Introduction

Retirement can be a daunting prospect, but one of the most important decisions you’ll make is how to allocate your hard-earned savings. And when it comes to retirement portfolios, one of the biggest questions is: how much cash should you keep on hand? The answer, as you might expect, is not a one-size-fits-all solution. It depends on a number of factors, including your age, risk tolerance, and investment goals. The general consensus among financial advisors is that retirees should keep between 0% and 25% of their portfolio in cash. However, there are a number of factors that can affect this number, such as your age, risk tolerance, and investment goals. Let’s dive into a few of these factors in more detail.

How Much Cash Should You Keep in Your Retirement Portfolio?

So, how much cash should you keep in your retirement portfolio? Well, it depends. There are a number of factors to consider, including your age, risk tolerance, and investment goals. If you’re young and have a long time until retirement, you can afford to take on more risk. You may want to consider keeping a smaller percentage of your portfolio in cash and investing more in stocks and bonds. However, if you’re closer to retirement or have a low risk tolerance, you may want to keep a larger percentage of your portfolio in cash. This will help protect your savings from market volatility. Ultimately, the best way to determine how much cash to keep in your retirement portfolio is to talk to a financial advisor.

Factors to Consider When Determining Your Cash Allocation

There are a number of factors to consider when determining your cash allocation, including:

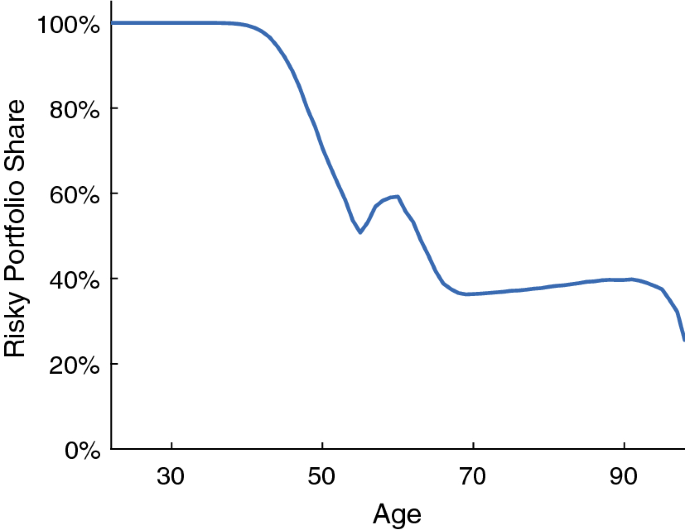

- Age: Generally speaking, the younger you are, the more risk you can afford to take. This means you can keep a smaller percentage of your portfolio in cash and invest more in stocks and bonds. However, as you get closer to retirement, you may want to start increasing your cash allocation to protect your savings from market volatility.

- Risk tolerance: If you’re comfortable with taking on more risk, you can keep a smaller percentage of your portfolio in cash. However, if you’re risk-averse, you may want to keep a larger percentage of your portfolio in cash.

- Investment goals: What are your investment goals? Are you saving for a specific purchase, such as a new home or a vacation? Or are you saving for a more general purpose, such as retirement? Your investment goals will help you determine how much cash you need to keep on hand.

Conclusion

Ultimately, the decision of how much cash to keep in your retirement portfolio is a personal one. There is no right or wrong answer, and the best approach will vary depending on your individual circumstances. However, by considering the factors discussed above, you can make an informed decision about how to allocate your retirement savings.

How Much of Your Retirement Portfolio Should Be in Cash?

Deciding how much of your retirement portfolio should be in cash is a crucial step in securing your financial future. The ideal percentage varies depending on several factors, including the age, risk tolerance, and expected retirement expenses of the individual. However, financial experts generally recommend allocating 5-10% of a retirement portfolio to cash.

Factors to Consider

Age: The younger you are, the more time your investments have to grow. This means you can afford to take on more risk, including stocks and bonds. As you get closer to retirement, it’s wise to shift more of your portfolio to cash to protect against potential market volatility.

Risk Tolerance: Risk tolerance is the measure of how comfortable you are with the possibility of losing money on your investments. If you’re more risk-averse, you’ll want to keep a larger portion of your portfolio in cash. Conversely, if you’re more willing to take risks, you can allocate more to stocks or other growth-oriented investments.

Expected Retirement Expenses: When you retire, you’ll need to have enough cash to cover your monthly expenses. Be sure to factor in things like housing, healthcare, and travel. Having a clear understanding of your expected expenses will help you determine how much of your portfolio should be in cash.

In addition to these factors, you may also want to consider your health, marital status, and tax situation. The more variables you account for, the more accurate your cash allocation will be.

The Role of Cash in a Retirement Portfolio

Cash plays an important role in a retirement portfolio. It provides a buffer against unexpected expenses and market downturns, and it can be used to take advantage of investment opportunities as they arise. Keeping a portion of your portfolio in cash can give you peace of mind and help you stay on track toward your retirement goals.

What Percent of Retirement Portfolio Should Be in Cash?

Navigating the labyrinthine world of retirement planning can be daunting, especially when it comes to deciphering the optimal allocation of your nest egg. One critical decision you’ll face is determining the appropriate percentage of your portfolio to dedicate to cash.

General Guidelines

A prudent rule of thumb suggests that individuals nearing retirement may opt for a higher cash allocation of up to 20%. This conservative approach provides a buffer against market volatility, ensuring that they have ready access to funds when they need them. Conversely, those with a longer horizon to retirement may find comfort in a smaller cash allocation, allowing their investments to reap the potential rewards of long-term growth.

Factors to Consider

The ideal cash allocation for your retirement portfolio hinges on a myriad of factors, including your:

- Age and time horizon to retirement

- Risk tolerance

- Investment goals

- Income needs

- Health status

It’s essential to tailor your cash allocation to your unique circumstances. What works for one retiree may not be suitable for another.

Detailed Analysis

The percentage of your retirement portfolio that should be in cash is a nuanced question, requiring careful consideration. Let’s delve into the factors that can help you determine the appropriate allocation:

- Age and time horizon: The closer you are to retirement, the higher your need for liquidity. A larger cash allocation will provide peace of mind, knowing that you can cover expenses without dipping into investments.

- Risk tolerance: Your comfort with market fluctuations will influence your cash allocation. If you have a low risk tolerance, a higher cash allocation will provide a safety net.

- Investment goals: Your retirement goals will shape your cash allocation. Do you plan to travel extensively, purchase a vacation home, or supplement your income with dividends? Your goals will dictate the need for liquidity.

- Income needs: Assess your anticipated income needs in retirement. If your pension or Social Security benefits will cover most of your expenses, you may need a smaller cash allocation.

- Health status: Unexpected medical expenses can disrupt retirement plans. A larger cash allocation can serve as a buffer against health-related costs.

It’s wise to consult with a financial advisor to devise a personalized cash allocation strategy that aligns with your specific needs and circumstances.

Trying to figure out how much of your retirement portfolio should be in cash? It’s a common question with no easy answer. The ideal cash allocation depends on several factors, including your age, risk tolerance, and investment goals. However, most financial advisors recommend keeping between 5% and 20% of your retirement savings in cash.

Benefits of Holding Cash

There are several benefits to holding cash in your retirement portfolio. First, cash provides liquidity. If you need to access your money quickly, you can sell your cash without having to wait for the market to recover. Second, cash reduces volatility. When the market is volatile, your cash will help to smooth out the returns on your portfolio. Third, cash can be used to take advantage of investment opportunities. If you see a stock or bond that you think is undervalued, you can use your cash to buy it.

How Much Cash Should I Keep?

The amount of cash you should keep in your retirement portfolio depends on your circumstances. If you are young and have a high risk tolerance, you may want to keep a smaller percentage of your portfolio in cash. As you get older and your risk tolerance decreases, you may want to increase the percentage of your portfolio in cash.

Other Factors to Consider

In addition to your age and risk tolerance, there are several other factors to consider when determining how much cash to keep in your retirement portfolio. These factors include:

- Your investment goals

- Your time horizon

- Your income and expenses

- Your tax situation

It’s important to consider all of these factors when making a decision about how much cash to keep in your retirement portfolio. A financial advisor can help you create a retirement plan that meets your specific needs.

How Much of Your Retirement Portfolio Should Be in Cash?

A common question among retirees and those nearing retirement is what percentage of their retirement portfolio should be allocated to cash. While there is no one-size-fits-all answer, financial experts generally recommend keeping between 0% and 20% of your portfolio in cash. Factors such as your age, risk tolerance, and retirement income needs should be considered when determining the appropriate cash allocation.

Benefits of Holding Cash

Holding cash in your retirement portfolio offers several benefits. The primary benefit is that cash provides liquidity and accessibility. If you need to cover an unexpected expense or make a large purchase, you can easily access your cash holdings without having to sell other assets, such as stocks or bonds.

Cash also acts as a hedge against market volatility. When stock markets experience downturns, cash can provide stability and help preserve your portfolio’s value. Additionally, cash can generate income through interest earned in savings accounts or money market funds.

Risks of Holding Too Much Cash

While holding cash offers benefits, excessive cash holdings can also pose risks. One risk is missing out on potential market growth. Historically, the stock market has outperformed cash over the long term. By keeping too much of your portfolio in cash, you may be sacrificing potential returns.

Another risk of holding too much cash is inflation erosion. Over time, inflation can reduce the purchasing power of your cash. This means that the same amount of cash will buy fewer goods and services in the future than it does today.

Finding the Right Balance

The optimal cash allocation for your retirement portfolio depends on your individual circumstances. Younger retirees with a higher risk tolerance may choose to allocate a smaller percentage to cash, while older retirees with a lower risk tolerance may allocate a larger percentage to cash.

It’s important to regularly review your cash allocation and make adjustments as needed. If the stock market is performing well and your risk tolerance has increased, you may consider reducing your cash holdings. Conversely, if the market is volatile and your risk tolerance has decreased, you may consider increasing your cash holdings.

No responses yet