Introduction

Ever dream of raking in the dough while you sleep? Passive income can make that dream a reality. It’s the holy grail of financial freedom, a steady stream of cash that keeps flowing in without you having to lift a finger. Whether you’re looking to boost your savings, retire early, or simply have some extra spending money, passive income is the key to unlocking your financial potential.

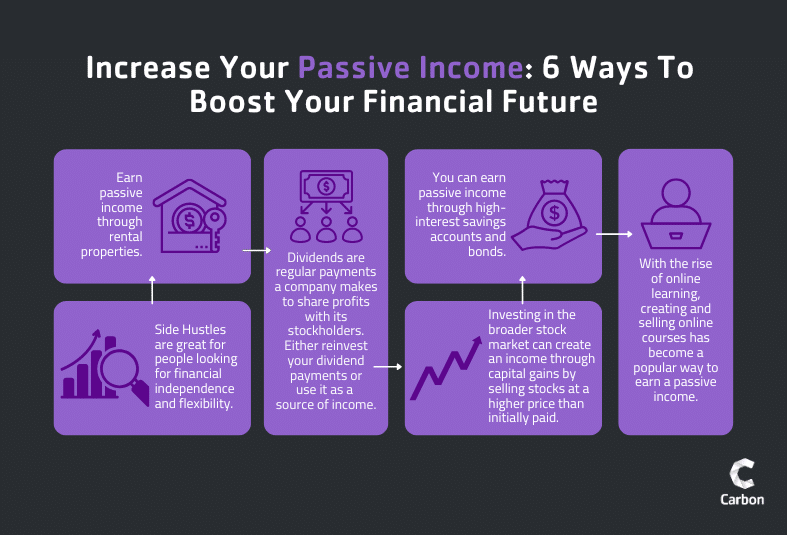

Passive income comes in all shapes and sizes. From rental properties to online courses, there’s an endless array of ways to generate income without active involvement. The key is to find something that aligns with your skills, interests, and financial goals. So, what are you waiting for? Dive into the world of passive income today and start building the financial future you’ve always dreamed of.

How Does Passive Income Work?

The beauty of passive income lies in its simplicity. Unlike traditional income, which requires you to trade your time for money, passive income allows you to earn money while you’re sleeping, traveling, or simply enjoying life on your own terms. The key is to create a system or asset that generates income without your active involvement. Once your system is in place, you can sit back, relax, and watch the money roll in.

There are countless ways to generate passive income. Some popular methods include investing in dividend-paying stocks, creating online courses, writing and selling ebooks, renting out property, and starting an affiliate marketing business. The possibilities are endless, so you’re sure to find something that suits your skills and interests.

Benefits of Passive Income

The benefits of passive income are undeniable. First and foremost, it can provide you with a steady stream of income, regardless of your circumstances. This can give you peace of mind knowing that you have a financial safety net to fall back on. Passive income can also help you reach your financial goals faster, whether it’s paying off debt, saving for retirement, or buying your dream home.

Furthermore, passive income can give you more freedom and flexibility in your life. You’ll no longer be tied to a traditional job, which means you can pursue your passions, travel the world, or simply spend more time with your loved ones. Passive income can truly be life-changing, giving you the opportunity to live the life you’ve always dreamed of.

Earn Passive Income: A Path to Financial Freedom

In this modern era, earning passive income has become a highly sought-after pursuit for many people seeking financial independence and security. It involves generating income that flows into your pockets without you having to actively work for it.

Types of Passive Income

There’s a whole smorgasbord of ways to earn passive income, from the traditional to the downright ingenious. Let’s dive right into some of the most popular methods:

1. Real Estate Investment

Real estate has long been a cornerstone of passive income strategies. Renting out properties or investing in REITs (real estate investment trusts) can provide a steady stream of rental income or dividends.

2. Investing in Stocks and Bonds

Investing in stocks and bonds offers the potential for capital appreciation and dividend payments. Stocks represent ownership in companies, while bonds are loans made to governments or corporations. Dividends are a share of a company’s profits that are paid out to shareholders, while bonds pay interest to investors.

3. Dividend-Paying Stocks

Oh, boy! Dividend-paying stocks are like the money-making machines of the stock market. These companies share a slice of their profits with their shareholders through dividends. So, you buy these stocks, sit back, and watch the dividends trickle into your account like a gentle rain.

4. Online Courses and Products

Hey, if you’ve got knowledge that others crave, why not package it into online courses or products? Create valuable content that people are willing to pay for, and you’ll have a passive income stream that just keeps on giving.

5. Affiliate Marketing

Affiliate marketing is like being a middleman for other businesses. You promote their products or services on your website or social media, and when someone makes a purchase through your unique link, you earn a commission. It’s like playing matchmaker for businesses and consumers, and you get paid for it!

6. Peer-to-Peer Lending

Peer-to-peer lending platforms like LendingClub and Prosper connect borrowers with investors. You can lend money to borrowers and earn interest on the loans, contributing to a steady stream of passive income.

7. Rental Income

Rental income is the bread and butter of passive real estate income. When you own properties and rent them out to tenants, you collect rent payments that flow into your account month after month. It’s like having a team of tenants working for you, generating income while you sleep.

8. Royalties

Royalty payments are a sweet deal for artists and creators. When you create a piece of work (e.g., a book, song, or movie), you can earn royalties every time it’s sold, streamed, or licensed. It’s like having a passive income machine that keeps churning out cash long after you’ve put in the initial work.

Earn Passive Income Like a Pro: A Guide to Achieving Financial Freedom

The concept of earning passive income has gained immense traction in recent times, offering individuals the enticing prospect of generating revenue without the constraints of traditional employment. This article delves into the myriad benefits of passive income and provides practical insights into how you can harness its power to create a more financially secure and fulfilling life.

Benefits of Passive Income

Passive income offers a wealth of advantages that can profoundly impact your financial well-being. Firstly, it provides an additional stream of income, supplementing your primary earnings and safeguarding you against financial downturns. This extra cushion can grant you the freedom to pursue passions, travel, or simply enjoy a higher standard of living.

Moreover, passive income bestows flexibility upon your life. Unlike traditional employment, passive income sources are not subject to fixed schedules or the whims of a boss. You can choose how much time and effort you dedicate to them, allowing you to strike a harmonious balance between work and personal fulfillment.

Lastly, passive income contributes to peace of mind. Knowing that you have a steady flow of revenue, regardless of your current circumstances, can alleviate financial stress and provide a sense of security. It’s akin to having a financial safety net, providing you with the confidence to take risks and pursue opportunities that may not have been possible otherwise.

How to Get Started Earning Passive Income

Earning passive income can be a great way to supplement your income or even replace your full-time job. But, how do you get started? There are a few different ways to earn passive income, and the best method for you will depend on your skills and interests. In this article, we’ll discuss some of the most popular ways to earn passive income and provide tips on how to get started.

Ways to Earn Passive Income

There are many ways to earn passive income, such as:* Investing in real estate: When you invest in real estate, you can earn passive income through rent payments or by selling the property for a profit. Owning rental properties can also be a great way to build wealth over time.

-

Investing in dividend-paying stocks: Dividend-paying stocks are stocks that pay a portion of their earnings to shareholders in the form of dividends. This can be a great way to earn passive income, especially if you invest in companies with a long history of paying dividends.

-

Starting an online business: Starting an online business can be a great way to earn passive income. There are many different ways to start an online business, such as selling products or services, creating a blog, or starting an affiliate marketing business.

-

Creating a course or ebook: If you have expertise in a particular area, you can earn passive income by creating a course or ebook and selling it online. This can be a great way to share your knowledge and help others while also earning money.

-

Investing in peer-to-peer lending: Peer-to-peer lending is a way to earn passive income by lending money to other people. This can be a great way to earn a higher return on your investment than you would from a traditional savings account.

Tips for Getting Started

Earning passive income takes time and effort, but it is definitely possible to achieve. Here are a few tips to get you started:

-

Start small: Don’t try to earn a lot of passive income right away. Start with a small goal and gradually increase your income over time.

-

Be patient: Earning passive income takes time. Don’t get discouraged if you don’t see results immediately. Just keep at it and you will eventually reach your goals.

-

Diversify your income: Don’t rely on just one source of passive income. Diversify your income by investing in different assets and businesses. This will help you reduce your risk.

-

Reinvest your earnings: Reinvest your earnings to grow your passive income over time. The more you reinvest, the more money you will make.

Earning passive income can be a great way to supplement your income or even replace your full-time job. By following the tips in this article, you can get started on the path to financial freedom.

Earn Passive Income: A Path to Financial Empowerment

Passive income is like the elusive pot of gold at the end of the financial rainbow – a tantalizing concept that promises to free us from the shackles of traditional employment. Earning passive income means generating revenue without actively working for it, allowing us to build wealth and achieve financial freedom. If you’ve ever wondered how to make money in your sleep, passive income is your golden ticket.

Rental Properties: A Classic Passive Income Avenue

Investing in rental properties is a time-honored way to earn passive income. By purchasing a property and renting it out, you can generate a steady stream of rental income while the property appreciates in value over time. This strategy is particularly appealing for those seeking long-term wealth creation and a hedge against inflation.

Dividend Investing: Harnessing the Power of Stocks

Becoming a shareholder in dividend-paying companies is another way to earn passive income. Dividends are regular payments made by companies to their shareholders, typically out of their profits. By investing in a portfolio of dividend-paying stocks, you can receive a portion of the company’s earnings without having to actively manage the business.

Online Business: Creating Your Own Income Stream

Starting an online business can be a lucrative path to passive income. E-commerce stores, affiliate marketing, and online courses are just a few examples of businesses that can generate passive income. By leveraging the power of the internet, you can reach a global audience and create a steady stream of revenue with minimal effort.

Investing in Intellectual Property: Monetizing Your Creativity

If you’re a writer, musician, or artist, you can earn passive income from your creations by licensing or selling your intellectual property. This could involve selling rights to your music, artwork, or written content to businesses or individuals for use in commercials, films, or publications.

Conclusion

Earning passive income is a powerful tool for achieving financial freedom and building wealth. Whether you choose to invest in rental properties, dividend stocks, or online businesses, there’s a passive income strategy that can fit your financial goals. Remember, the key is to find a strategy that aligns with your interests, risk tolerance, and financial situation. So, why wait? Dive into the world of passive income today and start reaping the rewards of financial independence.

No responses yet