How to Invest in Cryptocurrency: A Comprehensive Guide

The cryptocurrency landscape is brimming with opportunities, but navigating it can be daunting. If you’re itching to get a piece of the digital pie, here’s a comprehensive guide to help you invest wisely.

Selecting a Cryptocurrency

Choosing the right cryptocurrency is paramount. Consider these crucial factors:

- Market Capitalization: This metric reflects the total value of all circulating coins. A higher market cap indicates a more stable and established cryptocurrency.

- Use Cases: Determine whether the cryptocurrency has practical applications beyond speculation. Does it facilitate transactions, power decentralized applications, or solve real-world problems?

- Team Behind the Project: A solid team with a proven track record is essential. Research the founders, developers, and advisors to assess their expertise and credibility.

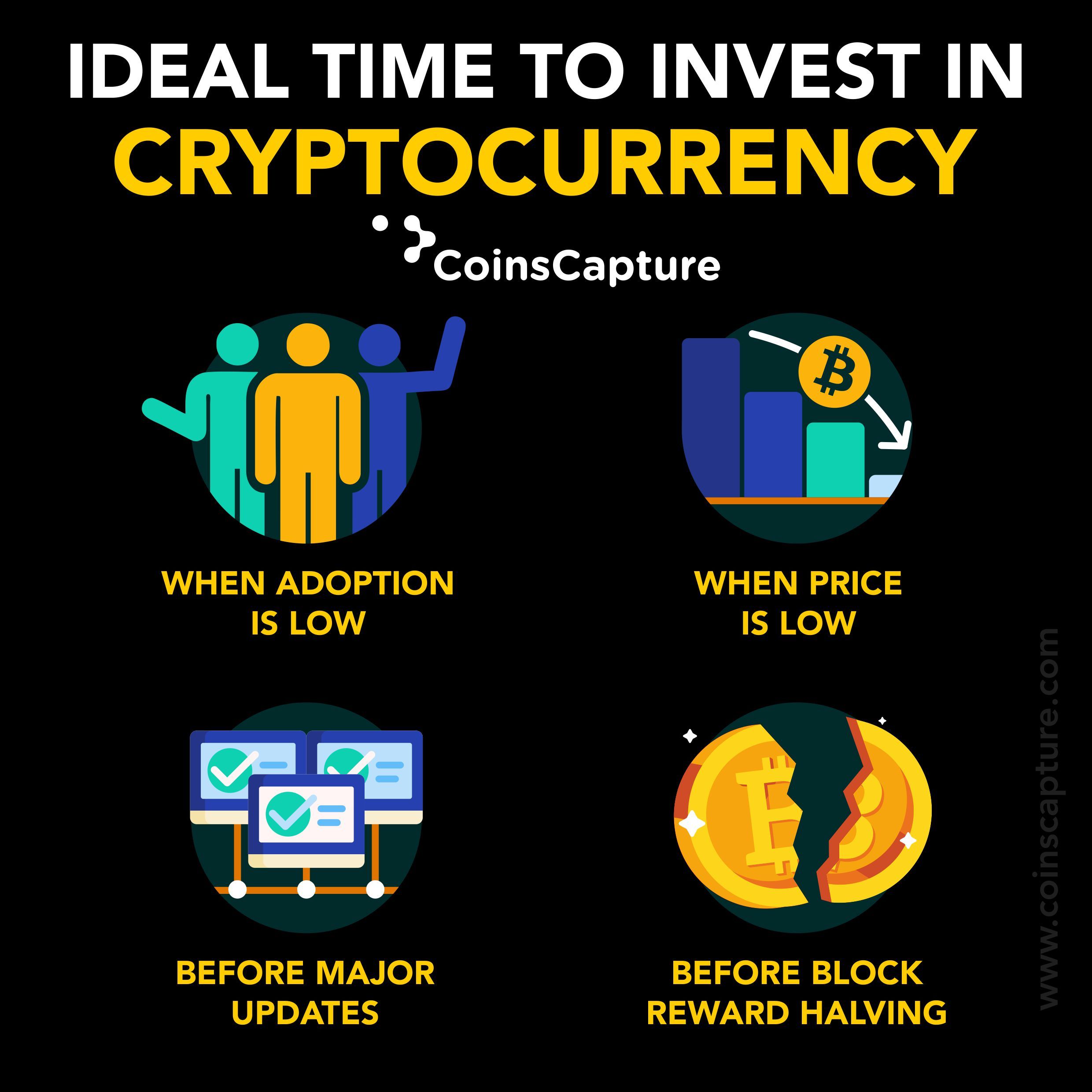

Assessing the Market

Before investing, it’s wise to analyze the cryptocurrency market. Monitor price trends, news, and expert opinions. Consider factors like economic conditions, regulatory developments, and industry advancements that could impact the market.

Understanding Risk and Reward

Cryptocurrency investments carry inherent risk. While the potential for high returns is enticing, it’s important to remember that the value of digital assets can fluctuate wildly. Determine your risk tolerance before diving in.

Choosing a Platform

Select a reputable cryptocurrency exchange or broker that offers the cryptocurrency you’re interested in. Consider factors like fees, security measures, and user interface.

Investing Safely

Once you’ve chosen your platform, take steps to secure your investments. Enable two-factor authentication, use a secure password manager, and store your cryptocurrency in a hardware wallet.

Long-Term Strategy

Investing in cryptocurrency isn’t a get-rich-quick scheme. Approach it as a long-term strategy. Hold your investments for extended periods to weather market fluctuations and potentially reap significant rewards.

Education and Due Diligence

Stay informed about the cryptocurrency market by reading industry news, attending conferences, and consulting with experts. Thorough due diligence is crucial before making any investment decisions. Don’t let fear of missing out cloud your judgment.

Conclusion

Investing in cryptocurrency can be a rewarding endeavor, but it requires research, caution, and a long-term perspective. By following these guidelines, you can navigate the digital maze and make informed investment choices that align with your financial goals.

How to Invest in Cryptocurrency: A Comprehensive Guide

Cryptocurrency, a digital or virtual currency secured by cryptography, has taken the financial world by storm. Investing in cryptocurrency can be a thrilling yet daunting experience. Here’s a comprehensive guide to help you navigate the investment process:

Choosing an Exchange

Exchanges are online marketplaces where cryptocurrency is bought, sold, and traded. When selecting an exchange, consider its fees, security measures, and user-friendliness.

Fees: Exchanges charge transaction fees for buying and selling cryptocurrency. Comparative research is essential to find the best rates.

Security: Cybersecurity is paramount in cryptocurrency exchanges. Reputable exchanges employ robust security protocols to safeguard users’ funds. Check for two-factor authentication (2FA) and other security features.

User Experience: A user-friendly interface makes it easy to navigate the exchange, especially for beginners. Look for exchanges with clear layouts, intuitive navigation, and responsive customer support. Consider the convenience of mobile apps for on-the-go trading.

Finding a Trusted Wallet

Once you’ve selected an exchange, you need a secure place to store your cryptocurrency. Cryptocurrency wallets are digital or physical devices that hold your private keys, which grant access to your funds.

Hardware Wallets: These are physical devices that store private keys offline, offering maximum security against online threats.

Software Wallets: These are digital software programs that store private keys on your computer or mobile device. They’re convenient but potentially less secure than hardware wallets.

Selecting Cryptocurrency

Delving into the vast array of cryptocurrencies can be overwhelming. Here are some factors to consider:

Market Capitalization: This refers to the total value of a cryptocurrency in circulation. Higher market capitalization generally indicates a more established currency.

Use Case: Consider the purpose and problem that a cryptocurrency solves. This can help you determine its potential value and longevity.

Risk Tolerance: Different cryptocurrencies entail different degrees of risk. Determine your risk tolerance before investing. Remember, the cryptocurrency market is known for volatility, so invest only what you can afford to lose.

Making the Investment

Once you’ve chosen an exchange and cryptocurrency, it’s time to invest.

Deposit Funds: Transfer funds to your exchange account using supported methods like bank transfer, credit card, or PayPal.

Place an Order: Use the exchange’s trading platform to place a buy order, specifying the cryptocurrency, amount, and price you’re willing to pay.

Monitor Your Investment: Cryptocurrencies fluctuate in value, so it’s essential to monitor your investments regularly. Keep an eye on market trends, news, and analysis to make informed trading decisions.

How to Invest in Cryptocurrency: A Beginner’s Guide

With the rise of cryptocurrency, many people are eager to invest and potentially reap its rewards. However, navigating the world of cryptocurrency can be daunting for beginners. This comprehensive guide will walk you through the steps involved in investing in cryptocurrency, starting with the basics and gradually delving into more advanced concepts.

Choosing a Cryptocurrency Exchange

The first step is to choose a reputable and well-established cryptocurrency exchange. Research different platforms, compare their fees, and read reviews from other users. The exchange you select should support the cryptocurrencies you’re interested in and provide a user-friendly interface.

Opening an Account

Once you’ve chosen an exchange, you’ll need to create an account. Follow the exchange’s requirements to verify your identity and provide any necessary documentation. Most exchanges require a photo ID and proof of address. Once your account is verified, you can fund it using a bank transfer or credit/debit card.

Selecting a Cryptocurrency

There are hundreds of different cryptocurrencies available, each with its own unique characteristics. Do thorough research to understand the fundamentals, market capitalization, and potential growth prospects of the cryptocurrencies you’re considering. Remember, investing in cryptocurrency carries inherent risk, so it’s crucial to diversify your portfolio and invest only what you can afford to lose.

Understanding Cryptocurrency Wallets

Your cryptocurrency must be stored securely in a cryptocurrency wallet. Wallets come in two primary forms: software wallets and hardware wallets. Software wallets are digital platforms that store your cryptocurrency online, while hardware wallets are physical devices that keep your cryptocurrency offline. Hardware wallets offer enhanced security but can be more expensive than software wallets. Choose a wallet that aligns with your security needs and level of comfort.

Buying and Selling Cryptocurrency

Once your account is funded and you’ve chosen a cryptocurrency, you can start buying and selling. The process is similar to trading stocks or other financial assets. You’ll place orders to buy or sell a specific amount of cryptocurrency at a specified price. After executing your order, the cryptocurrency will appear in your wallet.

Taxes and Regulations

It’s important to consider the tax implications of investing in cryptocurrency. Regulations vary by country or jurisdiction, so consult with a tax professional to understand your obligations. Some countries tax cryptocurrency as income, while others treat it as capital gains. Additionally, many countries are still developing clear regulatory frameworks for cryptocurrency, so it’s essential to stay informed.

How to Invest in a Cryptocurrency

In this fast-paced world of digital finance, investing in cryptocurrencies has become an increasingly popular pursuit. Whether you’re a seasoned investor or a novice in the realm of digital assets, following a few simple steps can guide you toward successful cryptocurrency investments. Let’s dive into the process that will help you navigate the exciting world of crypto investing.

Selecting a Cryptocurrency Exchange

The first step in your cryptocurrency investing journey is selecting a reputable exchange. These platforms serve as the bridge between you and the cryptocurrency market, facilitating the buying, selling, and storing of digital assets. Conduct thorough research to identify exchanges that align with your needs in terms of fees, security, and the range of cryptocurrencies offered.

Creating an Account

Once you have chosen an exchange, it’s time to create an account. This typically involves providing personal information, including your name, address, and contact details. Most exchanges require you to verify your identity through a process known as Know Your Customer (KYC). This measure is aimed at combating fraud and money laundering.

Funding Your Account

With an account set up, it’s time to inject some funds into it. Most exchanges support various payment methods, such as bank transfers, credit cards, and even other cryptocurrencies. Choose the method that best suits your circumstances and transfer the desired amount to your exchange account.

Placing an Order

Now comes the moment of truth: placing your first cryptocurrency order. Navigate to the exchange’s trading platform and select the cryptocurrency you wish to invest in. Determine the amount you want to buy and carefully review the current market price. When you’re ready, click the "Buy" button to execute your order.

Understanding Order Types

When placing an order, you’ll encounter different order types that cater to specific trading strategies:

- Market Order: This type of order executes instantly at the prevailing market price. It’s ideal for investors seeking a quick trade.

- Limit Order: A limit order allows you to specify a price at which you wish to buy or sell. Your order will only be executed if the market price reaches that level. This order type is suitable for investors looking to enter or exit a position at a precise price point.

- Stop-Limit Order: A stop-limit order combines features of a stop order and a limit order. It initially acts as a stop order, triggering a trade when the market price reaches a specified trigger price. However, once the trigger is reached, the order becomes a limit order, executing only if the market price meets your limit price requirement. This order type is helpful in managing risk and capturing opportunities.

Monitoring Your Investment

With your order placed, it’s crucial to monitor your investment’s performance. Cryptocurrency prices can fluctuate rapidly, so keeping an eye on your holdings is essential. Most exchanges provide real-time price charts and portfolio tracking tools to help you stay up-to-date on your investments. You can also set alerts to notify you of significant price changes or market events.

No responses yet