.

Best Dividend Stock: A Reliable Source of Income for Savvy Investors

When it comes to investing, you’re likely on a quest for the ideal investment vehicle that balances growth potential with stability. Dividend stocks step into the limelight, offering a compelling solution that has stood the test of time. These stocks regularly distribute a portion of their profits to shareholders, providing a steady stream of income you can count on.

What is a Dividend Stock?

So, what exactly is a dividend stock? Imagine this: you’re a proud owner of a slice of a company, a.k.a. a stock. Just like a landlord collects rent on a property, dividend-paying companies share a portion of their profits with you as a token of appreciation for your investment. These dividends can be paid out quarterly, semi-annually, or annually, depending on the company’s dividend policy.

Oh, and here’s a bonus tip: if you’re looking for a shining example of a dividend stock, look no further than the mighty Johnson & Johnson. This healthcare giant has been dishing out dividends consistently for over a century, earning it the title of a Dividend King.

Advantages of Investing in Dividend Stocks

Dividend stocks aren’t just a passive way to earn money; they pack a punch of benefits that can enhance your financial well-being:

- Regular Income: Dividends provide a steady flow of cash, regardless of market fluctuations, acting as a reliable source of income during retirement or periods of economic uncertainty.

- Compounding Returns: When reinvested, dividends can snowball over time, boosting your portfolio’s long-term growth potential. It’s like a financial snowball effect!

- Inflation Hedge: Dividends often outpace inflation, helping to protect your investments from the eroding effects of rising prices.

- Portfolio Diversification: Dividend stocks can diversify your portfolio, reducing risk and increasing stability.

How to Choose the Right Dividend Stock

Picking the right dividend stock is like finding a diamond in the rough. Here are some crucial factors to consider:

- Dividend Yield: This is the percentage of the stock’s price paid out as dividends. While a high yield can be tempting, it’s essential to look for stocks with a sustainable dividend payout.

- Dividend History: A company with a consistent and growing dividend history is a telltale sign of financial stability.

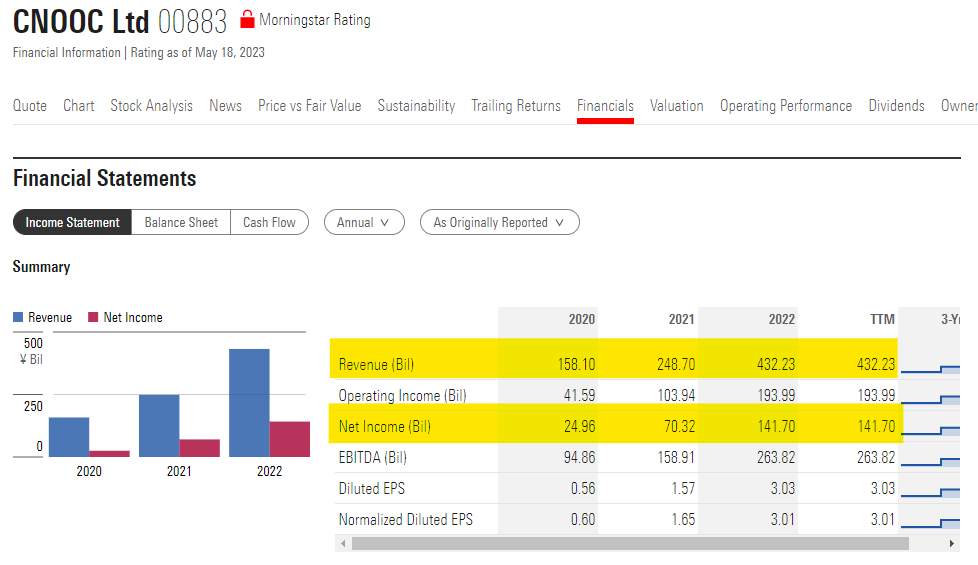

- Financial Health: Evaluate the company’s financial statements to ensure it has a strong balance sheet and sufficient cash flow to support dividend payments.

So, if you’re seeking a dependable investment that provides a steady income and the potential for long-term growth, dividend stocks deserve a place in your financial arsenal.

Best Dividend Stock

If you’re looking for a stock that can provide you with a steady stream of income, then you should consider investing in dividend stocks. Dividend stocks are shares of companies that pay out a portion of their profits to shareholders in the form of dividends.

One of the best dividend stocks on the market is Johnson & Johnson (JNJ). JNJ is a healthcare conglomerate that has been paying dividends for over 50 years. The company has a strong track record of dividend growth, and its current dividend yield is 2.5%.

Benefits of Investing in Dividend Stocks

There are a number of benefits to investing in dividend stocks, including:

1. Regular Income: Dividend stocks can provide you with a regular stream of income. This can be a valuable source of cash flow, especially if you’re retired or nearing retirement.

2. Long-Term Growth: Dividend stocks can help you build long-term wealth. Over time, the dividends you receive can be reinvested in more shares, which will compound your returns. For example, if you invest $1,000 in a dividend stock with a 3% dividend yield and reinvest the dividends, your investment will be worth over $1,700 in 10 years.

3. Reduced Risk: Dividend stocks are generally less risky than other types of stocks. This is because companies that pay dividends are typically more mature and stable. As a result, dividend stocks can be a good option for investors who are looking for a more conservative investment.

4. Inflation Protection: Dividends can help you protect your portfolio from inflation. This is because dividends are typically paid out in cash, which means that they will increase in value as inflation rises.

5. Tax Benefits: Dividends are taxed at a lower rate than other types of income. This is because dividends are considered to be a return of capital. As a result, you can save money on taxes by investing in dividend stocks.

Best Dividend Stocks to Consider

Dividend stocks can be a great way to generate passive income, and they can also help you hedge against inflation. But with so many different dividend stocks to choose from, it can be tough to know which ones are the best. That’s why we’ve put together a list of some of the best dividend stocks to consider for your portfolio.

Coca-Cola (KO) is a great dividend stock for those looking for a long-term investment. The company has been paying dividends for over 100 years, and it has a history of increasing its dividend each year.

Dividends vs. Share Price

It’s important to remember that dividends are not guaranteed. Companies can cut or eliminate their dividends at any time. That’s why it’s important to do your research before investing in any dividend stock.

Another thing to keep in mind is that dividend stocks tend to be more volatile than non-dividend stocks, especially during periods of economic uncertainty. So, if you’re looking for a stable investment, you may want to consider investing in a non-dividend stock.

3. How to Choose the Best Dividend Stocks

There are a few things you should consider when choosing a dividend stock, including:

The company’s financial health: You want to make sure that the company is financially stable and has a history of paying dividends.

The dividend yield: The dividend yield is the amount of dividend you will receive each year divided by the current share price. A higher dividend yield is usually better, but it’s important to look at the company’s financial health.

The company’s growth potential: You want to invest in companies that have the potential to grow their earnings and dividends over time.

The company’s valuation: You want to make sure that you’re not overpaying for a dividend stock.

By considering these factors, you can choose dividend stocks that are right for your investment goals.

What Makes a Good Dividend Stock?

In the realm of investing, there’s no shortage of stocks that offer dividends, those sweet little payments that companies dole out to their shareholders. But not all dividend stocks are created equal. Some are more generous than others, and some are more reliable. So, how do you choose the right dividend stock to supercharge your portfolio?

How to Choose the Right Dividend Stock

When choosing a dividend stock, there are a few key factors to consider:

- Dividend yield: This is the percentage of the stock’s price that is paid out as dividends. The higher the dividend yield, the more you’ll earn in dividends each year.

- Dividend payout ratio: This is the percentage of a company’s earnings that are paid out as dividends. While a high dividend yield might look tempting, you need to make sure the company you back into can actually afford it by comparing it to their dividend payout ratio. A high payout ratio could mean the dividend is at risk of being cut.

- Dividend growth rate: This is the rate at which a company’s dividends are increasing over time. A company that consistently increases its dividends is a good sign that it’s financially healthy and committed to rewarding its shareholders.

Number of Consecutive Dividend Increases

When looking at the dividend growth rate, check how many consecutive years the company has raised its dividend. The longer the streak of increases, the more likely the company may continue to up its dividend in the future. Finding a company with a long history of increasing dividends is like uncovering a gold mine: it shows that the company values its shareholders and is committed to sharing its success.

- The dividend payout ratio: This is the percentage of a company’s earnings that are paid out as dividends. A high dividend yield might look tempting, but you need to ensure that the company can afford to pay it; the dividend payout ratio can tell you this. A high payout ratio could mean the dividend is at risk of being cut.

Take Johnson & Johnson (JNJ) as an example. This healthcare giant has increased its dividend for 60 consecutive years, making it a Dividend Aristocrat—a title reserved for companies that have raised their dividends for at least 25 straight years. Johnson & Johnson’s dividend yield may not be the highest, but its long history of dividend growth makes it a reliable choice for income-seeking investors.

- Financial health: Before you invest in any dividend stock, it’s important to make sure that the company is financially healthy. Look at the company’s balance sheet and income statement to see if it has a strong cash flow and is generating enough profits to cover its dividend payments.

Conclusion

Choosing the right dividend stock can be a great way to generate income and grow your wealth. By considering the factors discussed above, you can increase your chances of finding dividend stocks that will meet your investment goals. Remember, investing in dividend stocks is a marathon, not a sprint. It takes time to build a diversified portfolio of dividend-paying stocks that can provide you with a steady stream of income for years to come.

The Allure of Best Dividend Stocks: A Comprehensive Guide

Investing in dividend stocks is like having a steady stream of income flowing into your pocket. It’s a way to supplement your retirement savings, fund your dream vacation, or simply have some extra cash to play with. And one of the top dividend stocks out there is Johnson & Johnson (JNJ), a healthcare giant with a long history of paying out dividends to its shareholders.

Benefits beyond Compare

Dividend stocks offer a slew of benefits that make them worth considering. Firstly, they provide a passive income stream. Dividends are typically paid out every quarter, so you can count on regular cash flow. Secondly, dividend stocks tend to be more stable than other types of stocks. Companies that pay dividends are usually well-established and financially sound. Thirdly, dividends can help you beat inflation. Over time, the value of your dividend payments will increase, outpacing inflation and preserving the purchasing power of your investments.

Choosing the Right fit

When selecting dividend stocks, there are a few key factors to keep in mind. First, consider the dividend yield. This is the annual dividend per share divided by the current stock price. A high yield can be enticing, but it’s also important to look at the company’s financial health and track record of paying dividends. Second, evaluate the company’s earnings and cash flow. Make sure the company is generating enough income to cover its dividend payments. Third, research the company’s industry and competitive landscape. Choose companies that are well-positioned in their respective markets. Finally, diversify your portfolio by investing in several dividend stocks from different sectors. This will help reduce your risk.

Tax Considerations

Dividend income is taxed differently than other types of income. Qualified dividends, which are dividends paid by U.S. corporations or certain foreign corporations, are taxed at a lower rate than ordinary income. Non-qualified dividends are taxed at your ordinary income tax rate. It’s important to understand the tax implications of dividend income before investing.

Conclusion

Investing in dividend stocks can be a smart move for investors seeking income and stability. By carefully considering the benefits, factors to consider, and tax implications, you can make informed decisions about which dividend stocks to add to your portfolio. Remember, dividend stocks are not a get-rich-quick scheme. They are a long-term investment that can provide you with a steady stream of income for years to come. So, if you’re looking for a way to add some extra income to your portfolio, consider investing in dividend stocks.

No responses yet