Best Retirement Plan Companies for Your Financial Future

Retirement planning is crucial for a secure financial future, and choosing the right company to manage your retirement funds is essential. With so many options available, it can be overwhelming to know where to start. Here are some of the best retirement plan companies to consider, based on factors such as fees, investment options, customer service, and overall performance.

What to Look for in a Retirement Plan Company

When evaluating retirement plan companies, there are several key factors to consider:

- Fees: Retirement plan companies charge various fees, including investment management fees, administrative fees, and transaction fees. It’s crucial to understand these fees and how they impact your returns over time.

- Investment Options: The range of investment options offered by a retirement plan company is another important consideration. Look for companies that offer a diverse selection of investments, including stocks, bonds, and mutual funds.

- Customer Service: In case of any issues or inquiries, it’s essential to have access to reliable and responsive customer service. Look for companies with a strong reputation for providing excellent support.

- Overall Performance: The overall performance of a retirement plan company is reflected in its investment returns. Research the company’s track record and compare it with that of its peers.

Best Retirement Plan Companies

Here are some of the top retirement plan companies in the market:

- Fidelity Investments: With over $4 trillion in assets under management, Fidelity is one of the largest and most well-established retirement plan providers. The company offers a wide range of investment options, low fees, and excellent customer service.

- Vanguard: Known for its low-cost index funds, Vanguard is a popular choice for investors looking to minimize fees. The company offers a comprehensive suite of retirement plan services and is renowned for its customer-centric approach.

- TIAA: Specializing in retirement plans for educators, healthcare professionals, and other non-profit employees, TIAA stands out with its tailored solutions and personalized advice. The company offers a diverse range of investment options and has a strong track record of performance.

- Principal Financial Group: Principal Financial Group is a leading retirement plan provider with over 130 years of experience. The company offers customized plans for businesses of all sizes and provides a comprehensive suite of investment and financial planning services.

- Transamerica: Transamerica is another well-established retirement plan provider known for its competitive fees and innovative products. The company offers a wide selection of investment options and provides personalized guidance to help investors achieve their retirement goals.

Making the Right Choice

Choosing the right retirement plan company is a crucial decision that can impact your financial future. Consider the factors discussed above and carefully evaluate the options available. By doing your research and making an informed decision, you can ensure that your retirement savings are in good hands and that you’re on track to a comfortable and secure retirement.

**Best Retirement Plan Companies**

When planning for your retirement, choosing the right retirement plan company is crucial. Several reputable companies offer a wide range of plans and services, but how do you know which one is right for you? To help you make an informed decision, let’s explore key factors to consider when evaluating retirement plan companies.

**Fees**

Fees can significantly impact your retirement savings over time. Compare different companies’ fee structures, including administrative fees, investment management fees, and transaction costs. Determine which company offers the most cost-effective solution that aligns with your financial goals.

**Investment Options**

The investment options offered by a retirement plan company can influence your portfolio’s performance. Look for companies that provide a diverse range of investment options, including stocks, bonds, mutual funds, and target-date funds. Ensure that the company offers investment choices that suit your risk tolerance and investment horizon.

**Customer Service**

Exceptional customer service is invaluable when managing your retirement savings. Consider companies that offer accessible and responsive customer support. Evaluate the availability of online resources, phone support, and in-person assistance. Make sure the company is committed to providing prompt and helpful guidance throughout your retirement journey.

**Company Experience**

The experience and credibility of a retirement plan company can provide peace of mind. Research the company’s track record, financial stability, and regulatory compliance. Look for companies that have been in the industry for a substantial period, demonstrating their expertise and commitment to serving clients.

**Additional Considerations**

Beyond the factors discussed above, consider the following when choosing a retirement plan company:

* **Employer Contribution Matching:** If your employer offers matching contributions, determine if the company supports this feature.

* **Online Tools:** Evaluate the company’s online tools, including account management portals, investment tracking, and educational resources.

* **Education and Financial Planning:** Look for companies that provide access to financial planning services and educational materials to help you make informed decisions.

By carefully evaluating these factors, you can select the retirement plan company that best meets your unique needs and sets you on the path to a secure financial future.

**Best Retirement Plan Companies: A Comprehensive Guide**

When it comes to securing your financial future, choosing the right retirement plan company is of paramount importance. Numerous reputable companies in the industry offer a range of services to help you plan and manage your retirement savings effectively. In this article, we’ll delve into the top-rated retirement plan companies, exploring their offerings and providing insights to guide you in making an informed decision.

**Top Retirement Plan Companies**

The following are some of the leading retirement plan companies that have consistently received high ratings for their services:

* **Vanguard:** Vanguard is renowned for its low fees and extensive investment options. Their index funds and ETFs have gained popularity among investors seeking cost-effective and diversified investment portfolios.

* **Fidelity Investments:** Fidelity Investments offers personalized investment advice and a comprehensive suite of retirement plan choices. They provide access to a wide range of investment options, including mutual funds, stocks, and bonds.

* **T. Rowe Price:** T. Rowe Price is known for its customized retirement solutions. They offer target-date funds that automatically adjust asset allocation based on the investor’s age and retirement date. Additionally, they provide access to experienced fund managers who actively manage investment portfolios.

* **Charles Schwab:** Charles Schwab focuses on providing affordable and accessible retirement plans. Their platform offers a wide range of investment options and retirement savings tools that cater to the needs of individuals at various stages of their financial journey.

* **Principal:** Principal offers a comprehensive package of retirement services, including annuities and target-date funds. They also provide retirement planning advice and educational resources to help investors make informed decisions about their retirement savings.

**Factors to Consider When Choosing a Retirement Plan Company**

When selecting a retirement plan company, consider the following factors:

* **Fees:** Compare the fees associated with different plans, including account maintenance fees, investment management fees, and transaction costs. Low fees can significantly impact your long-term savings growth.

* **Investment Options:** Consider the range and variety of investment options offered by the company. Look for providers that offer a mix of asset classes, including stocks, bonds, and real estate, to diversify your portfolio.

* **Personalized Advice:** Determine if you need personalized investment advice or prefer a self-directed approach. Some companies offer professional guidance, while others focus on providing online tools and resources for investors to manage their portfolios independently.

* **Reputation and Stability:** Research the company’s reputation in the industry and its financial stability. Look for providers with a strong track record of customer satisfaction and a proven history of managing retirement assets effectively.

**Additional Considerations for Retirement Planning**

Beyond choosing a retirement plan company, consider the following additional factors:

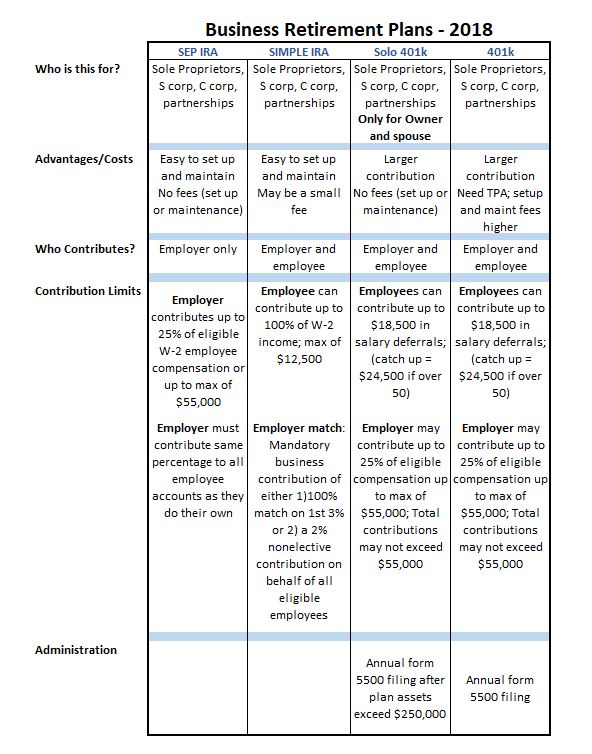

* **Contribution Limits:** Understand the contribution limits for different types of retirement accounts, such as 401(k)s and IRAs.

* **Tax Advantages:** Take advantage of the tax benefits offered by retirement accounts. Contributions to qualified plans may be tax-deductible or tax-deferred, reducing your current tax liability.

* **Investment Strategy:** Develop an investment strategy that aligns with your retirement goals and risk tolerance. Consider your age, time horizon, and financial situation when making investment decisions.

**Conclusion**

Choosing the right retirement plan company and implementing sound retirement planning strategies are crucial steps towards securing your financial well-being in the years to come. By carefully considering the factors discussed in this article, you can make informed decisions that will help you achieve your retirement savings goals. Remember, retirement planning is a marathon, not a sprint. Start early, contribute consistently, and make wise investment choices to ensure a secure and fulfilling retirement.

No responses yet