Cryptocurrency Price Dynamics

In the ever-evolving world of finance, cryptocurrencies have emerged as a captivating asset class, captivating investors with their allure of significant returns. However, unlike their traditional counterparts like stocks and bonds, cryptocurrencies are renowned for their dynamic price movements, often characterized by extreme volatility. The forces that drive these price fluctuations are as diverse as the digital landscape itself, ranging from market sentiment to global events and technological advancements. Understanding the intricate interplay of these factors is crucial for navigating the treacherous waters of cryptocurrency investing.

At the heart of cryptocurrency price dynamics lies market sentiment, a collective mood that permeates the investor community. When optimism reigns supreme, traders tend to flock towards cryptocurrencies, driving prices higher in a self-fulfilling prophecy. Conversely, when fear and uncertainty grip the market, investors often flee, triggering a domino effect that sends prices plummeting. News events, both positive and negative, can also exert a profound influence on cryptocurrency prices.

Regulatory developments, major exchange listings, and technological breakthroughs can all serve as catalysts for price surges. Conversely, negative news, such as security breaches or regulatory crackdowns, can send shockwaves through the market, causing prices to nosedive. Technological advancements, particularly those related to blockchain infrastructure and cryptocurrency adoption, can also impact prices. Improvements in scalability and security can enhance the utility and perceived value of a cryptocurrency, leading to increased demand and price appreciation.

Furthermore, the interconnectedness of the cryptocurrency market means that price movements in one cryptocurrency can have ripple effects on others. Bitcoin, as the dominant cryptocurrency, often sets the tone for the broader market. When Bitcoin’s price rallies, it tends to lift the tide for altcoins, while a Bitcoin sell-off can drag down the entire market. This correlation, however, is not absolute, and individual cryptocurrencies can exhibit unique price patterns based on their specific fundamentals and market dynamics.

In conclusion, cryptocurrency prices are a captivating dance between market sentiment, news events, technological advancements, and the interconnectedness of the digital asset ecosystem. Understanding the interplay of these factors is paramount for investors seeking to navigate the volatile waters of cryptocurrency investing.

Cryptocurrency Prices: A Rollercoaster Ride Driven by Complex Forces

As of today, the cryptocurrency market is experiencing another surge, with Bitcoin hovering around $23,000. But what drives these wild price fluctuations? Join us as we delve into the complex factors that shape the fortunes of digital currencies.

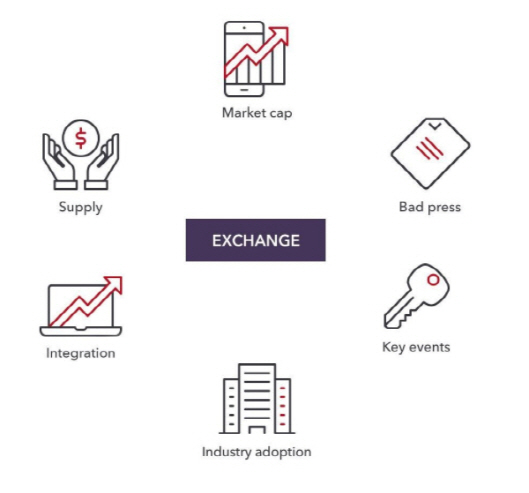

Influencing Factors

Exchange News and Announcements: Exchanges play a pivotal role in cryptocurrency trading. When a major exchange makes an announcement, it can have a ripple effect on prices. For instance, when Binance, the world’s largest cryptocurrency exchange, recently announced new listing plans, it sent a wave of optimism coursing through the market.

Government Regulations: Governments have taken an increasingly active role in regulating cryptocurrencies. When new regulations are announced, they can create uncertainty and volatility in the market. For example, China’s crackdown on crypto mining in 2021 triggered a sharp sell-off in cryptocurrency prices.

Whale Activity: "Whales" are individuals or institutions with substantial cryptocurrency holdings. Their actions can significantly impact prices. When whales buy or sell large amounts of cryptocurrency, it can cause temporary price spikes or dips. For instance, when Tesla CEO Elon Musk announced his purchase of $1.5 billion worth of Bitcoin in 2021, it sent the price soaring.

FOMO or FUD Sentiments: Fear of Missing Out (FOMO) and Fear, Uncertainty, and Doubt (FUD) are powerful psychological forces that drive cryptocurrency prices. When there’s a lot of excitement and positive sentiment, traders jump in out of FOMO, pushing prices higher. However, when negative news or rumors circulate, FUD can cause investors to panic and sell off, leading to price drops.

Supply and Demand: Ultimately, cryptocurrency prices are determined by supply and demand. When there’s more demand for a particular cryptocurrency than supply, its price goes up. Conversely, when supply exceeds demand, prices fall. Scarce cryptocurrencies with limited issuance, such as Bitcoin and Ethereum, tend to have higher prices due to their perceived value.

Cryptocurrency Price: A Volatile Journey

The cryptocurrency market is buzzing with activity, and the prices of these digital assets are constantly fluctuating. At this moment, the price of Bitcoin, the most well-known cryptocurrency, stands at $[cryptocurrency price].

Understanding Market Volatility

Cryptocurrency markets are notoriously volatile, with prices swinging wildly in both directions. This volatility is driven by a combination of factors, including global economic conditions, technological advancements, and the actions of whales—large holders who can significantly impact the market.

Bull and Bear Cycles

Every cryptocurrency investor experiences times of joy and boredom. Cryptocurrency markets experience bull and bear cycles, with periods of rapid price appreciation (bull markets) followed by periods of consolidation or decline (bear markets). The duration and magnitude of these cycles vary, but they’re an inherent part of the cryptocurrency landscape.

Price Formation Factors

The price of a cryptocurrency is determined by a complex interplay of factors. Supply and demand, market sentiment, and news events all play a role. When demand exceeds supply, prices tend to rise, while the opposite is true when supply outstrips demand. Market sentiment, influenced by news and rumors, can also have a significant impact on prices.

Investing Wisely

Investing in cryptocurrencies can be a lucrative but risky endeavor. It’s crucial to approach the market with a well-informed strategy. Do your research, understand the risks, and invest only what you can afford to lose. Remember, the cryptocurrency market is a rollercoaster ride, so buckle up and enjoy the ups and downs!

Cryptocurrency Prices: A Volatile Landscape

The world of cryptocurrency is a rollercoaster ride, with prices that can soar to dizzying heights and plummet just as quickly. As of today, Bitcoin, the most popular cryptocurrency, has a market capitalization of over $700 billion and a price of $22,000. However, just a few months ago, its price was hovering around $50,000. This extreme volatility can make it challenging for investors to navigate the market and protect their profits.

Risk Management: A Path Through the Crypto Jungle

In the treacherous terrain of cryptocurrency trading, risk management is like a compass, guiding you through the storms of market volatility. Failing to manage risk can lead to financial disaster, leaving you with nothing but regrets and empty wallets.

1. Set Stop-Loss Orders

Stop-loss orders are your safety net, protecting you from catastrophic losses. They automatically sell your coins when they reach a predetermined price, preventing your investment from evaporating like a snowman in the summer sun.

2. Diversify Your Crypto Portfolio

Diversification is the key to spreading your risk across different cryptocurrencies, just like not putting all your eggs in one basket. By investing in a mix of assets, you reduce the impact of any single cryptocurrency’s volatility on your overall portfolio.

3. Leverage with Caution

Leverage, like a double-edged sword, can amplify your profits or magnify your losses. It’s a risky game, best left to seasoned traders who know how to balance risk and reward.

4. Limit Your Exposure

Don’t put all your hard-earned money into cryptocurrencies. Only invest what you can afford to lose, without jeopardizing your financial stability. Remember, cryptocurrency trading is like walking a tightrope – don’t overextend yourself.

5. Manage Your Emotions

Emotions can cloud your judgment, leading to impulsive decisions that can hurt your investments. Take a deep breath, analyze the market objectively, and avoid making trades based on fear or greed. Cryptocurrency trading should be a rational, calculated endeavor, not an emotional roller coaster.

6. Do Your Research

Knowledge is power, especially in the crypto world. Before you buy any cryptocurrency, research its history, team, and underlying technology. Don’t fall for hype or FOMO (fear of missing out). Understand what you’re investing in, and never invest in something you don’t comprehend.

Cryptocurrency Prices: A Wild Ride in the Digital Frontier

Bitcoin may have crossed the $20,000 mark recently, but like a roller coaster ride, cryptocurrency prices have a knack for taking us on thrilling ups and downs. The question is: how can we navigate this unpredictable terrain while clinging to our investment aspirations?

Understanding Market Dynamics

Dissecting the cryptocurrency market is like deciphering a complex puzzle. The value of these digital assets doesn’t follow the same rules as traditional currencies. Instead, it’s a symphony of factors that orchestrates their movements. Economic conditions, regulatory changes, and even the whims of influential figures can send prices soaring or plummeting.

Trading Strategies: Navigating the Storm

In this high-stakes game, it pays to have a strategy. Dollar-cost averaging, a time-tested approach, involves investing equal amounts at regular intervals. It’s like spreading your bets, smoothing out the price fluctuations over time. Another tactic is technical analysis, the art of studying historical price patterns to predict future trends. Picture it as a treasure hunt, seeking clues in the market’s footprints.

Cautious Optimism: Riding the Waves

Investing in cryptocurrency is a bit like riding a surfboard on the open ocean. There will be towering waves and choppy waters, but the thrill of catching that perfect wave can be exhilarating. The key is to maintain a level-headed perspective. Understand the risks involved, and don’t let emotions cloud your judgment.

Diversification: Don’t Put All Your Eggs in One Basket

Imagine spreading your savings across different currencies? That’s the essence of diversification. By investing in a mix of cryptocurrencies, you’re reducing your vulnerability to the volatility of any single one. Think of it as a safety net, minimizing the risks associated with this unpredictable market.

HODL or Sell? A Million-Dollar Question

The cryptocurrency world has its own lingo, and “HODL” is one of its gems. It stands for “hold on for dear life,” a mantra adopted by long-term believers. On the other hand, selling might be a wise move if you’ve reached your financial goals or if market conditions warrant it. It’s a judgment call, often guided by your risk tolerance and investment strategy.

Conclusion

Cryptocurrency prices may be as unpredictable as the weather, but that doesn’t mean we should shy away from investing in this emerging asset class. By understanding market dynamics, employing sound trading strategies, and maintaining cautious optimism, we can increase our chances of finding success in this digital frontier. Remember, it’s a rollercoaster ride, but with the right mindset and a steady hand, we can navigate the ups and downs and emerge victorious.

No responses yet