Investment Portfolio Management Software: A Comprehensive Overview

Navigating the intricate world of investments can be a daunting task. Fortunately, technology has provided us with an invaluable tool – investment portfolio management software. These sophisticated programs are indispensable for investors, offering a powerful suite of features that streamline the management and monitoring of investment portfolios. Let’s dive into the realm of these software solutions, exploring their capabilities and the benefits they bring.

Investment Portfolio Management Software: A Navigator Through the Investment Landscape

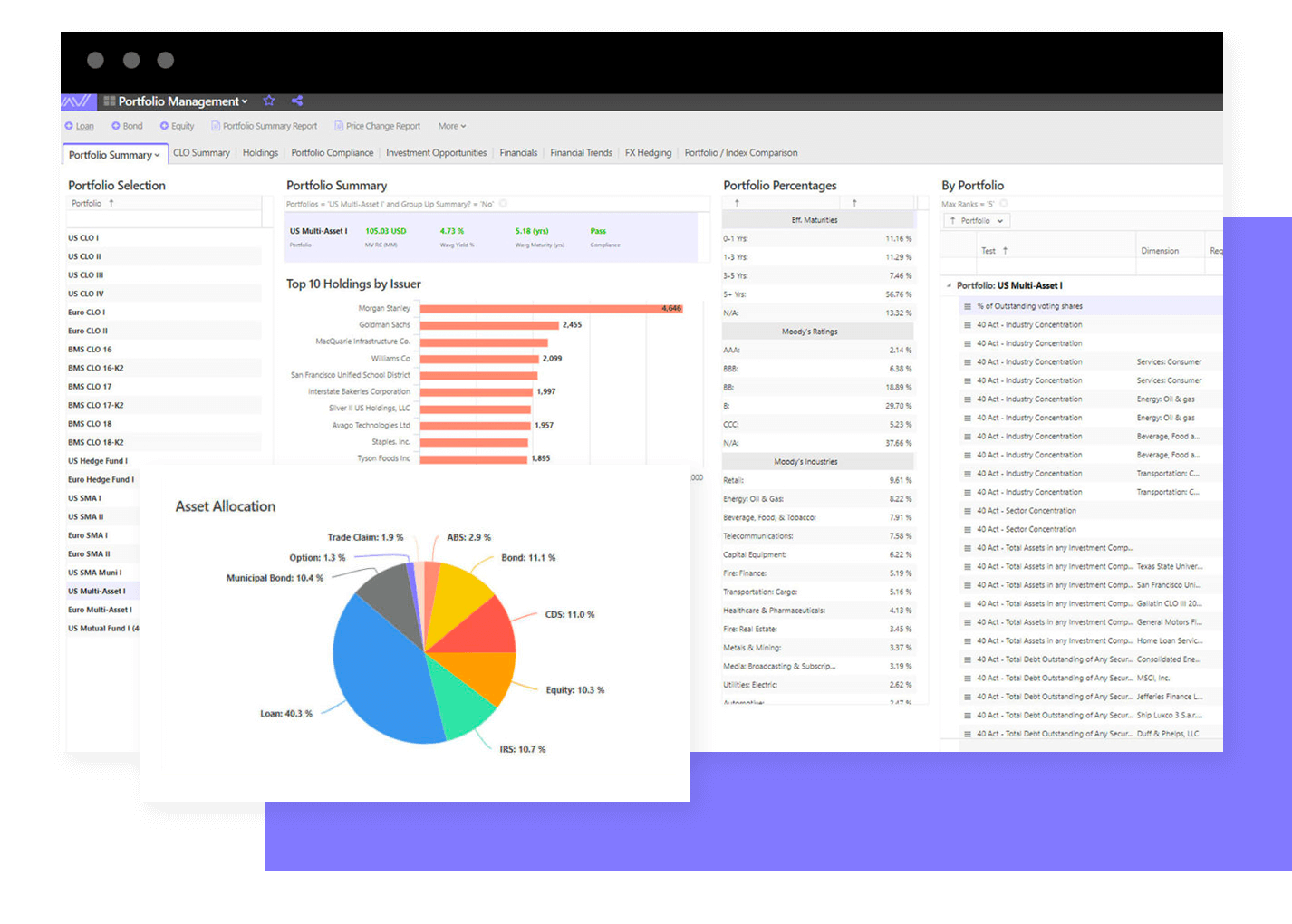

Picture an investor embarking on a journey through a vast and complex investment landscape. Armed with nothing but spreadsheets and manual calculations, they face the arduous task of tracking stocks, bonds, and other assets, while monitoring market trends and making informed decisions. Investment portfolio management software eliminates this burden, providing a centralized hub for all investment-related data. These programs offer a comprehensive overview of your portfolio, enabling you to analyze performance, identify opportunities, and make timely adjustments with ease.

For instance, consider Wealthfront’s innovative platform. This software seamlessly integrates with your financial accounts, automatically importing transactions and updating your portfolio in real-time. Its intuitive interface provides a clear understanding of your asset allocation, risk tolerance, and potential returns. With Wealthfront, you can effortlessly track your investments, stay informed about market fluctuations, and make informed decisions from anywhere, anytime.

Moreover, portfolio management software offers robust reporting capabilities. Generate customizable reports that provide detailed insights into your investment performance. Analyze historical trends, compare different asset classes, and identify areas for improvement. These reports empower you to make data-driven decisions, fine-tune your investment strategy, and maximize your returns.

The benefits of investment portfolio management software extend beyond increased efficiency and improved decision-making. These programs play a vital role in mitigating risks. Real-time alerts notify you of significant market events or changes in your portfolio, allowing you to react promptly and protect your investments. Risk management tools like diversification analysis help you spread your investments across various asset classes, reducing exposure to potential losses.

In conclusion, investment portfolio management software is not just a tool but an indispensable ally for investors. It streamlines portfolio management, provides real-time insights, helps identify opportunities, and mitigates risks. Whether you’re a seasoned investor or just starting out, these software solutions empower you to navigate the investment landscape with confidence and achieve your financial goals.

Introduction

Investment portfolio management software is a must-have in today’s financial climate. With the stock market’s constant fluctuations and the vast array of investment options available, it can be challenging to keep track of your portfolio and make informed decisions. That’s where investment portfolio management software comes in. These tools provide investors with the insights and tools they need to track, analyze, and optimize their investments, ensuring that they are making the most of their assets. One such software is [Software Name], a leader in the industry that offers a comprehensive suite of features to empower investors.

Key Features of Investment Portfolio Management Software

Investment portfolio management software typically offers a range of features that cater to the needs of investors. Some of the most common features include:

Benefits of Using Investment Portfolio Management Software

There are numerous benefits to using investment portfolio management software, including:

Investment Portfolio Management Software: A Comprehensive Guide

In today’s fast-paced financial world, staying on top of your investments is paramount. Investment portfolio management software has emerged as a valuable tool for both individual investors and financial advisors, offering a myriad of benefits that make it indispensable for managing your hard-earned money. One such investment portfolio management software is [software name], which offers a comprehensive suite of features to help you optimize your portfolio performance.

Benefits of Using Investment Portfolio Management Software

Managing an investment portfolio can be a complex and time-consuming task. Investment portfolio management software takes on this burden, streamlining investment tracking, reducing manual errors, and providing real-time performance monitoring. By automating these processes, you’ll save precious time and effort, allowing you to focus on making informed investment decisions.

Streamlined Investment Tracking

Investment portfolio management software acts as a central hub for all your investment information. It consolidates your holdings across different accounts and asset classes, providing you with a comprehensive view of your portfolio’s performance. This real-time data empowers you to make swift and strategic decisions based on the latest market trends.

Reduced Manual Errors

Manual tracking of investments is prone to human error, which can lead to costly mistakes. Investment portfolio management software eliminates this risk by automating various processes, such as data entry and performance calculations. You can rest assured that your investment data is accurate and up to date, giving you confidence in your decision-making.

Real-Time Performance Monitoring

Investment portfolio management software provides real-time updates on the performance of your holdings. You can track the value of your investments, calculate returns, and analyze risk exposure in an instant. This continuous monitoring allows you to stay abreast of market fluctuations and make adjustments as needed to maximize your returns.

Investment Portfolio Management Software: A Guide to Maximizing Your Returns

Navigating the complexities of investment management can be a daunting task, but powerful software solutions are available to help you streamline the process, optimize your portfolio, and stay ahead of the market. Investment portfolio management software like [software name] empowers investors with a comprehensive suite of tools, empowering them to make informed decisions and achieve their financial goals.

Features of Investment Portfolio Management Software

These software solutions are designed to equip investors with a range of essential features that cater to their diverse needs. They offer customization options, ensuring that portfolios can be tailored to individual risk tolerances and investment objectives. Moreover, they support multiple asset classes, allowing investors to diversify their holdings across stocks, bonds, real estate, commodities, and other investment vehicles.

The integration with financial data providers is another crucial feature of investment portfolio management software. This integration provides investors with real-time market data, research reports, and insights from industry experts. This wealth of information empowers investors to make informed decisions and stay abreast of the latest market trends.

Benefits of Investment Portfolio Management Software

The benefits of using investment portfolio management software are numerous. It saves time and effort, automating repetitive tasks such as account monitoring, performance tracking, and rebalancing. This frees up investors to focus on making strategic investment decisions and managing their overall financial strategy.

Moreover, these software solutions provide investors with a holistic view of their portfolios. They consolidate data from multiple accounts, enabling investors to see how their investments are performing in real-time. This consolidated view empowers investors to make informed decisions about asset allocation, risk management, and tax optimization.

Choosing the Right Investment Portfolio Management Software

Selecting the right investment portfolio management software is crucial for optimizing returns and achieving financial success. When making a choice, investors should consider the features they need, the cost of the software, and the level of customer support provided. It’s also important to ensure that the software is compatible with the investor’s operating system and devices.

Conclusion

Investment portfolio management software is an invaluable tool for investors of all levels. It empowers them with the knowledge, insights, and tools necessary to navigate the complexities of the financial markets. By choosing the right software and leveraging its features, investors can optimize their portfolios, make informed decisions, and maximize their investment returns. Is there anything else we can help you with today?

Investment Portfolio Management Software: A Guide for the Uninformed

Investing shouldn’t be a headache. That’s why investment portfolio management software has become a must-have for anyone serious about managing their finances and making the most of their investments. With the right software, you can track your investments, automate tasks, and make informed decisions to help you reach your financial goals.

Types of Investment Portfolio Management Software

There are two main types of investment portfolio management software: cloud-based and on-premise. Cloud-based solutions are hosted online, so you can access them from anywhere with an internet connection. On-premise software, on the other hand, is installed on your own computer or server.

Cloud-based solutions offer several advantages, including:

- Flexibility: You can access your portfolio from anywhere, at any time.

- Scalability: Cloud-based solutions can easily scale to meet your needs as your portfolio grows.

- Lower cost: Cloud-based solutions are often more affordable than on-premise software.

On-premise software offers some advantages as well, including:

- Security: On-premise software is more secure than cloud-based solutions because it is not accessible online.

- Customization: You can customize on-premise software to meet your specific needs.

The right type of investment portfolio management software for you will depend on your individual circumstances.

Features to Look for in Investment Portfolio Management Software

When choosing investment portfolio management software, there are a few key features to look for. These include:

- Asset tracking: The software should allow you to track all of your investment assets, including stocks, bonds, mutual funds, and real estate.

- Performance tracking: The software should allow you to track the performance of your investments over time.

- Rebalancing tools: The software should allow you to automatically rebalance your portfolio to ensure it stays aligned with your risk tolerance and financial goals.

- Reporting tools: The software should provide you with detailed reports on your portfolio’s performance, including charts, graphs, and tables.

- Integration with other financial software: The software should be able to integrate with other financial software, such as accounting and tax software.

Benefits of Using Investment Portfolio Management Software

There are many benefits to using investment portfolio management software. These benefits include:

- Save time: The software can automate many of the tasks associated with managing an investment portfolio, such as tracking performance and rebalancing.

- Make better decisions: The software can provide you with valuable insights into your portfolio’s performance, which can help you make better investment decisions.

- Reduce risk: The software can help you reduce risk by identifying potential problems and suggesting ways to mitigate them.

- Grow your wealth: The software can help you grow your wealth by providing you with the tools you need to make informed investment decisions.

Conclusion

Investment portfolio management software is a powerful tool that can help you manage your finances and reach your financial goals. By choosing the right software and using it effectively, you can save time, make better decisions, reduce your risk, and grow your wealth.

Investment Portfolio Management Software: A Guide to Making Wise Choices

With the advent of technology, managing investment portfolios has become more efficient and accessible than ever before. Investment portfolio management software offers a plethora of tools and features to help investors stay on top of their investments, make informed decisions, and maximize returns. Let’s delve into some best practices for using this powerful tool.

Best Practices for Using Investment Portfolio Management Software

Firstly, it’s crucial to pick the right software. With a wide range of options available, finding one that aligns with your needs is paramount. Consider factors such as the software’s user interface, functionality, reporting capabilities, and cost. A suitable software will empower you to seamlessly track and manage your investments.

Once you’ve selected your software, keeping it up-to-date is essential. Regular software updates ensure you have access to the latest features, bug fixes, and security patches. This is especially important for portfolio management, where accuracy and reliability are paramount.

Conducting regular portfolio reviews is another cornerstone of effective portfolio management. Use the software to analyze your performance, identify areas for improvement, and make necessary adjustments. Regular check-ins will keep you in the driver’s seat of your investments.

Consulting with financial professionals can provide invaluable insights and guidance. They can offer objective advice based on their expertise and understanding of the markets. Whether you’re just starting or have years of experience, seeking professional advice is always a prudent move.

Diligence in using your investment portfolio management software is the key to maximizing its benefits. Take the time to understand how the software works, explore its features, and customize it to suit your needs. The more proficient you become, the more value you’ll derive from it.

Security should always be top of mind when managing investments online. Ensure your software has robust security measures in place to protect your data and prevent unauthorized access. This includes using strong passwords, enabling multi-factor authentication, and backing up your data regularly.

Lastly, don’t be afraid to seek help when needed. Most software providers offer customer support or online forums where you can connect with others and find solutions to any challenges you may encounter. Don’t hesitate to reach out for assistance if something’s not clear or if you need guidance.

No responses yet