The Best Dividend-Paying Stocks

Want to earn passive income through dividends? Here’s a comprehensive guide to help you make savvy investment decisions. Let’s dive in!

Dividend-Paying Stocks: The Ultimate Guide

Dividend-paying stocks are a fantastic way to generate passive income. They offer a steady stream of dividends, which can supplement your salary, boost your retirement savings, or simply allow you to enjoy a little extra spending money. But not all dividend-paying stocks are created equal. It’s important to do your research and find the right ones for your investment portfolio.

There are a few key things to look for when selecting dividend-paying stocks. First, you want to make sure the company is financially sound and has a history of paying reliable dividends. Second, you want to consider the dividend yield. This is the annual dividend amount divided by the stock price. A higher dividend yield means you’ll receive a larger dividend payout for each share you own.

Finally, you want to think about your investment goals. Are you looking for stocks with high dividend yields that you can hold for the long term? Or are you more interested in stocks with lower dividend yields that have the potential to grow in value over time? Once you know your investment goals, you can start narrowing down your choices.

Top Dividend-Paying Stocks

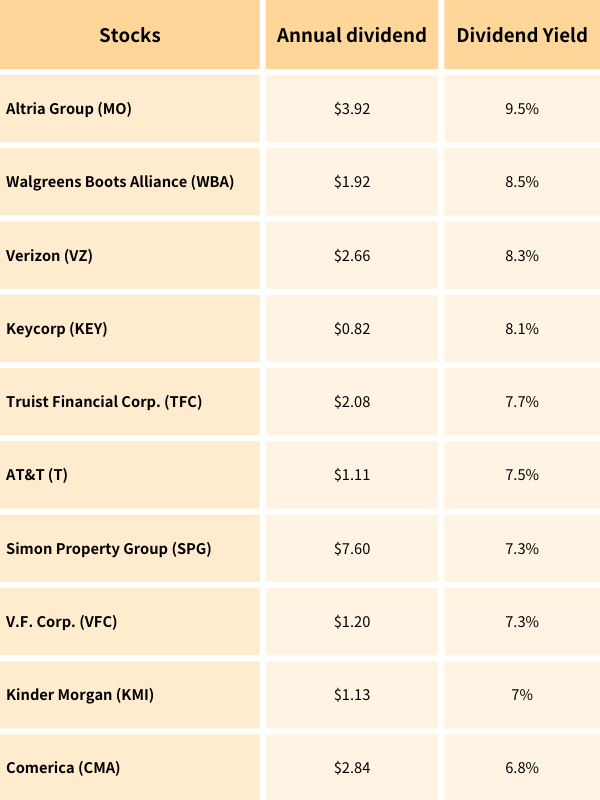

Here are a few of the best dividend-paying stocks on the market today:

- Johnson & Johnson (JNJ): A healthcare conglomerate with a long history of paying reliable dividends.

- Procter & Gamble (PG): A consumer goods giant with a portfolio of iconic brands, including Tide, Pampers, and Gillette.

- Coca-Cola (KO): A beverage company with a global reach and a strong track record of dividend growth.

- Verizon (VZ): A telecommunications company with a large customer base and a solid dividend yield.

- ExxonMobil (XOM): An oil and gas company with a high dividend yield and a long history of dividend payments.

These are just a few examples of the many great dividend-paying stocks available. By doing your research and considering your investment goals, you can find the right stocks to help you achieve your financial objectives.

There’s no secret that stocks are popular, but what about dividend stocks? Well, those are a whole other ball game. If you’re looking to invest your hard-earned cash in a company that’s going to reward you for holding its shares, dividend stocks are the way to go. They offer a steady stream of income, even during market downturns. And when it comes to picking the best dividend stocks, there are a few things to keep in mind: the types of dividends and the companies that pay them. Let’s delve into the details, shall we?

Types of Dividends

When it comes to dividends, there are two main types: cash dividends and stock dividends. Cash dividends are simply payments that companies make to their shareholders in the form of cash. Stock dividends, on the other hand, are payments that companies make to their shareholders in the form of additional shares of stock.

Cash dividends are the more common type of dividend. They’re typically paid out on a quarterly basis, and they can provide investors with a steady stream of income. Stock dividends, on the other hand, are less common. They’re typically paid out when a company has a lot of excess cash on hand. When a company pays a stock dividend, shareholders receive additional shares of stock, which can increase the value of their investment.

Now that you know the basics of dividends, let’s take a closer look at the companies that pay them. There are a number of companies that pay dividends, but not all dividends are created equal. Some companies have a long history of paying dividends, while others have just started paying them. Some companies pay high dividends, while others pay low dividends. It’s important to do your research before investing in any dividend stock. That way, you can make sure that you’re investing in a company that has a strong track record of paying dividends and that pays a dividend that meets your investment goals.

Best Stocks That Pay Dividends

For income-oriented investors, dividend-paying stocks are a reliable way to generate passive income. Dividends are a portion of a company’s profits that are distributed to shareholders, providing a steady stream of cash flow. However, not all dividend stocks are created equal, and there are several factors to consider when evaluating them.

Factors to Consider

When evaluating dividend stocks, consider the following factors:

Dividend Yield

The dividend yield is the annual dividend per share divided by the current stock price. It represents the percentage return you can expect from the dividend alone. While a high dividend yield may be tempting, it’s important to remember that it can also indicate that the stock is overvalued or has a high payout ratio.

Payout Ratio

The payout ratio is the percentage of earnings that a company pays out in dividends. A payout ratio of 100% means that the company is distributing all of its earnings to shareholders. While a high payout ratio can be attractive, it can also be unsustainable over the long term. Companies with a high payout ratio may have difficulty investing in growth and expanding their operations.

Company’s Financial Health

It’s crucial to evaluate the overall financial health of a company before investing in its dividend stock. Consider factors such as the company’s revenue growth, debt levels, and cash flow. Dividend payments should be supported by strong financial performance to ensure sustainability over the long term.

Other Factors

Look for companies with a history of consistent dividend payments. A company that has paid dividends for many years is more likely to continue doing so. Also, it’s essential to consider the company’s industry and competitive landscape. Companies in stable industries with strong competitive advantages are more likely to maintain their dividends.

Best Dividend Stocks

Looking for stocks that will pay you a steady income? The dividends paid by these three are top-notch. These companies are financially stable and have a track record of paying dividends, making them good choices for investors who want to generate income from their investments.

What’s A Dividend?

A dividend is a payment made by a company to its shareholders. Dividends are typically paid out of the company’s profits. Dividends are usually paid quarterly, but some companies pay them monthly or annually. The amount of the dividend is determined by the company’s board of directors. One way to decide if a stock is a good investment is to look at its dividend yield, which is the annual dividend divided by the current stock price. A high dividend yield can be a sign that a stock is undervalued. However, it’s important to look for companies with a track record of paying dividends, as well as a strong financial position.

Who Should Invest In Dividend Stocks?

Dividend stocks are a good option for investors who are looking for income from their investments. They can be a good way to supplement your retirement income, or to generate income from your investments while you’re still working. Dividend stocks can also be a good way to diversify your portfolio.

How To Choose Dividend Stocks?

There are a few things to consider when choosing dividend stocks. First, you’ll want to look at the company’s financial strength. Make sure the company is profitable and has a good track record of paying dividends. You’ll also want to look at the company’s dividend yield. A high dividend yield can be a sign that a stock is undervalued. However, it’s important to look for companies with a track record of paying dividends, as well as a strong financial position.

Some Of The Best Dividend Stocks

Some of the top dividend-paying stocks include Johnson & Johnson, Procter & Gamble, and Coca-Cola. These companies have a long history of paying dividends and are considered to be some of the most stable companies in the world. Other companies with a history of paying dividends include PepsiCo, Chevron, and ExxonMobil.

Dividend stocks can be a good way to generate income from your investments. However, it’s important to do your research before investing in any stock. Make sure you understand the company’s financial strength and dividend history. You should also consider your own investment goals and risk tolerance before investing in any stock.

Here Are the Best Dividend Stocks to Buy

The stock market is treacherous, with investors often finding themselves at the mercy of wildly fluctuating share prices. But even in this uncertain landscape, there’s a beacon of stability: dividend stocks. These gems regularly distribute a portion of their profits to shareholders, providing a steady stream of income that can weather even the fiercest market storms.

Top 5 Dividend Stocks

- Johnson & Johnson ($JNJ): This healthcare giant has been a dividend aristocrat for over 60 years, a testament to its consistent profitability. Its dividend yield currently stands at around 2.5%, a reliable income source for investors.

- Procter & Gamble ($PG): Another consumer staples powerhouse, P&G boasts a dividend yield of around 2.7%. With iconic brands like Tide, Pampers, and Gillette in its portfolio, P&G’s earnings are remarkably stable, making it a prime choice for dividend seekers.

- Coca-Cola ($KO): The epitome of brand recognition, Coca-Cola has been quenching our thirst for decades. Its dividend yield is currently around 3%, and the company has a long history of increasing its payouts, making it a solid investment for long-term income generation.

- Verizon ($VZ): In the realm of telecommunications, Verizon reigns supreme. Its dividend yield of around 4% is one of the highest in the sector. And with its strong cash flow and dominant market position, Verizon’s dividend payments look set to continue for the foreseeable future.

- AT&T ($T): Another telecom giant, AT&T offers a dividend yield of around 5%. While concerns linger about the company’s debt load, AT&T’s extensive network and loyal customer base make it a compelling choice for dividend investors.

Cautions

Before diving headfirst into the world of dividend stocks, it’s crucial to remember that dividend payments are not guaranteed. Companies can reduce or eliminate dividends at any time, so it’s essential to do your research and only invest in companies with a solid track record of dividend payments.

Another caution to heed is that dividend yields can be misleading. A high yield doesn’t necessarily mean a good investment. Some companies may have unsustainable dividend payouts, so it’s vital to look at the company’s overall financial health and cash flow before making a decision.

No responses yet