Blockchain Technology Companies in Finance

Get ready to dive into the world of blockchain technology and its game-changing impact on the financial industry. Blockchain, like a virtual vault, secures and streamlines financial transactions, leaving no room for mischief or trickery. Join us as we explore the companies that are at the forefront of this technological revolution, unlocking new possibilities for the way we handle our hard-earned cash.

Blockchain Technology Companies in Banking

Banks, the gatekeepers of our financial world, are embracing blockchain’s embrace wholeheartedly. Say goodbye to the days of slow and costly cross-border transactions. Blockchain has thrown open the doors to near-instantaneous and economical transfers, making international payments as simple as sending a text. Not only that, but blockchain’s trusty encryption safeguards sensitive financial data like a watchful guardian, keeping it out of the clutches of prying eyes.

But wait, there’s more! Blockchain’s got a secret weapon up its sleeve – smart contracts. These digital agreements automatically execute transactions when certain conditions are met, eliminating the need for costly lawyers and paperwork. Think of it as the ultimate efficiency booster, saving both time and money.

And let’s not forget about transparency. Blockchain’s crystal-clear ledger lays bare every transaction, fostering trust and accountability. No more shady dealings or hidden agendas. With blockchain on the scene, the financial world is becoming as transparent as a freshly cleaned window.

So, who are the pioneers leading the charge in this blockchain revolution? Well, let’s give a round of applause to Ripple, the company that’s making waves in cross-border payments. And let’s not forget R3 Corda, the blockchain platform that’s got the world’s biggest banks lining up to join the party.

Blockchain Technology: Revolutionizing Finance

In the ever-evolving landscape of technology, blockchain has emerged as a game-changer, boasting a roster of illustrious companies leading the charge. From behemoths like Coinbase to niche players like R3 Corda, these innovators are harnessing the transformative power of blockchain to reshape the financial realm.

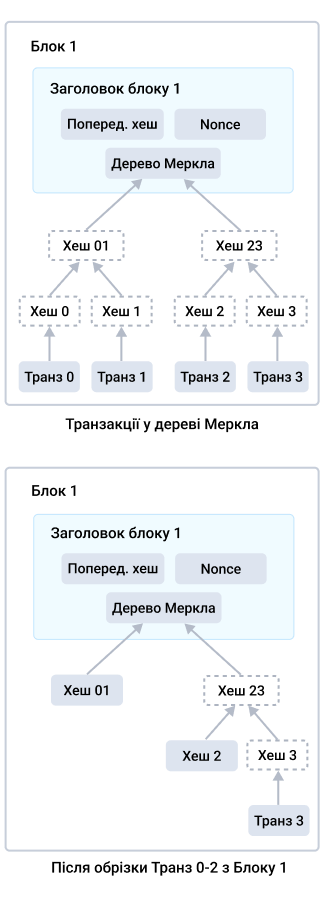

What exactly is blockchain, you ask? Think of it as an incorruptible digital ledger, a decentralized database spread across numerous computers that meticulously records every transaction. This distributed nature renders it virtually impervious to hacking or tampering, making it the epitome of security.

Benefits of Blockchain for Finance

Blockchain’s impact on finance is nothing short of profound. Like a beacon in a financial tempest, it offers a safe haven, anchored by enhanced security, transparency, and efficiency.

Enhanced Security: The Fort Knox of Finance

Blockchain’s decentralized architecture acts as a formidable bulwark against cyber threats. The cryptographic algorithms employed in blockchain render each transaction inviolable, ensuring that financial data remains safe from prying eyes. This impregnable security turns traditional money laundering and fraud attempts into a futile endeavor, protecting both institutions and individuals.

Take the case of Ripple, a blockchain-based financial network. Ripple’s distributed ledger provides a secure platform for cross-border transactions, slashing processing times and significantly reducing transaction costs. Moreover, Ripple’s inherent security safeguards financial transactions, minimizing the risk of fraud and cyberattacks.

Blockchain’s impenetrable security is a boon to financial institutions and consumers alike. It instills confidence, fosters trust, and empowers users to conduct financial transactions with peace of mind, knowing that their assets are shielded from malicious actors.

Transparency: A Crystal Ball for Finance

Blockchain’s transparent nature shines a piercing light on financial transactions, illuminating every nook and cranny. Each transaction is meticulously recorded on the immutable ledger, visible to all participants. This transparency fosters accountability, reduces the risk of financial misconduct, and promotes ethical practices.

For instance, blockchain-based platforms like Chainlink provide real-time data feeds for financial applications. This data transparency empowers investors and other financial stakeholders with accurate and up-to-date information, enabling them to make informed decisions.

Blockchain’s transparency not only enhances trust but also serves as a deterrent against financial malfeasance. With every transaction laid bare for the world to see, individuals and institutions are less likely to engage in unethical behavior, knowing that their actions will be exposed.

Efficiency: Lightning Speed for Finance

Blockchain’s lightning-fast efficiency in processing transactions is akin to a financial race car. By eliminating intermediaries and automating processes, blockchain streamlines transactions, reducing processing times, and minimizing transaction costs.

Consider the example of Ethereum, a programmable blockchain platform. Ethereum’s smart contracts automate complex financial agreements, reducing the need for manual intervention and paperwork. This efficiency translates into significant time and cost savings, making financial transactions more accessible and affordable for all.

Blockchain’s unparalleled efficiency is a boon to financial institutions and businesses. It accelerates processes, reduces operational costs, and frees up resources to focus on innovation and growth.

In conclusion, blockchain technology is poised to transform the financial industry, offering a myriad of benefits that enhance security, transparency, and efficiency. As more companies embrace blockchain’s transformative power, we can expect a financial landscape that is more secure, transparent, and efficient than ever before.

Blockchain Technology Companies

The rising stars of the tech world, blockchain technology companies are making waves by harnessing the transformative power of blockchain. These companies are developing innovative solutions that are poised to revolutionize industries far and wide.

By leveraging the decentralized and immutable nature of blockchain, these companies are creating new ways to store, secure, and share data. They are also developing applications that enable faster, more efficient, and more transparent transactions.

With their sights set on transforming the way we do business, blockchain technology companies are poised to become major players in the global economy. As the technology continues to evolve, these companies are expected to play an increasingly important role in shaping our future.

Use Cases for Blockchain in Finance

In the realm of finance, blockchain technology is making a significant impact. By providing a secure and efficient way to process transactions, blockchain is helping to streamline financial operations and reduce costs.

Payments

Blockchain is being used to streamline and speed up payments. By eliminating the need for intermediaries, blockchain can reduce transaction fees and processing times.

Imagine a world where you could send money to anyone, anywhere in the world, instantly and for free. That’s the promise of blockchain-based payments.

Clearing and Settlement

Blockchain is also being used to improve the clearing and settlement process. By providing a real-time, tamper-proof record of transactions, blockchain can help to reduce errors and fraud.

In the traditional clearing and settlement process, transactions can take days to complete. With blockchain, this process can be completed in minutes.

Trade Finance

Blockchain is also being used to transform trade finance. By providing a secure and transparent way to track and manage trade transactions, blockchain can help to reduce risk and improve efficiency.

Imagine a world where trade finance was as simple as sending a text message. That’s the goal of blockchain-based trade finance.

Blockchain Technology Companies: Revolutionizing the Finance Industry

In today’s ever-evolving financial landscape, blockchain technology has emerged as a game-changer, promising to revolutionize the way we handle transactions, manage data, and even create new financial products.

Blockchain companies, at the forefront of this technological revolution, are propelling the adoption of blockchain in the finance sector. These companies are pioneering innovative solutions that address industry challenges, foster collaboration, and open up new avenues for financial inclusion.

Challenges to Blockchain Adoption

Despite its transformative potential, blockchain adoption faces several significant challenges:

Scalability

When the volume of transactions on a blockchain network exceeds its capacity, scalability becomes an issue. Slow transaction speeds and high transaction fees can hinder the widespread adoption of blockchain-based solutions.

Interoperability

Different blockchain networks often operate independently, making it difficult for them to communicate with each other. This lack of interoperability limits the potential for seamless cross-chain transactions and the development of comprehensive blockchain ecosystems.

Regulation

The regulatory landscape for blockchain technology is still evolving, making it challenging for companies to operate in compliance with the law. Lack of clear regulations can introduce uncertainty and hinder the growth of blockchain in the finance industry.

Security

While blockchain is inherently secure, its decentralized nature poses unique security challenges. Companies must invest heavily in robust security measures to protect blockchain networks and data from malicious actors.

Cost

The cost of developing and maintaining blockchain-based solutions can be significant, especially for startups and small companies. This can hinder the adoption of blockchain in certain sectors where cost-effectiveness is a key consideration.

Blockchain Technology Companies: Revolutionizing the Future of Finance

In the ever-evolving landscape of finance, blockchain technology companies are poised to play a transformative role. From startups to established giants, these innovators are harnessing the power of decentralized ledgers to revolutionize everything from payments and lending to trading and asset management.

Evolution of Blockchain Technology in Finance

Blockchain technology has emerged as a game-changer for the finance industry, offering a secure, transparent, and tamper-proof platform for financial transactions. Unlike traditional systems, blockchain eliminates the need for intermediaries, reducing costs, speeding up processes, and improving trust.

Growing Adoption of Blockchain Solutions

As the benefits of blockchain become increasingly apparent, its adoption in the finance sector is on the rise. Banks, investment firms, and fintech companies are experimenting with a wide range of blockchain-based applications, including:

- Digital payments: Streamlining cross-border transactions and reducing transaction fees.

- Smart contracts: Automating contract execution and ensuring compliance.

- Tokenization of assets: Creating new investment opportunities and increasing liquidity.

Challenges Facing Blockchain Adoption

Despite its promise, blockchain technology faces challenges that hinder its widespread adoption. These include regulatory uncertainty, scalability issues, and the need for industry-wide standardization. However, companies and governments are actively working to address these obstacles and pave the way for the future of blockchain in finance.

Future of Blockchain in Finance

Despite the challenges, blockchain technology is expected to have a significant impact on the future of the finance industry. It has the potential to:

- Enhance security: Secure financial data and prevent fraud.

- Reduce costs: Eliminate intermediaries and automate processes.

- Increase transparency: Provide clear audit trails and build trust.

- Promote financial inclusion: Open up financial services to underserved communities.

- Foster innovation: Create new products and services that were previously impossible.

As blockchain technology matures and its applications are refined, the future of finance is poised for a seismic shift. The companies that embrace and leverage this transformative technology will be well-positioned to thrive in the years to come.

No responses yet