate, a downturn in the stock market might not hurt you as much as if your entire portfolio was invested in stocks. And if interest rates rise, your bonds might do well even if your stocks are struggling.

But portfolio risk management isn’t just about diversification. It’s also about understanding your investment goals and risk tolerance. How much risk are you comfortable taking? And what are your long-term investment goals? Once you know your risk tolerance, you can create a portfolio that’s right for you, balancing risk and reward to help you reach your financial goals.

Diversification: The Cornerstone of Risk Management

Diversification is like the golden rule of portfolio risk management, a foolproof way to spread your wings and reduce your chances of crashing and burning. The idea is simple: don’t put all your eggs in one basket. By investing in a variety of assets, you can reduce the impact of any one asset performing poorly.

Stocks, bonds, real estate, commodities—the investment world is your buffet, and you should sample as many dishes as you can. Why limit yourself to stocks when you could savor the stability of bonds or the potential growth of real estate? Diversification is the key to unlocking a balanced portfolio, one that weathers the storms and keeps your investments on track for success.

Asset Allocation: Finding the Right Mix

Asset allocation is the secret sauce of portfolio risk management. It’s the art of dividing your investments among different asset classes, like stocks, bonds, and cash. The goal is to find the right mix that matches your risk tolerance and investment goals.

If you’re young and willing to take on more risk, you might allocate a larger portion of your portfolio to stocks, which have the potential for higher returns. But if you’re nearing retirement and want to protect your savings, you might allocate a larger portion to bonds, which are typically less risky.

Asset allocation is a delicate dance, and there’s no one-size-fits-all approach. The right mix for you will depend on your unique circumstances. But by carefully considering your risk tolerance and investment goals, you can create a portfolio that’s tailored to your needs, helping you reach your financial goals with confidence.

Portfolio Risk Management: A Comprehensive Guide to Mitigating Investment Risks

If you’re a savvy investor, you know that managing risk is just as crucial as chasing returns. That’s where portfolio risk management comes into play, a proactive approach to safeguarding your investments from the inevitable ups and downs of the market. So, let’s dive into the nitty-gritty of portfolio risk management, starting with the first step: identifying risk sources.

Identifying Risk Sources

Just like a doctor who needs to diagnose an illness before prescribing a cure, identifying risk sources is the bedrock of effective portfolio risk management. These potential risks are like landmines lurking in the investment landscape, waiting to detonate your hard-earned cash. Chief among them are market volatility, the unpredictable fluctuations in stock prices that can shake even the steadiest of nerves. Interest rate fluctuations, those seemingly harmless numbers, can also wreak havoc on investments, influencing everything from bond prices to mortgage rates. And let’s not forget the elephant in the room: economic downturns, the dreaded periods of economic slowdown that can put even the best-laid investment plans on hold.

Assessing Risk Tolerance

Now that you’ve uncovered the potential hazards, it’s time to take stock of your risk tolerance. This is like gauging your pain threshold before jumping into a cold pool. Are you willing to weather market storms with a stoic smile, or do you prefer to play it a bit safer? Your age, investment goals, and financial situation will all influence your risk tolerance.

Diversification: Spreading Your Wings

Just as a wise old bird spreads its wings to avoid predators, diversification is your secret weapon in risk management. It’s the art of investing in a variety of different assets, like stocks, bonds, real estate, and even precious metals. Why does this work? Because when one investment takes a tumble, the others may still be soaring, cushioning the overall impact on your portfolio.

Rebalancing: Keeping Your Basket Balanced

Over time, your investments may stray from their original proportions, like a teetering scale. Rebalancing is the process of bringing them back into equilibrium, ensuring that your risk levels stay aligned with your tolerance. Think of it as a financial tune-up, keeping your investment machine running smoothly.

Monitoring and Adjusting: Stay on Course

Just as a ship’s captain monitors the horizon for changing weather patterns, you need to keep a watchful eye on your portfolio. Regular monitoring will help you spot potential risks and make adjustments as needed. Remember, risk management is not a one-and-done deal; it’s an ongoing process of assessing, adjusting, and adapting.

Portfolio Risk Management: A Comprehensive Guide to Safeguarding Your Investments

In the realm of investing, risk is an ever-present force that can make or break your financial dreams. That’s why portfolio risk management is paramount, a guiding light that illuminates the path to investment success. By understanding the risks involved and taking proactive steps to mitigate them, you can protect your hard-earned wealth and maximize your chances of achieving your financial goals.

Risk Assessment and Measurement

Identifying risks is just the first step; understanding their impact is equally crucial. That’s where risk assessment and measurement come in, the meticulous process of quantifying the probability and severity of each potential threat. Armed with this knowledge, you can prioritize risks and allocate resources accordingly.

Risk Management Strategies

Once risks have been assessed and measured, it’s time to roll up your sleeves and implement risk management strategies. These strategies are like sturdy shields that protect your portfolio from the slings and arrows of market fluctuations. Diversification, hedging, and asset allocation are just a few of the weapons in your arsenal to combat risk.

Risk Monitoring and Control

Managing risk is not a one-and-done deal; it’s an ongoing process that requires constant monitoring and refinement. The financial landscape is ever-changing, and risks can materialize in unexpected ways. By keeping a watchful eye on your portfolio and adjusting your strategies as needed, you can stay ahead of the risk curve and weather the storms.

Common Portfolio Risks

Understanding common portfolio risks is like knowing your enemy; it gives you a head start in the battle against financial peril. Interest rate risk, inflation risk, market risk, and liquidity risk are just a few of the obstacles you may encounter. By being aware of these risks and taking steps to mitigate them, you can minimize their impact on your investments.

Portfolio Risk Management: A Shield Against Market Turbulence

In today’s volatile financial markets, managing risk is a crucial aspect of safeguarding your investments. Portfolio risk management is like a compass, guiding you through turbulent waters and keeping your financial ship afloat. It’s a process that helps you identify, assess, and mitigate potential risks that could jeopardize your portfolio’s value.

Risk Assessment: A Microscope for Portfolio Health

The first step in managing risk is to conduct a comprehensive risk assessment. This involves scrutinizing your portfolio’s composition, investment objectives, and your own risk tolerance. Based on this analysis, you can identify areas of vulnerability and potential threats to your financial goals.

Risk Management Strategies: Tools to Weather the Storm

Based on the risk assessment, portfolio managers develop and implement risk management strategies to mitigate potential losses. These strategies include:

Diversification: Spreading Your Wings

Imagine balancing multiple balls in the air – diversification is akin to that. It involves investing in a range of different assets, such as stocks, bonds, real estate, and commodities. By spreading your assets across various classes and sectors, you minimize the impact of any single asset underperforming.

Hedging: An Insurance Policy for Investments

Hedging is like buying an insurance policy for your portfolio. It involves using financial instruments, such as futures contracts or options, to offset the risk of adverse price movements in a particular asset. By doing this, you reduce the overall volatility of your portfolio and protect against unexpected losses.

Asset Allocation: The Key to Balance

Asset allocation is the backbone of risk management. It’s like striking a harmonious chord between different asset classes based on your risk tolerance and investment goals. By allocating appropriate proportions to stocks, bonds, and other investments, you create a balanced portfolio that can withstand market fluctuations.

Rebalancing: Staying in Tune with Risks

Over time, your portfolio’s risk profile can drift as markets evolve. Rebalancing is like tuning a guitar – it involves periodically adjusting your asset allocation to maintain your desired risk level. By selling assets that have outperformed and buying those that have underperformed, you keep your portfolio in sync with your risk tolerance and investment objectives.

When it comes to investing, every investor wants a piece of the pie, and a big piece at that. However, there’s a catch: the bigger the potential return, the bigger the risk. That’s where portfolio risk management comes in. It’s like the insurance policy for your investments, protecting you from financial storms and keeping your dreams afloat.

Diversification

Diversification is the golden rule of portfolio risk management. It’s like spreading your eggs across multiple baskets; if one basket falls, you don’t lose everything. By diversifying your investments across different asset classes, sectors, and geographical regions, you reduce the overall risk of your portfolio. Think of it as investing in a variety of stocks, bonds, and real estate from different countries. That way, if one sector or region takes a hit, the impact on your overall portfolio is minimized.

Asset Allocation

Asset allocation is the art of dividing your portfolio pie among different asset classes. It’s like deciding how much to put into stocks, bonds, and other investments. The key here is to find the right balance that aligns with your risk tolerance and investment goals. If you’re a thrill-seeker, you might allocate more to high-risk, high-return stocks. But if you’re a bit more cautious, you might favor the stability of bonds.

Risk Tolerance

Risk tolerance is all about understanding how much financial turbulence you’re willing to stomach. It’s like a ride at an amusement park; some people love the adrenaline rush of a roller coaster, while others prefer the gentle sway of a carousel. Knowing your risk tolerance helps you make informed decisions about your portfolio. If you’re not the type who can handle wild market swings, you’ll want to invest more conservatively.

Rebalancing

Rebalancing is like spring cleaning for your portfolio. Over time, the proportions of your investments may shift as some grow faster than others. Rebalancing brings your portfolio back to its original asset allocation, ensuring that your risk and return profile remains aligned with your goals. It’s like adjusting the sails on a ship to keep it on course during changing winds.

Monitoring and Adjustment

Portfolio risk management is an ongoing process, not a one-and-done deal. Markets are constantly evolving, and so should your portfolio. Regular monitoring and adjustments are essential to keep your investments on track. It’s like checking in on your car during a road trip; if the tire pressure’s off, you adjust it to ensure a smooth ride.

Portfolio Risk Management: A Comprehensive Guide to Mitigating Investment Risks

As an investor, managing the risks associated with your portfolio is paramount to achieving long-term financial success. Portfolio risk management is the process of identifying, assessing, and mitigating potential threats to your investments. By employing prudent risk management strategies, you can safeguard your wealth, maximize returns, and sleep soundly at night.

Hedging

Hedging is a risk management technique that involves using financial instruments, such as options or futures contracts, to reduce the potential for losses in one investment by offsetting them with gains in another correlated asset. For instance, if you own a stock that you believe is overvalued, you can hedge your risk by purchasing a put option on that stock. If the stock price falls, the value of your put option will increase, partially offsetting your losses on the stock. Hedging is a valuable tool for managing risk; however, it requires a thorough understanding of financial markets and derivate instruments.

Diversification

Diversification is a fundamental principle of portfolio risk management. It involves spreading your investments across different asset classes, such as stocks, bonds, real estate, and commodities. By doing so, you reduce the overall risk of your portfolio because the performance of different asset classes tends to vary over time. For example, when the stock market declines, bond prices often rise. By investing in both stocks and bonds, you can mitigate the impact of market downturns. Diversification is a simple but highly effective risk management strategy.

Asset Allocation

Asset allocation refers to the strategic distribution of your investments among different asset classes. The optimal asset allocation for you depends on your individual circumstances, including age, risk tolerance, and financial goals. For example, a young investor with a high risk tolerance may choose to allocate a larger portion of their portfolio to stocks, while a retiree with a lower risk tolerance may prefer a more conservative allocation with a larger portion of bonds. Determining the appropriate asset allocation is a crucial step in managing portfolio risk.

Rebalancing

Over time, the performance of different asset classes can vary, leading to changes in your portfolio’s asset allocation. Rebalancing involves adjusting your portfolio to restore your desired asset allocation. For instance, if the stock market has performed exceptionally well, you may need to sell some stocks and purchase more bonds to maintain your target asset allocation. Rebalancing helps ensure that your portfolio remains aligned with your risk tolerance and financial goals.

Risk Assessment

Before implementing any risk management strategies, it’s essential to thoroughly assess your risk tolerance. Risk tolerance refers to the amount of potential loss you’re comfortable with. It’s influenced by various factors, such as age, income, and financial situation. Once you understand your risk tolerance, you can tailor your portfolio risk management strategies accordingly.

Conclusion

Portfolio risk management is a multifaceted discipline that requires a comprehensive approach. By incorporating hedging, diversification, asset allocation, rebalancing, and risk assessment into your investment strategy, you can significantly reduce the risk of financial losses. Remember, risk management is an ongoing process. As your circumstances and market conditions change, you’ll need to adjust your strategies accordingly. By embracing a proactive approach to portfolio risk management, you can navigate the financial markets with confidence and achieve your long-term financial goals.

Portfolio Risk Management:

Navigating the turbulent waters of financial markets requires a prudent strategy to mitigate risks and maximize potential returns. Enter portfolio risk management, a dynamic approach that orchestrates your investments like a symphony, striking a harmonious balance between risk and reward.

Asset Allocation: The Foundation of Diversification

Asset allocation forms the cornerstone of portfolio risk management. It’s the art of spreading your investments across diverse asset classes, such as stocks, bonds, and real estate. This diversification strategy is like a lifeboat, safeguarding you from sinking if one asset class hits choppy waters. Your allocation should align with your unique risk appetite and long-term objectives.

Risk Tolerance: Knowing Your Limits

Before venturing into the investment arena, it’s imperative to assess your risk tolerance. This gauge measures your comfort level with potential losses. Are you a thrill-seeking investor who relishes the adrenaline rush of high-risk, high-return investments? Or does the thought of volatility make you break out in a cold sweat? Understanding your tolerance is crucial for making informed decisions.

Investment Horizon: A Journey with a Destination

Your investment horizon paints a picture of your financial goals and the timeframe within which you aim to achieve them. Are you saving for a down payment on a house or planning a comfortable retirement? The horizon determines the appropriate risk profile for your portfolio. Long-term horizons allow for greater risk-taking, while short-term goals may warrant a more conservative approach.

Monitoring and Rebalancing: Keeping Your Portfolio in Tune

Portfolio risk management is not a set-it-and-forget-it strategy. It requires diligent monitoring and periodic rebalancing. As market conditions fluctuate, your asset allocation may drift away from your desired targets. Rebalancing restores the equilibrium, ensuring your portfolio remains aligned with your risk tolerance and investment goals.

Risk Management Tools: Your Financial Toolkit

Beyond asset allocation, a myriad of risk management tools is at your disposal. Hedging, for instance, is like an insurance policy, protecting your portfolio from specific risks. Stop-loss orders automatically sell off assets that fall below a predetermined price, salvaging some value in a downturn. Diversification, on the other hand, acts as a safety net, safeguarding against the pitfalls of over-reliance on a single asset or sector.

Portfolio Risk Management: A Guide to Minimizing and Managing Portfolio Risk

If you’re an investor, you know that the stock market can be a wild ride. The value of your portfolio can go up or down at any moment, and there’s always the potential for a big loss. That’s why portfolio risk management is so important. By taking steps to manage your risk, you can help protect your investments and ensure that you reach your financial goals.

Understanding Portfolio Risk

The first step to managing portfolio risk is to understand what it is. Portfolio risk is the chance that your portfolio will lose value. It can be caused by a number of factors, such as changes in the economy, interest rates, or inflation. The more risk you take on, the greater the chance that you’ll lose money. However, taking on more risk can also lead to greater returns, so it’s important to find a balance that’s right for you.

Diversifying Your Portfolio

One of the most important things you can do to manage portfolio risk is to diversify your investments. This means investing in a variety of different assets, such as stocks, bonds, and real estate. When you diversify your portfolio, you’re reducing the risk that any one asset will lose value. If one asset does poorly, the others may still perform well, and your overall portfolio will be less likely to lose value.

Asset Allocation

Another important aspect of portfolio risk management is asset allocation. This is the process of dividing your investments among different asset classes, such as stocks, bonds, and cash. The goal of asset allocation is to create a portfolio that has the right balance of risk and return for your individual needs. A financial advisor can help you create an asset allocation plan that’s right for you.

Rebalancing Your Portfolio

Over time, the value of your portfolio will change. As a result, you’ll need to rebalance your portfolio periodically to ensure that it still meets your investment goals. Rebalancing involves selling some of the assets that have increased in value and buying more of the assets that have decreased in value. This will help to keep your portfolio diversified and reduce your overall risk.

Monitoring and Rebalancing

Portfolio risk management is an ongoing process that requires continuous monitoring and rebalancing to adjust to changing market conditions and risk profiles. By regularly reviewing your portfolio and making adjustments as needed, you can help protect your investments and ensure that you reach your financial goals. Here are some tips for monitoring and rebalancing your portfolio:

- Review your portfolio regularly. It’s a good idea to review your portfolio at least once a year, or more often if the market is volatile. This will help you track your progress and identify any areas where you need to make changes.

- Rebalance your portfolio as needed. As your portfolio changes in value, you’ll need to rebalance it to ensure that it still meets your investment goals. This may involve selling some of the assets that have increased in value and buying more of the assets that have decreased in value.

- Consider using a financial advisor. A financial advisor can help you create a personalized portfolio risk management plan and provide ongoing support. This can be especially helpful if you’re new to investing or if you have a complex portfolio.

Portfolio Risk Management: Navigating the Financial Maze

Introduction

When it comes to investing, risk is a constant companion. But just because it’s a threat doesn’t mean it should deter us from the pursuit of financial freedom. Enter portfolio risk management, an indispensable tool for navigating the financial maze and safeguarding our hard-earned capital. By embracing sound risk management principles, investors can weather market storms and emerge stronger on the other side.

What is Portfolio Risk Management?

Think of portfolio risk management as an insurance policy for your investments. It’s like buying a safety net that protects you from potential pitfalls that could derail your financial goals. By identifying and analyzing the risks associated with each investment, you can make informed decisions that minimize the chances of losing money.

Types of Portfolio Risks

The investment landscape is a vast ocean filled with various types of risks. Here are a few common ones to watch out for:

- Market risk: Stock prices can fluctuate dramatically, so you need to assess the risk of your investments losing value due to market movements.

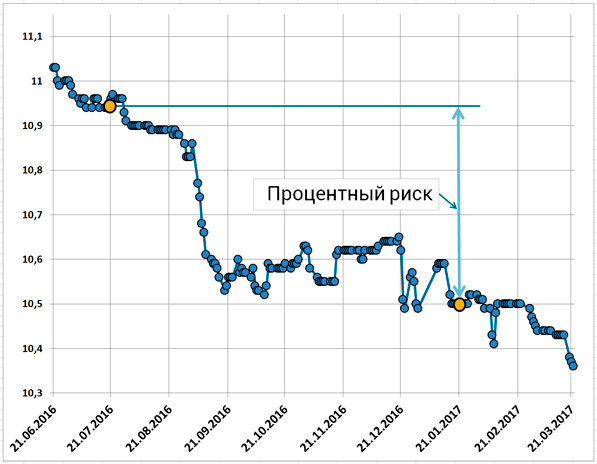

- Interest rate risk: Changes in interest rates can impact the value of bonds and other fixed-income investments.

- Inflation risk: Rising prices can erode the purchasing power of your investments over time.

- Liquidity risk: If you can’t sell an investment quickly without incurring a loss, it’s considered illiquid, which can tie up your money and leave you vulnerable in a crisis.

- Concentration risk: Putting all your eggs in one basket can amplify your risk. Diversifying your portfolio across different asset classes and industries helps spread out your risk exposure.

- Political and economic risk: Events such as elections, wars, or economic downturns can impact the value of investments.

- Currency risk: Investing in foreign currencies exposes you to the risk of fluctuations in exchange rates, which can affect the value of your investments.

- Tech risk: Technological advancements can disrupt businesses and industries, potentially leading to loss of investments.

- ESG risk: Environmental, social, and governance factors can impact the value of investments by influencing consumer preferences, regulations, and investor sentiment.

How to Manage Portfolio Risks

Now that you have a grasp of the different types of risks, let’s delve into some strategies for managing them:

- Diversification: The golden rule of risk management is to not put all your eggs in one basket. By investing in a wide range of assets, you spread out your risk and reduce the impact of any individual investment’s performance on your overall portfolio.

- Asset allocation: Decide on the appropriate mix of stocks, bonds, and other assets based on your risk tolerance and financial goals. A balanced portfolio with the right balance of risk and return can help you achieve your investment aspirations.

- Rebalancing: Over time, your portfolio’s asset allocation may drift away from your desired balance. Rebalancing involves adjusting your portfolio back to your target percentages to maintain your risk profile.

- Risk monitoring: Keep a close eye on your investments and market conditions to identify potential risks early on. Regular portfolio reviews and risk assessments help you stay vigilant and make necessary adjustments.

- Hedging: Consider hedging strategies to offset specific risks. For example, buying a put option can protect your portfolio from a decline in stock prices.

Conclusion

Effective portfolio risk management is the cornerstone of prudent investing. By understanding the different types of risks and implementing sound risk management strategies, investors can preserve capital and enhance their long-term investment performance. Remember, it’s not about eliminating risk altogether, but about managing it wisely to achieve financial stability and ultimately realize your investment dreams.

No responses yet