What Stocks Pay the Best Dividends?

When it comes to investing, finding the best dividend-paying stocks can be like striking gold. Dividends are a portion of a company’s profits that are paid out to shareholders, providing you with a steady stream of income. But not all dividend stocks are created equal—some pay more than others. So how do you separate the wheat from the chaff and find the stocks that will pay you the most?

There are a few factors to consider when evaluating dividend-paying stocks. First, look at the dividend yield, which is the annual dividend per share divided by the current stock price. A higher dividend yield generally means more income for you. However, don’t get too caught up in the yield—it’s also important to consider the company’s financial health and its history of paying dividends.

Dividend Growth: The Key to Long-Term Wealth

While dividend yield is important, it’s not the only factor to consider. Dividend growth is also crucial, especially if you’re planning to hold your stocks for the long term. A company that consistently increases its dividend is likely to provide you with a growing stream of income over time.

To assess a company’s dividend growth potential, look at its history of dividend increases. A company that has consistently increased its dividend over the years is more likely to continue doing so in the future.

Dividend growth is like a snowball—it can start small, but it can grow into something much larger over time. By investing in companies that have a track record of dividend growth, you can position yourself to generate increasing income year after year.

Finding the Best Dividend Stocks

Now that you know what to look for, it’s time to start hunting for the best dividend-paying stocks. There are a few places you can look:

Dividend ETFs: These exchange-traded funds offer a basket of dividend-paying stocks, giving you instant diversification. However, you’ll have to pay a management fee for the convenience.

Dividend websites: There are a number of websites that track dividend-paying stocks, such as Dividend.com and Simply Safe Dividends. These websites can help you screen for stocks based on dividend yield, dividend growth, and other criteria.

Company websites: You can also find information about a company’s dividend history on its website. Look for the “Investor Relations” section, where you’ll find information about dividends, earnings, and other financial data.

What Stocks Pay the Best Dividends?

In the labyrinth of investment opportunities, dividend-paying stocks gleam like beacons, beckoning investors seeking passive income. Dividends, those periodic cash payments that companies distribute to their shareholders, can bolster your portfolio and provide a steady stream of returns. But not all dividend payers are created equal. So, how do you navigate the market to find the stocks that offer the best dividends?

Factors to Consider

Sifting through potential dividend stocks requires a keen eye for certain key factors:

-

Dividend History: A track record of consistent dividend payments is a telltale sign of a company’s commitment to its shareholders. Look for companies that have been paying dividends for at least five years, preferably more.

-

Financial Strength: Dividend payments are only sustainable if a company is financially健全. Scrutinize the company’s balance sheet and income statement to assess its overall financial health. Consider factors such as profitability, debt levels, and cash flow. Remember, companies that are struggling to make ends meet are less likely to maintain their dividend payments.

-

Payout Ratio: The payout ratio is the percentage of a company’s earnings that are paid out as dividends. A high payout ratio may indicate that the company is not retaining sufficient funds for future growth or debt repayment. Conversely, a low payout ratio suggests that the company has room to increase dividend payments in the future. Aim for companies with payout ratios between 30% and 50%.

-

Industry Outlook: Consider the industry in which the company operates. Industries with strong growth prospects and low competition tend to offer better dividend opportunities. On the other hand, cyclical industries like energy and construction may experience fluctuations in dividends during economic downturns.

-

Dividend Yield: The dividend yield is the annual dividend per share divided by the current stock price. It indicates the percentage return you can expect from the dividend alone. However, remember that dividend yield is just one piece of the puzzle. Focus on finding companies with a combination of sustainable dividends and strong fundamentals.

Remember, investing in dividend-paying stocks is not a get-rich-quick scheme. It’s a long-term strategy that requires patience and due diligence. By carefully considering the factors discussed above, you can increase your chances of finding stocks that not only pay the best dividends but also have the potential for long-term growth.

What Stocks Pay the Best Dividends?

If you’re looking for stocks that pay the best dividends, you’ll want to consider Dividend Champions and Kings. These are companies that have a long history of increasing their dividends, year after year. That means you can count on them to provide you with a steady stream of income, even in tough economic times.

Dividend Champions and Kings

Dividend Champions are companies that have increased their dividends for 25 consecutive years. Dividend Kings are companies that have increased their dividends for 50 consecutive years. That’s a remarkable achievement, especially considering that the average company only increases its dividend once every few years.

Benefits of Investing in Dividend Champions and Kings

There are several benefits to investing in Dividend Champions and Kings. First, they offer a high degree of safety. These companies have a long history of profitability and they’re committed to returning cash to shareholders. Second, they provide a steady stream of income. You can count on Dividend Champions and Kings to pay you a dividend every year, even during recessions. Third, they have the potential to grow your wealth over time. Dividend Champions and Kings have a history of outperforming the market.

How to Find Dividend Champions and Kings

There are a few ways to find Dividend Champions and Kings. One way is to use a stock screener. A stock screener is a tool that allows you to search for stocks based on certain criteria. You can use a stock screener to find stocks that have a history of increasing their dividends.

Example of Dividend Champions and Kings

Some examples of Dividend Champions and Kings include:

- Johnson & Johnson (JNJ)

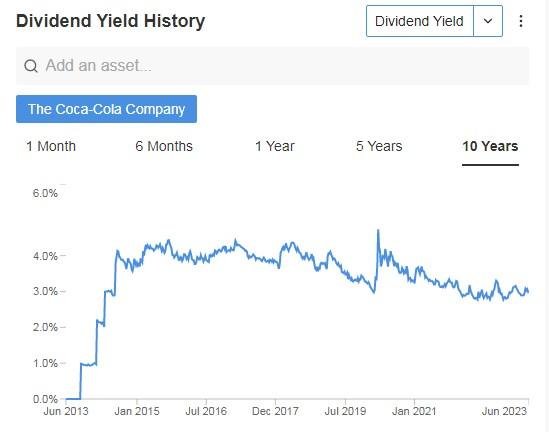

- Coca-Cola (KO)

- Procter & Gamble (PG)

- ExxonMobil (XOM)

- Chevron (CVX)

What Stocks Pay the Best Dividends?

In a climate of rising interest rates and market volatility, dividend-paying stocks can offer a haven for investors seeking income stability. But with a plethora of options, determining which stocks yield the best dividends can be a daunting task. Here’s a comprehensive guide to help you navigate the landscape and identify the companies that dish out the richest dividends.

High-Yield Stocks

Companies offering high dividend yields can certainly pique one’s curiosity. However, it’s crucial to approach these investments with caution. While a juicy yield can be alluring, it’s equally important to scrutinize the company’s sustainability and overall financial health. Some high-yield stocks may have underlying issues that make the dividends unsustainable in the long run.

Dividend Aristocrats

For a more reliable route, consider Dividend Aristocrats—companies that have consistently increased their dividends for 25 consecutive years or more. These stalwarts have demonstrated a long-standing commitment to rewarding shareholders and often boast strong financial foundations. Don’t miss out on their impressive dividend growth potential.

Dividend Challengers

Dividend Challengers are a rising star in the dividend-paying world. These companies have increased their dividends for at least 10 consecutive years, demonstrating a strong growth trajectory. While they haven’t yet reached their Aristocratic status, they’re on their way to becoming income-generating powerhouses.

Dividend Kings

The dividend elite, Dividend Kings, have a remarkable track record of increasing their dividends for an impressive 50 years or more. These time-tested companies have weathered economic storms and market downturns, consistently providing their loyal shareholders with growing income streams. They may not offer the highest yields, but their reliability and long-term growth potential make them a wise investment choice.

Factors to Consider

When selecting dividend stocks, consider these key factors:

- Dividend yield: The annual dividend divided by the current stock price.

- Dividend history: Look for companies with a track record of consistent or increasing dividends.

- Financial health: Evaluate the company’s balance sheet, cash flow, and earning power to gauge its ability to sustain dividends.

- Growth potential: Consider the company’s prospects for future dividend growth.

What Stocks Pay the Best Dividends?

If you’re on the hunt for stocks that pay the best dividends, you’ve come to the right place. Dividends are payments made by companies to their shareholders, and they can provide a steady stream of income. But not all dividends are created equal. Some companies pay higher dividends than others, and some dividends are more reliable than others.

In this article, we’ll take a look at some of the stocks that pay the best dividends. We’ll also discuss what to look for when evaluating dividend stocks, and we’ll provide some tips on how to invest in dividend stocks.

Dividend Stocks

Dividend stocks are a type of stock that pays dividends to its shareholders. Dividends are typically paid on a quarterly basis, and they can provide a steady stream of income. Dividend stocks are often considered to be a good investment for retirees and other investors who are looking for a steady return on their investment.

There are many different factors that can affect a company’s dividend payout, including its earnings, its cash flow, and its debt levels. Some companies have a long history of paying dividends, while others may only pay dividends occasionally. It’s important to do your research before investing in any dividend stock to make sure that the company has a strong track record of paying dividends and that it is likely to continue to do so in the future.

Growth Stocks

Growth stocks are stocks of companies that are expected to grow rapidly in the future. These companies typically have high earnings growth rates and strong cash flow. Growth stocks often pay lower dividends than dividend stocks, but their potential for appreciation can make them a more attractive investment over the long term.

If you’re looking for stocks that pay the best dividends, you’ll need to do your research. There are many different factors to consider, and it’s important to find a stock that meets your individual investment goals. With a little bit of research, you can find a dividend stock that can provide you with a steady stream of income for years to come.

Value Stocks

Value stocks are stocks of companies that are trading at a discount to their intrinsic value. These companies may not be growing as fast as growth stocks, but they offer the potential for a higher return on investment. Value stocks often pay higher dividends than growth stocks, and they can be a good option for investors who are looking for a more conservative investment.

High-Yield Dividend Stocks

High-yield dividend stocks are stocks of companies that pay a high dividend yield. These stocks can be attractive for investors who are looking for a high income stream, but it’s important to be aware of the risks involved. High-yield dividend stocks can be more volatile than other types of stocks, and they may not be a good option for investors who are looking for a long-term investment.

If you’re thinking about investing in dividend stocks, it’s important to do your research and to choose stocks that meet your individual investment goals. With a little bit of research, you can find a dividend stock that can provide you with a steady stream of income for years to come.

What Stocks Pay the Best Dividends?

When it comes to dividend-paying stocks, investors are always on the lookout for the best possible yields. But finding the highest dividend payers isn’t always as simple as it seems. Some companies pay out a high percentage of their earnings as dividends, while others retain more of their profits for growth. So, what’s a dividend investor to do?

To help you out, we’ve compiled a list of the best dividend-paying stocks across various sectors. These companies have a history of paying consistent and growing dividends, making them a good choice for income investors. But before we dive into the list, let’s take a quick look at some of the factors to consider when choosing dividend stocks.

Factors to Consider When Choosing Dividend Stocks

There are a few key factors to keep in mind when choosing dividend stocks:

- Dividend yield: The dividend yield is the annual dividend per share divided by the current stock price. A high dividend yield can be attractive, but it’s important to look at other factors as well.

- Dividend growth: Some companies have a history of increasing their dividends over time. This is a great sign, as it shows that the company is committed to returning value to shareholders.

- Dividend payout ratio: The dividend payout ratio is the percentage of a company’s earnings that are paid out as dividends. A high dividend payout ratio can be risky, as it leaves less money for the company to reinvest in its business.

- Company fundamentals: It’s important to look at the overall financial health of a company before investing in its stock. A strong balance sheet and healthy cash flow are good signs.

Now that we’ve looked at some of the factors to consider, let’s take a look at the best dividend-paying stocks across various sectors:

Real Estate Investment Trusts (REITs)

When it comes to dividend-paying stocks, one of the best places to look is the real estate sector. REITs are companies that own and operate real estate properties. They are required to distribute at least 90% of their taxable income as dividends to shareholders, making them a popular choice for income investors.

REITs offer investors a number of benefits, including:

- High dividend yields: REITs typically offer higher dividend yields than other types of stocks.

- Diversification: REITs can provide diversification to your portfolio, as they offer exposure to real estate without the need to own and manage property directly.

- Inflation protection: REITs have a natural hedge against inflation, as they can increase rents to keep pace with rising costs.

However, there are also some risks to consider when investing in REITs:

- Interest rate risk: REITs are sensitive to interest rates, as rising rates can make it more expensive for them to borrow money.

- Economic risk: REITs can be affected by economic downturns, which can lead to lower rents and occupancy rates.

Despite these risks, REITs can be a good addition to a well-diversified portfolio. Here are a few of the best REITs for dividend investors:

- Realty Income Corporation (O): O is a triple-net lease REIT that owns a diversified portfolio of properties across the United States. The company has a long history of paying consistent and growing dividends, and currently yields around 5%.

- STAG Industrial (STAG): STAG is an industrial REIT that owns a portfolio of warehouses and distribution centers. The company has a strong track record of dividend growth, and currently yields around 4.5%.

- W.P. Carey Inc. (WPC): WPC is a diversified REIT that owns a portfolio of office, industrial, and retail properties. The company has a long history of paying dividends, and currently yields around 5%.

What Stocks Pay the Best Dividends?

If you’re looking for stocks that pay out handsomely, you’ve come to the right place. Here’s a breakdown of the best dividend-paying companies in various sectors, so you can make informed investment decisions.

Utility Stocks

Utility companies provide essential services like electricity, gas, and water. These companies often have stable operations and pay reliable dividends, making them suitable for conservative investors. Examples include NextEra Energy, Duke Energy, and Southern Company.

Consumer Staples Stocks

Consumer staples companies sell products that people need regardless of the economic climate, such as food, beverages, and household items. These companies tend to have consistent earnings and pay steady dividends. Some examples include Procter & Gamble, Coca-Cola, and PepsiCo.

Healthcare Stocks

Healthcare companies offer a mix of growth and income potential. Pharmaceutical companies often pay high dividends, as do healthcare REITs and medical device manufacturers. Some examples include AbbVie, Johnson & Johnson, and UnitedHealth Group.

Real Estate Investment Trusts (REITs)

REITs invest in real estate properties and distribute a portion of their rental income to shareholders. They offer higher dividend yields than many other asset classes. Some popular REITs include Prologis, Crown Castle, and American Tower.

Energy Stocks

Energy companies can pay significant dividends, especially during periods of high oil and gas prices. However, their dividends can fluctuate with commodity prices. Some examples include ExxonMobil, Chevron, and ConocoPhillips.

Telecommunications Stocks

Telecommunications companies provide internet, phone, and cable services. They often have stable operations and pay reliable dividends. Some examples include AT&T, Verizon, and T-Mobile US.

Financial Stocks

Financial stocks can offer high dividend yields, but they also come with higher risk. Banks, insurance companies, and brokerage firms are among the types of financial stocks that pay dividends. Some examples include JPMorgan Chase, Bank of America, and Wells Fargo.

What Stocks Pay the Best Dividends?

In the world of investing, dividends are like a steady stream of income, providing a nice little bonus to your portfolio. But not all dividend-paying stocks are created equal. Some pay out more than others, and some are more reliable than others. So, if you’re looking for the best of the best, here are a few stocks that pay the best dividends:

What to Look for in a Dividend Stock

Before you jump into the world of dividend investing, there are a few things you need to keep in mind. First, don’t just go for the highest yield. A high yield can be a sign that the company is struggling and may not be able to sustain its dividend payments. Second, look for companies with a history of paying dividends. A long and consistent track record of dividend payments is a good sign that the company is committed to its shareholders. Finally, consider your own investment goals and risk tolerance. If you’re looking for a steady stream of income, you’ll want to focus on companies with a low payout ratio. This means that the company is not paying out too much of its earnings in dividends, which leaves it with plenty of cash to reinvest in its business and grow its future earnings.

Top Dividend-Paying Stocks

Now that you know what to look for, here are a few of the best dividend-paying stocks on the market today:

- AT&T (T): AT&T is a telecommunications giant with a long history of paying dividends. The company currently has a yield of about 7%, and it has increased its dividend for 35 consecutive years.

- Verizon (VZ): Verizon is another telecommunications giant with a strong dividend yield. The company currently has a yield of about 4.5%, and it has increased its dividend for 15 consecutive years.

- ExxonMobil (XOM): ExxonMobil is an oil and gas company with a long history of paying dividends. The company currently has a yield of about 3.5%, and it has increased its dividend for 37 consecutive years.

- Johnson & Johnson (JNJ): Johnson & Johnson is a healthcare company with a long history of paying dividends. The company currently has a yield of about 2.5%, and it has increased its dividend for 59 consecutive years.

- Coca-Cola (KO): Coca-Cola is a beverage company with a long history of paying dividends. The company currently has a yield of about 3%, and it has increased its dividend for 59 consecutive years.

- Procter & Gamble (PG): Procter & Gamble is a consumer goods company with a long history of paying dividends. The company currently has a yield of about 2.5%, and it has increased its dividend for 65 consecutive years.

- Kimberly-Clark (KMB): Kimberly-Clark is a consumer goods company with a long history of paying dividends. The company currently has a yield of about 3%, and it has increased its dividend for 48 consecutive years.

- Altria (MO): Altria is a tobacco company with a long history of paying dividends. The company currently has a yield of about 8%, and it has increased its dividend for 52 consecutive years.

Conclusion

Choosing the right dividend-paying stocks requires careful research and consideration of your investment goals and risk tolerance. But if you do your homework, you can find stocks that will provide you with a steady stream of income for years to come.

No responses yet