**7 Mistakes to Avoid When Hiring a Financial Agent**

Navigating the complex world of personal finance can be daunting, which is why many individuals seek the guidance of a financial agent. However, hiring the wrong agent can be a costly mistake with far-reaching consequences. To avoid hiring a financial agent who falls short, it’s crucial to steer clear of the following seven common pitfalls:

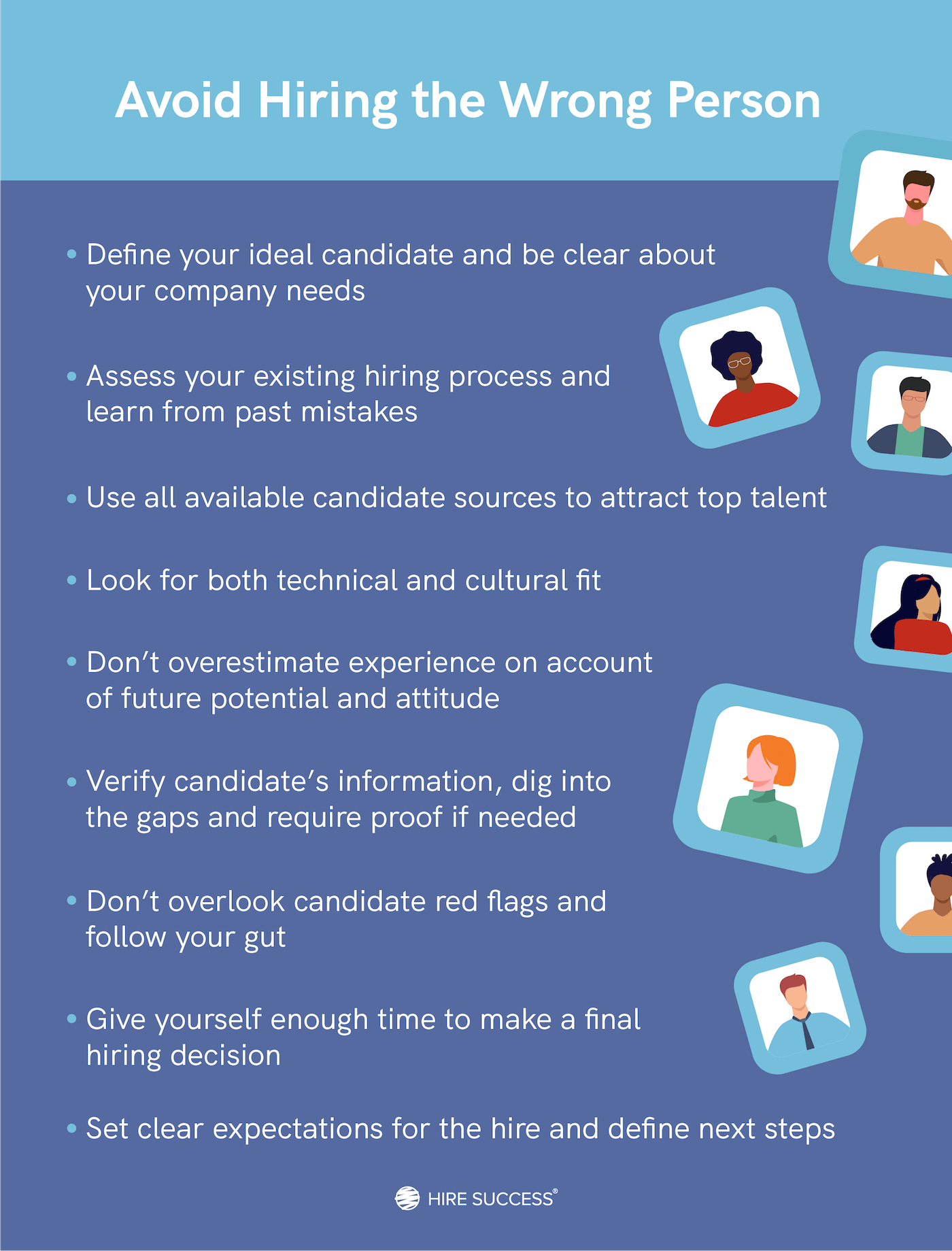

**1. Not Properly Vetting Candidates**

When it comes to hiring a financial agent, due diligence is paramount. This means conducting thorough background checks and verifying references to ensure that the candidate is reputable, qualified, and has a clean professional record.

Failing to properly vet candidates can be akin to handing over the keys to your financial castle without knowing who’s at the helm. Just as you wouldn’t hire a babysitter without verifying their credentials, the same level of scrutiny should be applied when selecting a financial agent who will be entrusted with your financial well-being.

A comprehensive background check should include verifying the agent’s education, professional certifications, and any previous disciplinary actions or complaints. It’s also wise to request client references and reach out to them to gather firsthand accounts of the agent’s service and ethical behavior.

References serve as valuable testimonials, offering insights into the agent’s communication skills, responsiveness, and ability to meet client expectations. By meticulously vetting candidates, you can increase your chances of finding an agent who is trustworthy, competent, and aligned with your financial goals.

Overlooking Suitability

When hiring a financial agent, it’s not just about finding someone with the right credentials; it’s also about finding an agent whose approach and philosophy align with your own. A mismatch in suitability can lead to miscommunications, misunderstandings, and ultimately, dissatisfaction.

Consider your investment style, risk tolerance, and long-term financial objectives. Does the agent’s investment philosophy complement your own? Are they willing to tailor their advice to your specific needs or do they adopt a one-size-fits-all approach?

A compatible agent will act as a trusted guide, providing personalized advice that empowers you to make informed financial decisions. On the other hand, an unsuitable agent may lead you down a path that doesn’t align with your financial goals and values.

Ignoring Fees and Commissions

Financial agents earn their compensation through fees, commissions, or a combination of both. Understanding the fee structure and potential conflicts of interest is essential to avoid any hidden costs or surprises down the line.

Commissions, while common in the industry, can create a potential conflict of interest. Agents may be incentivized to recommend certain products or investments that generate higher commissions, even if they’re not the most suitable for your needs.

Be sure to ask about all fees and commissions upfront. Are there any hidden costs or ongoing charges? How do the fees compare to industry averages? By fully understanding the compensation structure, you can make an informed decision about whether the agent’s services justify the cost.

**7 Pitfalls to Sidestep When Hiring a Financial Agent**

Hiring a financial agent is a momentous decision that can profoundly impact your financial well-being. Yet, many individuals stumble upon common pitfalls that can undermine their experience. Here’s a comprehensive guide to help you navigate the treacherous waters and make an informed choice.

Ignoring Cultural Fit

Cultural fit is not a mere buzzword; it’s a vital component of a successful agent-client relationship. When your agent’s values, work style, and company culture mesh with your own, you create a harmonious and productive environment. Conversely, a misalignment can sow seeds of discord that can poison the relationship.

**Consider these crucial aspects:**

* **Values:** Do their ethical principles mesh with yours? Are they transparent, honest, and ethical?

* **Work Style:** Are they meticulous planners or intuitive risk-takers? Do they prefer face-to-face meetings or virtual collaborations?

* **Company Culture:** Is their company a good fit for your business? Does it align with your company’s mission, vision, and values?

Failing to consider these factors is akin to embarking on a road trip with a co-pilot whose navigational skills leave much to be desired. It’s a recipe for a bumpy and unproductive journey.

7 Mistakes When Hiring a Financial Agent

Getting the right financial agent is like finding a needle in a haystack, but it needn’t be a hassle. We’ve outlined seven common pitfalls to steer clear of when making your choice. Whether you’re a seasoned investor or just starting out, these tips will guide you towards a successful financial partnership.

Focusing Solely on Experience

While experience is a valuable asset, it’s not the be-all and end-all when choosing a financial agent. Yes, years of expertise can provide a solid foundation, but it’s equally important to assess an agent’s ability to adapt to the ever-evolving financial landscape. Markets fluctuate, regulations change, and investment strategies must evolve accordingly. A forward-thinking agent who stays abreast of industry trends and embraces innovation will be better equipped to navigate these choppy waters and keep your financial boat afloat.

Ignoring Communication Style

Communication is key in any relationship, and it’s no different when it comes to financial advisors. You need an agent who speaks your language, literally and figuratively. They should be able to explain complex financial concepts in clear, concise terms, and tailor their communication style to your preferences. Do they prefer phone calls, emails, or video conferences? How often do they provide updates? Find an agent who’s on the same page as you when it comes to communication, because open and honest dialogue is the cornerstone of a successful partnership.

Overlooking Credentials and Licenses

When it comes to financial matters, trust is paramount. That’s why it’s imperative to verify an agent’s credentials and licenses. Are they registered with the Securities and Exchange Commission (SEC) or other regulatory bodies? Do they hold certifications that demonstrate their expertise in specific areas of finance? Don’t be afraid to ask for proof of their qualifications. After all, you wouldn’t hire a doctor without a medical degree, so why should you entrust your hard-earned money to someone who hasn’t proven their competence?

Not Vetting References

References are like the Yelp reviews of the financial world. Before you sign on with an agent, take the time to speak to their existing clients. Ask about their experiences, their level of satisfaction, and whether they would recommend the agent to others. Positive feedback can give you peace of mind, while negative reviews can save you from a potentially costly mistake.

Chasing the Lowest Fees

While fees are an important consideration, they shouldn’t be the sole factor driving your decision. Remember, you’re not just paying for an agent’s time; you’re paying for their expertise, experience, and guidance. A qualified agent will provide value that far outweighs their fees. So don’t fall into the trap of chasing the lowest cost; instead, focus on finding an agent who offers the best value for your money.

Ignoring Red Flags

Trust your instincts when it comes to financial agents. If something doesn’t feel right, it probably isn’t. Be wary of agents who pressure you into making quick decisions, who promise unrealistic returns, or who make you feel uncomfortable in any way. These could be red flags indicating that they’re not acting in your best interests. It’s better to walk away from a potentially risky situation than to regret it later.

Not Seeking Professional Advice

If you’re uncertain about any aspect of choosing a financial agent, don’t hesitate to seek professional advice. A financial planner or attorney can provide an unbiased perspective, help you assess your needs, and guide you towards a suitable agent. Remember, hiring a financial agent is a significant decision that can have a lasting impact on your financial future. By avoiding these common mistakes, you can increase your chances of finding the right agent to help you achieve your financial goals.

Seven Common Mistakes to Sidestep When Hiring a Financial Agent

Hiring a financial agent shouldn’t be a shot in the dark. By familiarizing yourself with the following pitfalls, you can enhance your chances of selecting the ideal professional for your unique financial needs.

Overlooking Soft Skills

Exceptional financial acumen is a given when hiring an agent. However, don’t overlook the significance of interpersonal skills. Building a strong rapport with your agent hinges on effective communication, a knack for connecting with others, and a dash of emotional intelligence. These soft skills are indispensable for fostering trust, understanding complex financial concepts, and navigating the inevitable ups and downs of the market together.

Failing to Check Credentials

Verifying an agent’s qualifications is non-negotiable. Seek out professionals who hold reputable certifications, such as the CERTIFIED FINANCIAL PLANNER™ (CFP®) or Chartered Financial Analyst (CFA) designations. Such credentials attest to their expertise and adherence to ethical standards. Additionally, inquire about their experience, specialization, and any regulatory actions or complaints against them.

Inadequate Research

Don’t limit your search to the first agent who crosses your path. Take the time to explore various options. Consult with friends, family, or other trusted individuals for referrals. Leverage online directories, such as the Financial Planning Association (FPA) or the National Association of Personal Financial Advisors (NAPFA), to expand your search. By conducting thorough research, you’ll increase your odds of finding an agent who aligns with your financial goals and values.

Ignoring Compatibility

Beyond technical skills and experience, compatibility plays a crucial role in a successful agent-client relationship. Look for an agent whose communication style, investment philosophy, and overall demeanor resonate with you. A strong rapport built on mutual respect and understanding will make the journey toward achieving your financial aspirations smoother and more enjoyable.

Overlooking Fees and Compensation Structures

Transparency regarding fees is paramount. Before signing on the dotted line, gain a clear understanding of how your agent will be compensated. Whether it’s a flat fee, hourly rate, or commission-based model, ensure that you comprehend the potential costs involved and how they align with your financial goals. A straightforward and transparent fee structure can prevent any unpleasant surprises down the road.

Neglecting Communication Style

Communication is the lifeblood of any relationship, including the one between you and your financial agent. Determine whether the agent’s preferred communication channels suit your needs. Whether it’s regular phone calls, email updates, or face-to-face meetings, establish a communication style that works for both parties. Open and timely communication is essential for staying on the same page, addressing concerns, and making well-informed financial decisions.

7 Mistakes to Avoid When Hiring a Financial Agent

Before you hand over your hard-earned money to a financial agent, there are a few crucial mistakes you should be aware of. Steering clear of these pitfalls can help ensure you find the right professional to guide you on your financial journey.

Relying on Recommendations Alone

Recommendations from friends or family can be a helpful starting point, but they shouldn’t be the sole basis for your decision. Conduct your own thorough due diligence and interviews to assess each agent’s credentials, experience, and compatibility with your needs.

Ignoring Credentials and Experience

Financial planning is a complex field, so it’s essential to hire someone who has the necessary knowledge and skills. Look for agents with relevant certifications, such as CFP or ChFC, and ask about their years of experience in the industry.

Assuming Compatibility

Even if an agent comes highly recommended, it’s crucial to ensure they are a good fit for you. Consider their investment philosophy, communication style, and responsiveness. Schedule a meeting to get to know them and discuss your financial goals before making a decision.

Failing to Check Background

Before entrusting your finances to anyone, verify their background with regulatory agencies like the SEC or FINRA. This will help you uncover any potential red flags or disciplinary actions.

Neglecting to Negotiate Fees

Financial agents typically charge fees for their services. Be sure to clarify the fee structure upfront and understand how you will be compensated. Don’t hesitate to negotiate if the fees seem excessive.

Overlooking Communication Skills

Effective communication is key in any financial relationship. Ensure the agent you hire can clearly explain financial concepts, respond promptly to inquiries, and keep you informed about your investments.

Not Considering a Fiduciary

A fiduciary is a financial advisor who is legally obligated to act in your best interests. While not all financial agents are fiduciaries, it’s highly recommended to work with one who has this ethical obligation.

7 Mistakes to Avoid When Hiring a Financial Agent

Hiring a financial agent can be a daunting task, especially if you don’t know what to expect. Many common mistakes can be avoided by doing some research and due diligence upfront. Here are seven common pitfalls to avoid when hiring a financial agent:

Not Establishing Clear Expectations

One of the biggest mistakes you can make is not setting clear expectations with your financial agent. What are your financial goals? What level of risk are you comfortable with? How often do you want to meet with your agent? Answering these questions upfront will help avoid confusion and disappointment down the road.

Hiring Based on Sales Pitch

It’s easy to get caught up in a persuasive sales pitch, but it’s important to remember that not all financial agents are created equal. Do your research and interview multiple agents before making a decision. Ask about their experience, qualifications, and fees. And be sure to get everything in writing before you sign on the dotted line.

Ignoring Red Flags

If something about a financial agent doesn’t feel right, it’s probably best to listen to your gut. Some red flags to watch out for include unrealistic promises, high-pressure sales tactics, and a lack of transparency. If you’re not comfortable with an agent, don’t hesitate to move on.

Not Understanding the Fees

Financial agents typically charge fees for their services. It’s important to understand what these fees are and how they will be calculated before you hire an agent. Some agents charge a flat fee, while others charge a percentage of your assets under management. Be sure to get a clear explanation of the fee structure before you make a decision.

Failing to Monitor Performance

Once you’ve hired a financial agent, it’s important to monitor their performance regularly. Are they meeting your expectations? Are they helping you reach your financial goals? If you’re not satisfied with your agent’s performance, don’t be afraid to have a conversation with them. Or, if necessary, you can fire them and find a new agent.

Not Getting Everything in Writing

When you hire a financial agent, it’s important to get everything in writing. This includes the agent’s responsibilities, fees, and performance metrics. Having a written agreement will help protect you if there are any disputes down the road.

7 Mistakes to Avoid When Hiring a Financial Agent

Hiring a financial agent is a significant decision that can have a substantial impact on your financial well-being. However, many people make common mistakes during the hiring process that can lead to unfavorable outcomes. To ensure you find the right agent for your needs, it’s crucial to be aware of these pitfalls and take steps to avoid them.

Neglecting Training and Development

A qualified financial agent should be up-to-date on the latest industry best practices and regulatory changes. Ongoing education and professional development are essential for agents to stay abreast of evolving client needs and provide sound financial advice. Look for agents who prioritize their professional growth and invest in continuing education.

Overemphasizing Credentials and Experience

While credentials and experience are important factors to consider, they shouldn’t be the sole determining factors in your decision. Some agents with impressive credentials may not possess the interpersonal skills or communication style that is a good fit for you. Take the time to interview multiple agents and assess their listening skills, empathy, and ability to explain complex financial concepts in a clear and understandable manner.

Ignoring Compatibility

The relationship between you and your financial agent should be built on trust, open communication, and shared financial goals. It’s essential to find an agent with whom you feel comfortable discussing your financial situation, concerns, and objectives. Consider your personality, communication style, and values, and choose an agent who aligns with your needs and expectations.

Failing to Check Background and References

Before hiring a financial agent, thoroughly research their background and professional history. Check for any complaints or disciplinary actions against them with regulatory bodies or consumer protection agencies. Ask for references from previous clients and contact them to get their feedback on the agent’s services.

Putting Too Much Weight on Fees

While fees are a factor to consider, they shouldn’t be the driving force behind your decision. Focus on finding an agent who provides the services and expertise you need at a reasonable cost. Remember, the right agent can help you save money in the long run by providing sound financial advice and helping you make informed decisions.

Neglecting Communication and Responsiveness

Effective communication is vital for a successful relationship with your financial agent. Choose an agent who is responsive, accessible, and willing to answer your questions and concerns in a timely manner. Clear and regular communication will ensure that your financial goals are being met and that you’re kept informed of market trends and financial opportunities.

Ignoring Ethical Considerations

Trust is paramount when dealing with financial matters. Look for an agent who demonstrates integrity, transparency, and a commitment to ethical practices. They should be transparent about their fees, investments, and conflicts of interest, and they should put your interests first. A reputable agent will act as a fiduciary, meaning they are legally obligated to act in your best interests and avoid conflicts that could compromise their duty to you.

No responses yet