Vanguard Retirement Portfolio: A Blueprint for a Secure Financial Future

Retirement planning can be a daunting task, but it doesn’t have to be. The Vanguard Retirement Portfolio offers a comprehensive solution for investors looking to secure their financial future. This well-diversified portfolio includes a mix of index funds that represent different asset classes, including stocks, bonds, and real estate.

Components

The Vanguard Retirement Portfolio is designed to provide investors with a balanced and diversified investment strategy. It includes a mix of Vanguard index funds, representing different asset classes, including:

-

Stocks: These funds invest in a broad range of companies, both large and small, providing exposure to the growth potential of the stock market.

-

Bonds: These funds invest in a variety of fixed-income securities, such as government bonds and corporate bonds. Bonds provide stability and income to the portfolio.

-

Real estate: These funds invest in a variety of real estate-related securities, such as real estate investment trusts (REITs) and real estate mutual funds. Real estate can provide diversification and a potential hedge against inflation.

Asset Allocation

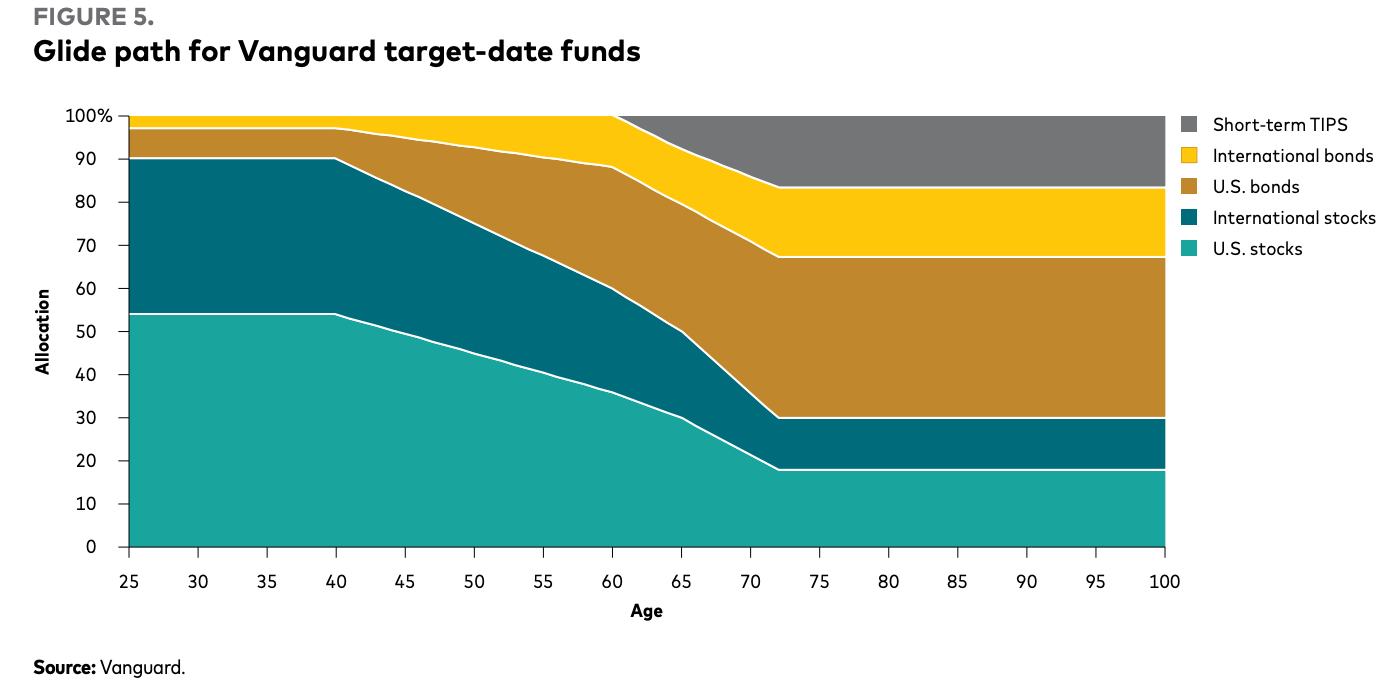

The asset allocation of the Vanguard Retirement Portfolio is based on a target retirement date. The closer you get to retirement, the more conservative the portfolio becomes. For example, a portfolio for someone who is 20 years away from retirement might have an 80% allocation to stocks and a 20% allocation to bonds. As the investor gets closer to retirement, the allocation to stocks would gradually decrease and the allocation to bonds would increase.

Rebalancing

Over time, the asset allocation of the Vanguard Retirement Portfolio will drift as the value of the different asset classes changes. To maintain the desired level of diversification, it’s important to rebalance the portfolio periodically. Rebalancing involves selling some of the assets that have performed well and buying more of the assets that have performed poorly.

Benefits

The Vanguard Retirement Portfolio offers a number of benefits to investors, including:

-

Diversification: The portfolio’s mix of asset classes helps to reduce risk by spreading your investments across different types of investments.

-

Low cost: Vanguard index funds are known for their low fees, which can save you money over the long run.

-

Professional management: Vanguard’s professional portfolio managers oversee the portfolio and make investment decisions on your behalf.

-

Automatic rebalancing: Vanguard offers automatic rebalancing services, which can help you maintain your desired asset allocation.

Conclusion

If you’re looking for a simple and effective way to save for retirement, the Vanguard Retirement Portfolio is a great option. It offers a diversified investment strategy, professional management, and low costs. With the Vanguard Retirement Portfolio, you can gain peace of mind knowing that you’re on track to achieve your retirement goals.

Vanguard Retirement Portfolio: A Comprehensive Guide

Retirement planning is not an easy task. Many factors need consideration, like potential market volatility and downturns. That’s why having a strong portfolio, such as Vanguard’s, is essential. Here, we’ll delve into the key aspects of Vanguard’s retirement portfolio, including its risk management strategies, asset allocation, and investment options. Whether you’re a novice or an experienced investor, this guide will arm you with the knowledge you need to make informed decisions about your retirement savings.

Risk Management

When it comes to retirement planning, managing risk is paramount. Vanguard’s Retirement Portfolio employs a multifaceted approach to risk mitigation. It spreads investments across various asset classes, such as stocks, bonds, and real estate, thereby reducing exposure to any single sector or market. Diversification plays a crucial role in dampening the impact of volatility and safeguarding your portfolio from severe losses. For instance, if the stock market takes a hit, your portfolio won’t be as heavily affected if it includes bonds.

Asset Allocation

Asset allocation is a critical aspect of retirement planning. It involves dividing your investments among different asset classes based on your risk tolerance and time horizon. Vanguard’s Retirement Portfolio offers various asset allocation strategies to cater to individual needs. These strategies are tailored to your age, retirement date, and risk appetite. As you approach retirement, the portfolio gradually shifts towards more conservative investments, such as bonds, to preserve capital.

Investment Options

Vanguard’s Retirement Portfolio offers a wide range of investment options to meet your specific investment goals. These include target-date funds, index funds, and actively managed funds. Target-date funds are designed to automatically adjust your asset allocation as you approach retirement, providing a hassle-free solution. Index funds track a specific market index, like the S&P 500, and offer low management fees. Actively managed funds are overseen by portfolio managers who make investment decisions based on their research and analysis.

Fees

Fees can eat into your retirement savings over time. Vanguard is renowned for its low-cost funds, which can significantly impact your long-term returns. The fees associated with Vanguard’s Retirement Portfolio are minimal, allowing your investments to grow without being burdened by excessive charges. By keeping fees low, Vanguard puts more money in your pocket, where it belongs.

Performance

Vanguard’s Retirement Portfolio has a proven track record of delivering solid returns. The portfolio’s diversified approach and low fees have consistently outperformed many of its competitors. Past performance isn’t a guarantee of future results, but it does provide some insight into the portfolio’s ability to navigate different market conditions and deliver consistent returns. It’s always advisable to consult with a financial advisor to determine if Vanguard’s Retirement Portfolio aligns with your unique circumstances and goals.

No responses yet