الأفضل من الأسهم ذات العائد على شكل أرباح

Best Dividend Yield Stocks In the stock market’s bustling arena, dividend yield stocks stand as beacon of stability and returns. These stocks captivate investors with[…]

самые прибыльные дивидендные акции

Best Dividend Paying Stocks In the bustling stock market, where countless investment opportunities beckon, dividend-paying stocks stand out as beacons of stability and potential growth.[…]

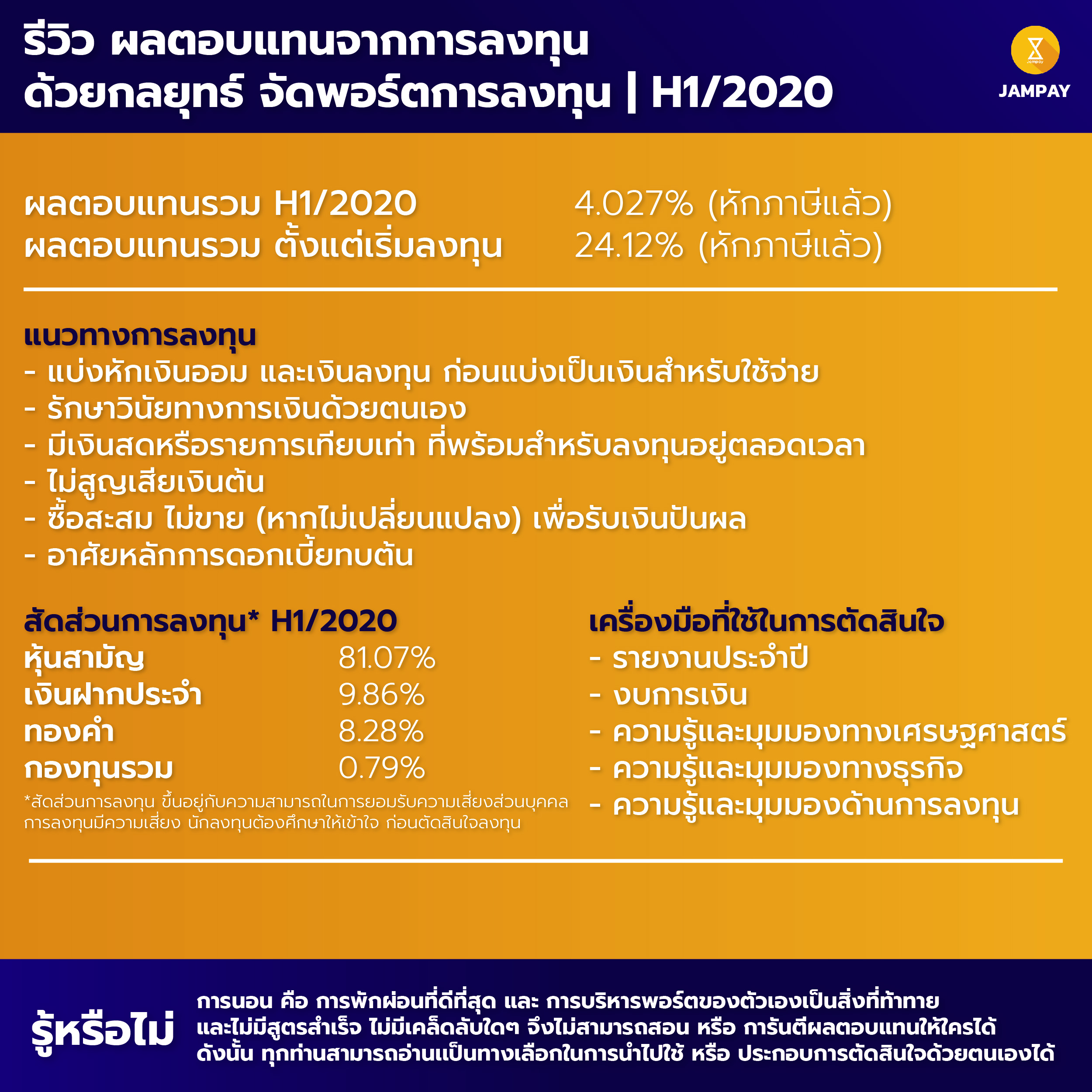

ลงทุนพอร์ตโฟลิโออย่างไรให้งอกเงย

Investment Portfolio Management When it comes to your financial future, there’s no one-size-fits-all solution. That’s where investment portfolio management comes in. It’s like having a[…]

best cryptocurrency to invest in right now

Best Cryptocurrency to Invest in Right Now Cryptocurrency has become a popular investment option, with many looking to capitalize on the potential for significant returns.[…]

retraite ideala

Introduction If you’re like most people, retirement is probably one of the most important goals in your financial life. But how do you make sure[…]

Blockchain Technology: Decoded

What Is the Purpose of Blockchain Technology? Blockchain technology, a groundbreaking invention that has revolutionized the digital realm, has taken the financial world by storm.[…]

retraite varlıkları yaşa göre nasıl dağıtılır?

Retirement Portfolio Allocation by Age As you near retirement, you may wonder how to allocate your retirement assets. After all, you’ve worked hard, saved diligently,[…]

2024 წლის საუკეთესო დივიდენდიანი აქციები

Best Dividend Stocks 2024: A Guide to Steady Returns and Long-Term Growth In the ever-changing landscape of the stock market, investors are always on the[…]

Kryptovaluta-lijst

Introduction Picture this: a digital currency, independent of any central authority, using a complex code to keep everything secure. That’s cryptocurrency in a nutshell. It’s[…]