Introduction

Are you searching for the best stocks with dividends? Well, you’re in luck! Dividend-paying stocks can be a great way to generate passive income and build wealth over time. And when it comes to dividend stocks, there are a few that stand out from the crowd. One of the best is Johnson & Johnson (JNJ). This healthcare giant has been paying dividends for over 50 years, and it has a history of increasing its dividend every year. In fact, JNJ has increased its dividend for 60 consecutive years, making it a Dividend Aristocrat.

What is a Dividend Aristocrat?

A Dividend Aristocrat is a company that has increased its dividend for at least 25 consecutive years. This is a remarkable achievement, and it shows that the company is committed to rewarding its shareholders. JNJ is one of only a handful of companies that have been able to maintain this level of dividend growth for such a long period of time.

Why is JNJ a Good Dividend Stock?

There are several reasons why JNJ is a good dividend stock. First, it has a strong track record of dividend growth. As mentioned above, JNJ has increased its dividend for 60 consecutive years. This shows that the company is committed to returning cash to its shareholders, even during tough economic times.

Second, JNJ has a strong financial position. The company has a solid balance sheet and generates strong cash flow. This gives JNJ the financial flexibility to continue increasing its dividend in the future.

Third, JNJ has a diversified business model. The company operates in three main segments: pharmaceuticals, medical devices, and consumer products. This diversification helps to reduce JNJ’s risk profile and makes it less vulnerable to economic downturns.

Fourth, JNJ has a strong brand name. The company’s products are well-known and trusted by consumers around the world. This gives JNJ a competitive advantage and helps to ensure that the company will continue to generate strong cash flow in the future.

Conclusion

If you’re looking for a high-quality dividend stock, JNJ is a great option. The company has a long history of dividend growth, a strong financial position, a diversified business model, and a strong brand name. These factors make JNJ a good choice for investors who are looking for a reliable source of passive income.

Investing in the Best Stocks: A Dividend Aristocrats Guide

Unlocking the world of dividend investing can be an enticing prospect, offering a steady stream of passive income. However, navigating this landscape can seem daunting, but fear not! Allow us to guide you through the crème de la crème of dividend-paying stocks: the Dividend Aristocrats.

Dividend Aristocrats

These are the crème de la crème of dividend-paying companies, the steadfast giants who have consistently rewarded their shareholders with unwavering dividend increases for at least a quarter of a century. They’re the reliable workhorses of the stock market, weathering market storms and bull runs with aplomb. Some of the most notable Dividend Aristocrats include Johnson & Johnson (JNJ), Procter & Gamble (PG), and Coca-Cola (KO). These stalwarts have stood the test of time and proven their ability to generate consistent returns for investors.

But why stop there? Let’s delve deeper into the world of Dividend Aristocrats, exploring their secrets and uncovering the factors that make them such attractive investments. These companies typically operate in stable industries, possess strong cash flows, and have a track record of prudent financial management. They’re the blue-chip stocks of the dividend world.

Investing in Dividend Aristocrats is like buying into a well-oiled machine, a company that has consistently delivered results. They’re not flashy or glamorous, but they get the job done, providing investors with a steady stream of dividend income year after year. So, if you’re seeking stability and long-term growth, Dividend Aristocrats should be on your radar.

Best Stocks with Dividends: A Guide to Passive Income

In the world of investing, passive income is like the Holy Grail. Dividend-paying stocks offer a steady stream of income, providing financial stability and the potential to grow wealth over time. But with so many options on the market, finding the best stocks with dividends can be a daunting task.

Types of Dividend-Paying Stocks

Dividend-paying stocks come in various flavors, each with its own unique characteristics:

- High-Yield Stocks: These stocks offer a higher dividend yield than average, but they may also be more volatile. Examples include telecom companies, utilities, and real estate investment trusts (REITs).

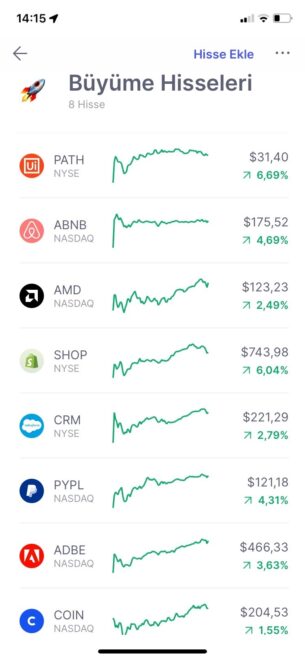

- Growth Stocks: These stocks typically have a lower dividend yield but offer the potential for significant capital appreciation. Examples include technology companies, consumer discretionary companies, and healthcare companies.

- Value Stocks: These stocks are generally undervalued relative to their intrinsic value and offer a more balanced approach between yield and growth. Examples include consumer staples companies, industrial companies, and financial companies.

- Income Stocks: These stocks provide a reliable, predictable stream of income and are often favored by retirees and risk-averse investors. Examples include preferred stocks, closed-end funds, and certain bonds.

High-Yield Stocks: Balancing Risk and Return

High-yield stocks can be a tempting option for income-minded investors. However, it’s important to understand the potential risks associated with these investments:

- Higher Volatility: High-yield stocks tend to be more sensitive to market fluctuations, meaning their prices can be more volatile than the broader market.

- Credit Risk: Companies with high dividend yields may have a high level of debt, increasing the risk of default.

- Dividend Cuts: Dividends are not guaranteed and can be cut or suspended at any time, especially during economic downturns.

Strategy for Selecting Dividend-Paying Stocks

To maximize your chances of success with dividend-paying stocks, consider the following strategies:

- Research the Company: Before investing in any stock, thoroughly research the company’s financial health, dividend history, and industry dynamics.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Spread your investments across different companies and sectors to mitigate risk.

- Consider Tax Implications: Dividends are taxed differently than capital gains, so be mindful of the tax ramifications of your investment decisions.

Conclusion

Investing in dividend-paying stocks can be a powerful way to generate passive income and grow your wealth. However, it’s crucial to understand the risks and choose stocks wisely. By following the strategies outlined above, you can increase your chances of success in this exciting area of investing.

Best Stocks with Dividends: A Guide to Reliable Returns

In the realm of investing, dividend stocks stand out as reliable sources of passive income. These companies share a portion of their earnings with shareholders, offering a steady stream of cash that can supplement your retirement savings, fund major purchases, or simply provide a cushion against market fluctuations. When it comes to reaping the rewards of dividend investing, knowledge is power. This comprehensive guide will unveil the secrets of identifying the best stocks with dividends, empowering you to make informed decisions and maximize your financial potential.

What Are Dividends?

Dividends are payments made by companies to their shareholders, representing a share of the company’s profits. These payments can be in cash, stock, or a combination of both. For investors, dividends provide a tangible return on their investment and can significantly enhance their overall returns.

Benefits of Dividend-Paying Stocks

Investing in dividend-paying stocks offers a slew of benefits that make them a cornerstone of many successful investment portfolios. These include:

Choosing the Best Dividend Stocks

Selecting the best dividend stocks requires a comprehensive approach that considers a range of factors, including:

Sector Spotlight: Utilities

When it comes to dividend-paying stocks, the utilities sector stands out as a reliable source of income. Utilities companies, such as electric, gas, and water companies, typically have stable operations, predictable cash flow, and a long history of paying dividends. Their dividend yields tend to be higher than the average stock market, making them attractive to investors seeking a steady stream of income.

One of the top utility stocks for dividend income is NextEra Energy (NEE). NEE is a leading clean energy provider with a track record of consistent dividend growth. The company has increased its dividend for 27 consecutive years and currently offers a dividend yield of around 4%.

Conclusion

Investing in dividend stocks can be a powerful way to generate passive income, reduce volatility, and achieve long-term financial growth. By carefully considering the factors discussed above, investors can identify the best stocks with dividends and create a portfolio that meets their individual investment goals. Remember, dividend investing is a marathon, not a sprint, and consistency is key. By reinvesting dividends and staying invested over the long term, you can harness the power of compounding and maximize your returns.

No responses yet