Introduction

There’s no doubt you have a financial portfolio, whether you know it or not. A portfolio is just a collection of investments, like stocks, bonds, and real estate. Strategic portfolio management is the process of making decisions about what to include in your portfolio and how to manage it over time. It’s a bit like cooking; you need to start with the right ingredients and then you need to cook them in the right way to get the best results.

Strategic portfolio management is a crucial aspect of managing investments to achieve desired objectives and manage risk. It involves making decisions about what assets to include in the portfolio, how to allocate them, and how to manage them over time. While there is no one-size-fits-all approach, there are some general principles that can help you create a strategic portfolio that meets your needs.

Strategic portfolio management is a complex and challenging process, but it is also essential for achieving your financial goals. If you are not comfortable making these decisions on your own, you may want to consider working with a financial advisor.

What is Strategic Portfolio Management?

Strategic portfolio management (SPM) is the process of managing a portfolio of investments to meet specific objectives, such as growing wealth, generating income, or preserving capital. SPM involves making decisions about the types of assets to include in the portfolio, the allocation of funds between those assets, and the overall risk and return profile of the portfolio.

SPM is a complex and dynamic process that requires ongoing monitoring and adjustment. The optimal investment strategy will vary depending on a variety of factors, including the investor’s financial goals, risk tolerance, and time horizon. However, there are some general principles that can help investors create a strategic portfolio that meets their needs.

The Benefits of Strategic Portfolio Management

There are many benefits to developing a strategic portfolio management plan. These include:

- Improved investment returns: A strategic portfolio management plan can help you to make more informed investment decisions, which can lead to improved returns over time.

- Reduced risk: By diversifying your portfolio across a range of asset classes, you can reduce the overall risk of your investments.

- Increased peace of mind: Knowing that your investments are being managed according to a well-defined plan can give you peace of mind and help you to sleep better at night.

- Achieving your financial goals: A strategic portfolio management plan can help you to achieve your financial goals, such as retiring early, buying a home, or funding your child’s education.

The Process of Strategic Portfolio Management

Creating a strategic portfolio management plan is a multi-step process that involves the following steps:

- Setting investment goals and objectives: The first step in creating a strategic portfolio management plan is to set investment goals and objectives. These goals and objectives should be specific, measurable, achievable, relevant, and time-bound.

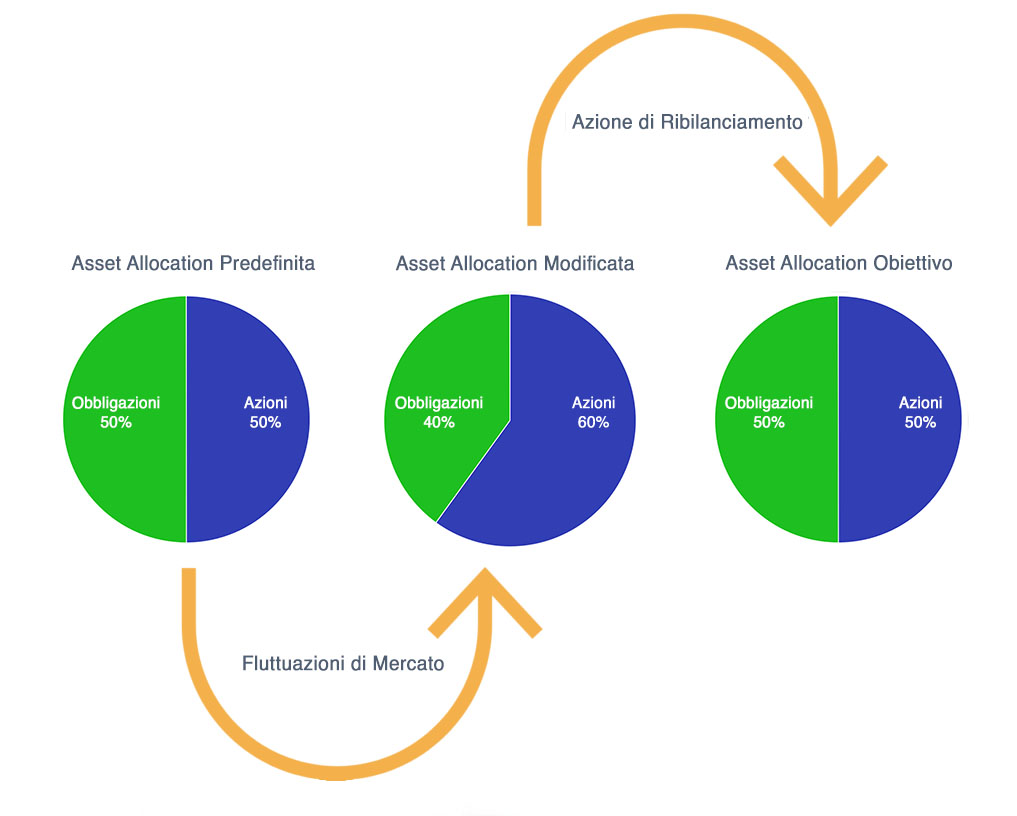

- Developing an investment strategy: Once you have set your investment goals and objectives, you can develop an investment strategy. This strategy should outline the types of assets you will invest in, the allocation of funds between those assets, and the overall risk and return profile of the portfolio.

- Implementing the investment strategy: Once you have developed an investment strategy, you can implement it by buying and selling investments.

- Monitoring and adjusting the portfolio: Once you have implemented the investment strategy, you should monitor the portfolio’s performance and make adjustments as necessary.

Conclusion

Creating a strategic portfolio management plan is an important step towards achieving your financial goals. By following the steps outlined above, you can create a plan that meets your specific needs and helps you to achieve your investment objectives.

No responses yet