Introduction

Buckle up, folks! Investing in cryptocurrency can be a wild ride, but also a golden opportunity. However, before you dive in headfirst, let’s get the lowdown on the best cryptocurrencies to invest in.

Bitcoin: The OG Crypto Kingpin

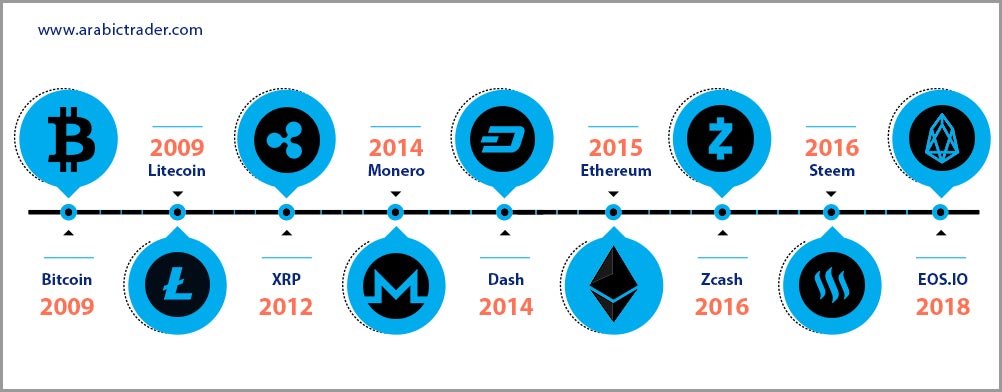

Bitcoin, the OG crypto kingpin, has been making waves since its inception in 2009. Its decentralized nature and limited supply have made it a favorite among investors. Think of it as the blue-chip stock of the crypto world! Bitcoin’s value has skyrocketed over the years, making it a top choice for savvy investors looking for long-term gains.

Ethereum: The Blockchain Bonanza

Ethereum is like the Swiss Army knife of cryptocurrencies. Not only is it a valuable investment, but its blockchain platform also supports a wide range of applications. From decentralized finance (DeFi) to non-fungible tokens (NFTs), Ethereum is at the heart of the crypto ecosystem. So, if you’re looking for a versatile investment with a promising future, Ethereum is worth checking out.

Binance Coin: The Exchange Powerhouse

Binance Coin, the native token of the Binance cryptocurrency exchange, has become a major player in the crypto market. Binance is one of the world’s largest crypto exchanges, and its coin has benefited from its popularity. Whether you’re trading crypto or just holding Binance Coin for potential gains, it’s a solid choice for those looking to invest in the exchange ecosystem.

Cardano: The Eco-Friendly Challenger

Cardano is a newer cryptocurrency that’s gaining traction due to its eco-friendly approach. Unlike Bitcoin and Ethereum, which use energy-intensive mining processes, Cardano uses a more sustainable proof-of-stake consensus mechanism. Its focus on scalability and security also make it a promising investment for those who believe in a greener future for crypto.

Solana: The Lightning-Fast Contender

Solana has emerged as a formidable competitor in the crypto space, thanks to its blazing-fast transaction speeds and low fees. Its unique architecture allows it to process thousands of transactions per second, making it a top choice for decentralized applications (dApps). If you’re looking for a cryptocurrency with the potential for high performance and scalability, Solana is worth keeping an eye on.

The Best Cryptocurrencies to Invest In

With the ever-evolving landscape of the cryptocurrency market, identifying the best cryptocurrencies to invest in can be a daunting task. However, by considering key factors such as performance history, development team, and use case, it’s possible to make informed choices that could potentially yield significant returns. Here’s a comprehensive guide to help you navigate the cryptocurrency investment landscape and select the best cryptocurrencies to add to your portfolio.

Essential Factors to Consider

When evaluating cryptocurrencies for potential investment, there are several crucial factors to consider: Performance: A strong track record of performance is a key indicator of a cryptocurrency’s stability and potential. Look for coins with consistent growth over time and a proven ability to weather market fluctuations. Development Team: A solid development team is vital for the ongoing success of a cryptocurrency. Research the team’s experience, expertise, and commitment to the project. A well-equipped development team is more likely to drive innovation and maintain the cryptocurrency’s relevance. Use Case: A clear and compelling use case is essential for the long-term viability of a cryptocurrency. Consider the problem it solves, the target market it addresses, and its potential for widespread adoption. Cryptocurrencies with a well-defined use case are more likely to gain traction and drive demand.

Top Cryptocurrencies for Investment

Based on the aforementioned factors, here are some of the best cryptocurrencies to consider for investment: Bitcoin: As the pioneer and market leader, Bitcoin remains a top choice for investors. Its established status, strong security, and widespread acceptance make it a reliable investment option. Ethereum: Ethereum is the second-largest cryptocurrency by market capitalization, known for its smart contract functionality. Its blockchain enables the development of decentralized applications, creating a vast ecosystem and driving innovation. Litecoin: Litecoin is often regarded as the “silver to Bitcoin’s gold.” It offers faster transaction times and lower fees compared to Bitcoin, making it a viable alternative for everyday transactions. Cardano: Cardano is a third-generation cryptocurrency that emphasizes scalability, security, and sustainability. Its unique proof-of-stake consensus mechanism and layered blockchain architecture have drawn attention from investors. Binance Coin: Binance Coin is the native token of the Binance exchange, one of the largest cryptocurrency exchanges in the world. Its utility in trading fees and ecosystem services makes it a valuable investment for those involved in the Binance ecosystem.

Best Cryptocurrency to Invest In: A Comprehensive Guide

In the ever-evolving world of cryptocurrency, picking the right investment can be akin to navigating a stormy sea. With countless options and volatile market conditions, investors need a compass to guide them towards promising shores. One standout performer that has consistently garnered attention is Bitcoin (BTC), the pioneer of the digital currency realm. Its established market position, strong community, and growing adoption make it a compelling choice for those seeking a reliable investment.

How to Choose the Right Cryptocurrency to Invest In

The decision of which cryptocurrency to invest in should not be taken lightly. Consider your investment goals, risk tolerance, and time horizon. Before diving in, conduct thorough research on the cryptocurrency’s technology, team, and use cases.

Understanding Technology and Team

When evaluating a cryptocurrency’s technology, delve into its underlying blockchain platform. Examine its security, scalability, and transaction speed. A well-developed blockchain provides a robust foundation for the cryptocurrency’s growth and sustainability.

The team behind a cryptocurrency is equally crucial. Look for a team with experience, technical prowess, and a proven track record in the industry. A dedicated and capable team is essential for ongoing development and innovation, which can drive the cryptocurrency’s long-term value.

Determining Use Cases and Adoption

When considering a cryptocurrency’s use case, ask yourself if it solves a real-world problem. A cryptocurrency with a clear and practical use case has the potential for widespread adoption, which can drive its price upward.

Adoption is also a key indicator of a cryptocurrency’s potential. Look for cryptocurrencies that are gaining traction among users and businesses. High adoption rates suggest that the cryptocurrency is meeting a market need and has the potential to become a mainstream payment or utility.

Investing in the Crypto Gold Rush: A Comprehensive Guide

Investing in cryptocurrency has become a topic of immense fascination for countless individuals seeking to venture into the realm of digital finance. As the hype surrounding cryptocurrencies continues to reverberate across financial markets, discerning the best ones to invest in can be a daunting task. Among the myriad of options available, one cryptocurrency that has garnered significant attention is Bitcoin, renowned for its pioneering role in this nascent industry.

Tips for Navigating the Cryptocurrency Maze

Embarking on a cryptocurrency investment journey requires a prudent approach to mitigate potential pitfalls. To ensure a well-informed decision-making process, consider implementing these essential safeguards:

-

Diversify Your Portfolio: Don’t put all your financial eggs in one digital basket. Spread your investments across a range of cryptocurrencies, mitigating the impact of fluctuations in any single asset.

-

Invest Prudently: Remember the golden rule of investing—only venture what you can afford to lose. Cryptocurrency markets are notoriously volatile, so tread cautiously and avoid jeopardizing your financial stability.

-

Secure Your Assets: Protect your hard-earned cryptocurrency investments by storing them in a secure digital wallet. Opt for reputable platforms that employ stringent security measures to safeguard your assets.

-

Stay Informed: Cryptocurrency landscapes are in a constant state of evolution. Arm yourself with knowledge by staying abreast of industry news, technological advancements, and regulatory developments. Ignorance can lead to costly mistakes.

-

Beware of Scams: The allure of quick profits can attract dishonest actors. Exercise caution and conduct thorough research before entrusting your funds to any platform or individual. If an investment opportunity sounds too good to be true, it probably is.

Delving into the Heart of Cryptocurrency Investment

Recognizing the volatility inherent in cryptocurrency markets, it’s crucial to acknowledge that even the most promising investments can encounter setbacks. However, by adhering to these prudent investment principles, you can navigate the complexities of this ever-evolving industry with greater confidence.

Ultimately, the best cryptocurrency to invest in depends on your individual risk tolerance and financial goals. Nevertheless, Bitcoin remains a formidable contender, having established itself as the cornerstone of the cryptocurrency ecosystem. Its limited supply and established infrastructure make it a compelling investment choice for many.

Embark on your cryptocurrency investment journey with a clear understanding of the risks and rewards involved. Remember, investing in cryptocurrency is not a get-rich-quick scheme; it’s a long-term endeavor that requires patience, strategy, and a keen eye for innovation. By embracing these guidelines and staying informed, you can increase your chances of reaping the rewards of this burgeoning financial frontier.

No responses yet