7 Mistakes People Make While Hiring a Financial Planner

Hiring a financial planner can be a smart move for your financial future. But it’s important to avoid these common mistakes.

1. Not doing your research

This is perhaps the biggest mistake you can make. Before you hire a financial planner, it’s important to do your research and find someone who is qualified and experienced. Ask for referrals from friends or family, read online reviews, and interview several different planners before making a decision. what’s more, doing your research will help you avoid, shady planners, who are only interested in making a quick buck.

Here are 10 questions to ask a financial planner before hiring them:

- What are your qualifications?

- How long have you been in business?

- What is your investment philosophy?

- How do you charge for your services?

- What is your track record?

- What are your references?

- Can you provide me with a written proposal?

- What is your availability?

- How will we communicate?

- What are your thoughts on my financial situation?

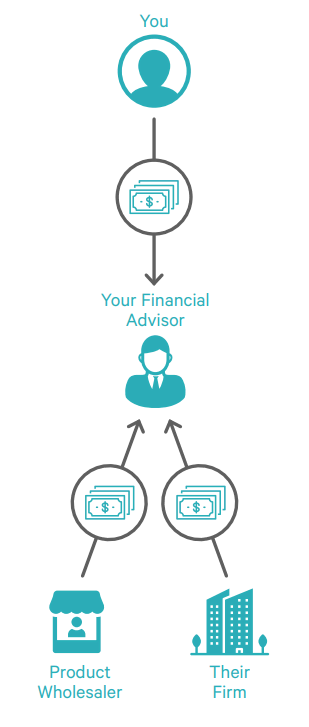

2. Hiring a planner who is not a fiduciary

A fiduciary is a financial professional who is legally obligated to act in your best interests. This means that they must put your interests ahead of their own and provide you with objective advice. Not all financial planners are fiduciaries, so it’s important to ask about this before you hire someone.

3. Not understanding the fees

Financial planners charge a variety of fees, so it’s important to understand how they work before you hire someone. Some planners charge an hourly rate, while others charge a percentage of your assets under management. Be sure to ask about all of the fees involved so that you can make an informed decision.

4. Not being clear about your goals

Before you hire a financial planner, it’s important to be clear about your financial goals. What do you want to achieve with your investments? Do you want to retire early? Save for your children’s education? Buy a house? Once you know your goals, you can start to look for a planner who can help you achieve them.

5. Not being realistic about what you can afford

Financial planning is not a get-rich-quick scheme. It takes time and effort to achieve your financial goals. Be realistic about what you can afford to invest and don’t try to do too much too soon by overextending yourself.

6. Not being patient

Investing is a long-term game. Don’t expect to get rich overnight. Be patient and stay invested for the long haul. Over time, your investments will grow and you will reach your financial goals.

7. Not getting a second opinion

Once you’ve found a financial planner, it’s a good idea to get a second opinion. This will help you make sure that you’re making the right decision. Talk to another planner or two to get their thoughts on your financial situation and goals.

**The Pitfalls of Hiring a Financial Planner: 7 Common Mistakes to Avoid**

Navigating the complex world of personal finance can be a daunting task. Enlisting the services of a financial planner can provide invaluable guidance, but it’s crucial to avoid common pitfalls that can undermine your financial well-being. Here are seven mistakes to watch out for:

2. Not Vetting Their Credentials

Choosing a financial planner is like entrusting your financial future to a stranger. Before making a decision, thoroughly investigate their qualifications and credentials. Verify their licenses and certifications with reputable organizations like the Certified Financial Planner Board of Standards (CFP(R)) or the National Association of Personal Financial Advisors (NAPFA). Don’t be shy about asking for proof of their experience and track record. Remember, it’s your money on the line.

7 Mistakes People Make When Hiring a Financial Planner

Hiring a financial planner is a big decision. After all, you’re entrusting someone with your financial future. That’s why it’s important to do your research and avoid these seven common mistakes.

Not doing your research

One of the biggest mistakes you can make is not doing your research. Before you hire a financial planner, take some time to learn about the different types of planners and the services they offer. Consider your financial goals and needs, and make sure you find a planner who is qualified to help you achieve them.

Not interviewing multiple planners

Once you’ve found a few potential financial planners, it’s important to interview them to get a sense of their personality, their investment philosophy, and their fees. Don’t be afraid to ask tough questions, and make sure you feel comfortable with the planner you choose. You’ll be working closely with this person for years to come, so it’s important to find someone you can trust.

Not getting a written agreement

Once you’ve found a financial planner you’re comfortable with, it’s important to get a written agreement in place. This agreement should outline the services the planner will provide, the fees they will charge, and the terms of your relationship. Getting a written agreement will help to protect both you and the planner in the event of any disputes.

Not setting realistic expectations

It’s important to set realistic expectations when you hire a financial planner. Don’t expect them to work miracles overnight. Financial planning is a slow and steady process, and it takes time to see results. Be patient and stick with it, and you’ll be glad you did.

Not being honest with your planner

The relationship between a financial planner and their client is based on trust. It’s important to be honest with your planner about your financial situation, your goals, and your concerns. The more information your planner has, the better they can help you achieve your goals.

7 Mistakes People Make While Hiring a Financial Planner

Hiring a financial planner can be a daunting task. There are so many things to consider, such as experience, qualifications, and fees. It’s easy to make mistakes, but by avoiding these common pitfalls, finding the right planner should be a breeze.

1. Not doing your research

The first mistake people make is not doing their research. Before you even start looking for a financial planner, take some time to learn about the different types of planners and what they can do for you. This will help you narrow down your search and find the right planner for your specific needs.

2. Not interviewing multiple planners

Once you’ve done your research, it’s important to interview multiple planners before making a decision. This will give you a chance to get to know each planner and see how they work. Ask about their experience, qualifications, and fees. And don’t be afraid to ask difficult questions.

3. Not getting a written agreement

Once you’ve found a financial planner that you’re comfortable with, it’s important to get a written agreement that outlines the terms of your relationship. This agreement should include the planner’s fees, the services they will provide, and the termination terms. Getting a written agreement will protect both you and the planner.

4. Not asking about the planner’s investment philosophy

One of the most important things to consider when hiring a financial planner is their investment philosophy. This will determine how they invest your money. Make sure you understand the planner’s investment philosophy and that it’s aligned with your own goals.

5. Not understanding the planner’s fees

Financial planners charge a variety of fees, so it’s important to understand how they’re compensated before you hire one. Some planners charge a flat fee, while others charge a percentage of your assets under management. Be sure to ask the planner about their fees and make sure you’re comfortable with the amount they charge.

7 Mistakes People Make While Hiring a Financial Planner: Don’t Fall Into These Traps!

Hiring a financial planner can be a smart move for individuals looking to manage their finances effectively and achieve their financial goals. However, there are some common pitfalls that people often fall into during the hiring process. Avoiding these mistakes can help you find the right planner for your needs and maximize the benefits of their guidance.

1. Not Doing Your Research

Before you start interviewing financial planners, take the time to research your options. This includes reading reviews, checking credentials, and comparing fees. It’s also important to consider the type of financial planning services you need and whether the planner you’re considering specializes in those areas.

2. Hiring Based on Price Alone

While cost is certainly a factor to consider, it shouldn’t be the only one. The cheapest planner isn’t always the best one for your needs. Look for a planner who offers a comprehensive range of services and who you feel comfortable working with.

3. Not Checking References

Once you’ve narrowed down your list of candidates, ask each planner for references. Contact these references and ask about their experiences working with the planner. This can give you valuable insights into the planner’s work ethic, communication skills, and ability to meet client expectations.

4. Not Being Clear About Your Goals

Before you hire a financial planner, it’s important to be clear about your financial goals. This could include saving for retirement, buying a home, or planning for your children’s education. Once you know your goals, you can find a planner who has experience helping clients achieve similar objectives.

5. Not Interviewing Multiple Planners

Don’t make the mistake of hiring the first financial planner you meet. Take the time to interview multiple candidates and compare their qualifications, experience, and fees. This will give you a better idea of the options available to you and help you make an informed decision.

6. Not Getting Everything in Writing

Once you’ve found a financial planner you like, be sure to get everything in writing. This includes the planner’s fees, the services they will provide, and the terms of your agreement. Having a written agreement will help protect you in case of any disputes down the road.

7. Not Communicating Regularly

Once you’ve hired a financial planner, it’s important to communicate regularly with them. This will help you stay on track with your financial goals and make any necessary adjustments along the way.

7 Common Pitfalls to Avoid When Hiring a Financial Planner

Seeking professional financial guidance can be a smart move, but there are some common mistakes that can derail the process. Here are seven pitfalls to steer clear of when hiring a financial planner:

1. Not Doing Your Homework

Don’t just pick the first planner you come across. Take the time to research your options, read reviews, and interview several candidates before making a decision.

2. Hiring Someone Who’s Not a Fiduciary

A fiduciary is legally bound to act in your best interests, so it’s crucial to hire one. Non-fiduciaries may have conflicts of interest that could lead them to recommend products that aren’t right for you.

3. Getting Caught Up in Sales Pitches

Financial planners are salespeople, so it’s important to be on guard against slick sales pitches. Focus on the substance of their advice, not just their charm or charisma.

4. Ignoring Your Gut Feeling

If you don’t feel comfortable with a planner, don’t hire them. Trust your instincts. You’re going to be working closely with this person, so it’s essential to have a good rapport.

5. Not Being Realistic About Your Expectations

Financial planners can’t wave a magic wand and solve all your financial problems. They can provide guidance and support, but ultimately it’s up to you to make the tough decisions.

6. Choosing Someone Who’s Too Expensive

Financial planning fees can vary widely, so it’s important to find someone who fits your budget. Don’t be afraid to negotiate on fees, and don’t hesitate to walk away if the planner is too expensive. Remember, you’re the one who’s paying the bills!

7. Not Getting Everything in Writing

Once you’ve found a financial planner you like, make sure to get everything in writing. This includes the scope of their services, their fees, and any other important details. This will help to avoid misunderstandings down the road.

7 Mistakes People Make When Hiring a Financial Planner

Hiring a financial planner can be a daunting task. There are so many things to consider, from finding the right person to negotiating fees. If you’re not careful, you could end up making one of these seven common mistakes.

1. Not doing your research

Before you even start looking for a financial planner, it’s important to do your research. This means understanding your own financial goals and needs. What are you trying to achieve with your money? What are your concerns? Once you have a good understanding of your own finances, you can start looking for a planner who can help you reach your goals.

2. Hiring the wrong person

Not all financial planners are created equal. It’s important to find a planner who is qualified, experienced, and who you can trust. Ask for referrals from friends or family members. Read online reviews. And interview several planners before you make a decision.

3. Not being clear about your goals

When you meet with a financial planner, it’s important to be clear about your goals. What do you want to achieve with your money? What are your concerns? The more specific you are, the better your planner can help you develop a plan that meets your needs.

4. Not being honest with your planner

It’s important to be honest with your financial planner about your financial situation. This includes disclosing your income, expenses, debts, and assets. The more information your planner has, the better they can help you develop a plan that is right for you.

5. Not being prepared to pay for services

Financial planning is a valuable service, and it’s important to be prepared to pay for it. The fees that you pay will vary depending on the level of service that you need. However, it’s important to remember that you get what you pay for. A good financial planner can help you save money in the long run, so it’s worth investing in a qualified professional.

7 Mistakes People Make While Hiring a Financial Planner

Hiring a financial planner can be a daunting task. There are so many factors to consider, and it’s important to make sure you find the right person for the job. Unfortunately, many people make mistakes during the hiring process, which can lead to dissatisfaction or even financial loss. Here are 7 common mistakes to avoid:

1. Not doing your research

The first step in hiring a financial planner is to do your research. Talk to friends, family, and colleagues to get recommendations. Read online reviews and articles about different planners. Once you’ve narrowed down your list, interview several candidates to find the one who is the best fit for your needs.

2. Hiring a friend or family member

It may be tempting to hire a friend or family member as your financial planner, but this is not always a good idea. While they may be well-intentioned, they may not have the necessary experience or training to provide you with sound financial advice. It’s better to hire a qualified professional who can objectively assess your situation and make recommendations that are in your best interests.

3. Not checking their credentials

Before you hire a financial planner, it’s important to check their credentials. Make sure they are licensed and registered with the appropriate regulatory bodies. You should also verify that they have a clean disciplinary record. This will help you ensure that you’re dealing with a reputable and trustworthy professional.

4. Not getting a written agreement

Once you’ve found a financial planner you’re comfortable with, it’s important to get a written agreement in place. This agreement should outline the scope of services, the fees, and the terms of the relationship. This will help to protect both you and your planner in the event of any disputes.

5. Not communicating your goals

One of the most important things you can do when working with a financial planner is to communicate your goals. What do you want to achieve with your investments? What is your risk tolerance? How long do you have until you need to reach your goals? By clearly communicating your goals, your planner can develop a plan that is tailored to your specific needs.

6. Not reviewing your plan regularly

Your financial plan should be a living document that is reviewed and updated regularly. As your life circumstances change, so too should your plan. By reviewing your plan regularly, you can make sure it’s still on track to help you achieve your goals.

7. Not firing your planner if you’re not happy

If you’re not happy with your financial planner, don’t be afraid to fire them. You should be able to find a planner who is a good fit for your needs. Don’t be afraid to ask questions. A good financial planner will be happy to answer any questions you have about their services, their fees, and their investment philosophy. By asking questions, you can make sure that you’re comfortable with the planner you’re choosing.

8. Assuming it’s a one-size fits all approach

Hiring a financial planner isn’t a one-size-fits-all proposition. The best financial planner for you will depend on your individual circumstances, goals, and risk tolerance. Take the time to find a planner who you trust and who you feel comfortable working with. This will help you get the most out of the financial planning process and achieve your financial goals.

No responses yet