**401(k) Plans:** 401(k) plans are employer-sponsored retirement savings plans that allow employees to contribute a portion of their salary on a pre-tax basis. The contributions grow tax-free until withdrawal in retirement. Employers may also match a portion of employee contributions, which can significantly boost retirement savings.

**IRAs (Individual Retirement Accounts):** IRAs are retirement savings accounts that can be opened by individuals without an employer-sponsored plan. Contributions to traditional IRAs are tax-deductible, while contributions to Roth IRAs are made after-tax but grow tax-free. IRA withdrawals are subject to income tax in retirement.

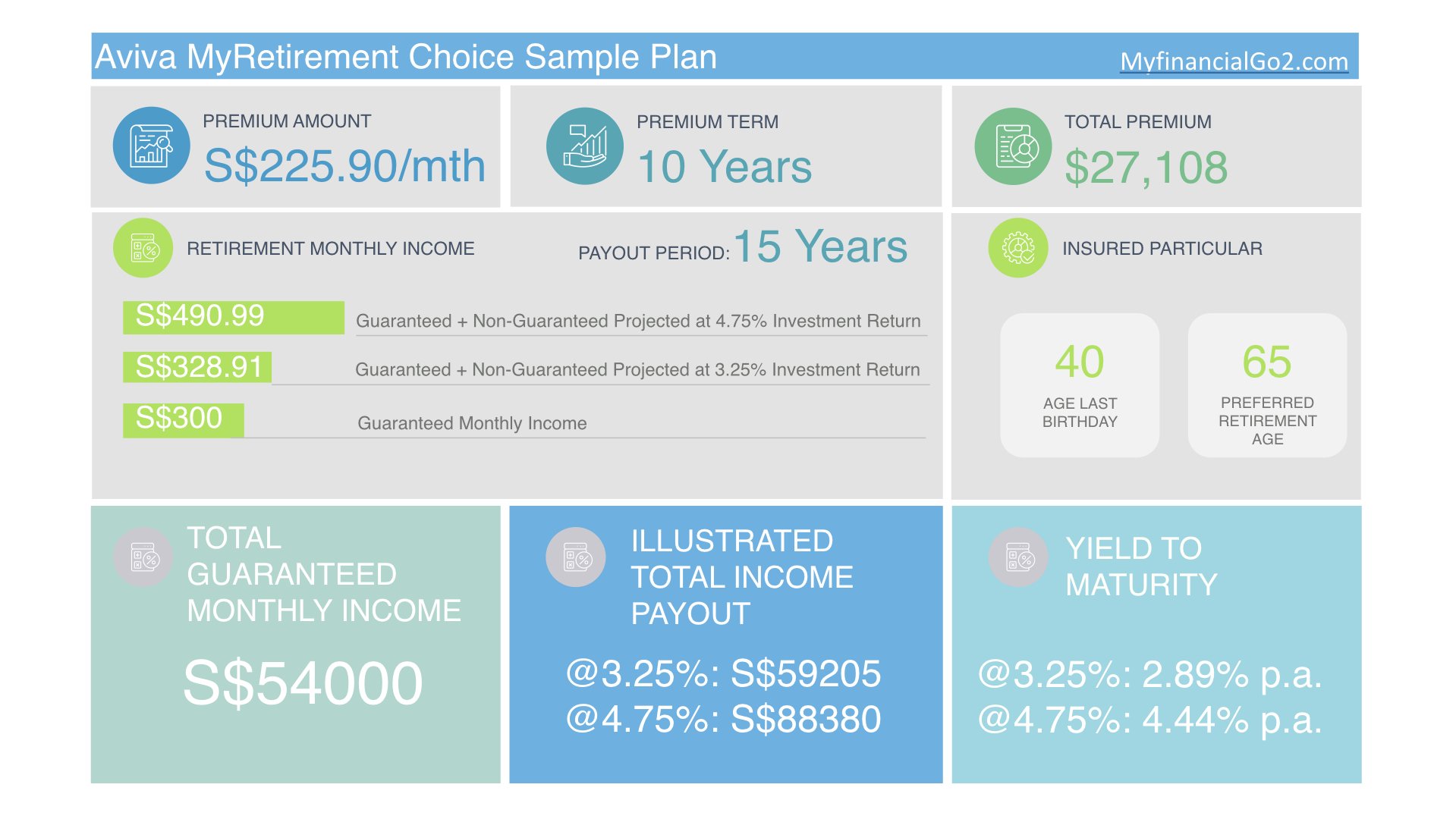

**Annuities:** Annuities are insurance contracts that provide a guaranteed stream of income for a specific period or for the rest of the annuitant’s life. They can be a valuable source of retirement income, but it’s important to understand the terms and conditions carefully before purchasing an annuity.

**Real Estate:** Real estate can be a good investment for retirement, as it can provide both rental income and capital appreciation. However, it’s important to consider the costs of ownership, such as property taxes, insurance, and maintenance, before investing in real estate.

**Other Retirement Savings Options:** In addition to the plans mentioned above, there are other retirement savings options available, such as:

* **529 Plans:** These plans are designed to save for college expenses, but they can also be used to save for retirement. Earnings grow tax-free, and withdrawals are tax-free if used for qualified educational expenses.

* **Health Savings Accounts (HSAs):** HSAs are tax-advantaged accounts that can be used to pay for qualified medical expenses. Unused funds can be invested and grow tax-free until withdrawal.

* **Simplified Employee Pension (SEP) Plans:** SEP plans are retirement savings plans for self-employed individuals and small business owners. Employers can contribute a percentage of their net income on behalf of eligible employees.

Understanding Retirement Plans

Retirement plans are like a financial safety net that you build for your future self, providing financial security during your golden years. They’re an essential part of planning for the day when you hang up your hat and trade in your work attire for leisure wear. And while there’s no one-size-fits-all retirement plan, there are plenty of options to choose from.

Why Retirement Plans Are a Big Deal

Retirement may seem like a distant dream, but it’s never too early to start planning. Think of it like a marathon: you wouldn’t show up at the starting line without any training, would you? The same goes for retirement. The earlier you start saving and investing, the more time your money has to grow. And who knows, you might even be able to retire early and enjoy a few extra years of sipping piña coladas on the beach!

Types of Retirement Plans

When it comes to retirement plans, you have two main options: employer-sponsored plans and individual retirement accounts (IRAs). Employer-sponsored plans are offered through your workplace, and they come in two flavors:

- 401(k) plans: With a 401(k) plan, you contribute a portion of your paycheck before taxes, reducing your taxable income. The money grows tax-deferred, meaning you don’t pay taxes on the earnings until you withdraw them in retirement.

- 403(b) plans: Similar to 401(k) plans, 403(b) plans are available to employees of public schools and certain other non-profit organizations.

IRAs

If you don’t have an employer-sponsored retirement plan, or if you want to save even more for retirement, IRAs are a great option. IRAs are individual accounts that you can open and contribute to on your own. There are two main types of IRAs:

- Traditional IRAs: With a traditional IRA, you can deduct your contributions from your taxable income, reducing your tax bill. The catch is that you’ll have to pay taxes on the money when you withdraw it in retirement.

- Roth IRAs: Roth IRAs are funded with after-tax dollars, which means you don’t get an immediate tax break. However, the money grows tax-free, and you won’t have to pay taxes on withdrawals in retirement.

How to Choose the Right Retirement Plan

Choosing the right retirement plan depends on your individual circumstances and financial goals. If you have an employer-sponsored plan, it’s a good idea to participate in it, especially if your employer offers a matching contribution. Matching contributions are like free money, so don’t pass them up!

If you don’t have an employer-sponsored plan, or if you want to save more for retirement, IRAs are a great option. Traditional IRAs are a good choice if you’re in a high tax bracket now and expect to be in a lower tax bracket in retirement. Roth IRAs are a good choice if you’re in a low tax bracket now and expect to be in a higher tax bracket in retirement.

Don’t Put Off Retirement Planning

Retirement planning is like brushing your teeth: it’s something you should do regularly, even if you don’t always want to. The sooner you start planning, the more time your money has to grow, and the better off you’ll be in retirement.

**Best Retirement Plans for Individuals: Navigating the Maze of Options**

In this fast-paced, unpredictable world, planning for a secure retirement has become paramount. With a plethora of retirement plans available, choosing the best one for your individual needs can be daunting. This article delves into the various types of retirement plans, their advantages and drawbacks, and provides guidance on how to select the one that fits you like a glove.

**Types of Retirement Plans**

Individuals have a wide array of retirement plans to choose from, each with its own set of rules, tax treatment, and investment options. Understanding the differences between these plans is crucial for making an informed decision.

**1. Employer-Sponsored Plans**

**401(k) Plans**

401(k) plans are employer-sponsored retirement savings plans that allow employees to contribute a portion of their pre-tax income. Employers may offer matching contributions, effectively boosting employees’ savings even further. Withdrawals before age 59½ may incur penalties, unless taken under specific circumstances.

**403(b) Plans**

Similar to 401(k) plans, 403(b) plans are retirement savings plans available to employees of public schools and certain nonprofit organizations. Contributions are made with pre-tax dollars, offering potential tax savings.

**2. Individual Retirement Accounts (IRAs)**

**Traditional IRAs**

Traditional IRAs are retirement savings accounts that offer tax-deferred growth. Contributions are made with pre-tax dollars, reducing current income taxes but subject to taxes upon withdrawal in retirement.

**Roth IRAs**

Roth IRAs are retirement savings accounts that offer tax-free growth and qualified withdrawals. Contributions are made with after-tax dollars, providing no immediate tax benefit but tax-free income in retirement.

**3. Annuities**

Annuities are insurance contracts that provide a stream of income in retirement. Premium payments can be made with either pre-tax or after-tax dollars, and earnings grow tax-deferred. Income payments in retirement may be subject to taxes.

**Best Retirement Plans for Individuals**

When it comes to securing your financial future in retirement, choosing the right plan is crucial. With various options available, it’s essential to consider your unique needs and goals.

**Choosing the Best Plan**

Selecting the optimal retirement plan involves carefully weighing several factors:

* **Investment Options:** Consider the range of investment choices offered by the plan. Determine if the options align with your risk tolerance and investment strategy.

* **Fees:** Look out for hidden costs, such as account maintenance fees or fund management expenses. These fees can eat into your retirement savings over time.

* **Tax Implications:** Understand the tax advantages and disadvantages of different plans. Some plans offer tax-deferred growth, while others provide potential tax savings upon withdrawal.

**Best Retirement Plans for Individuals**

* **401(k) Plans:** Employer-sponsored plans that offer tax-deferred contributions and matching funds (if available).

* **IRAs (Individual Retirement Accounts):** Personal retirement savings accounts with various options available, including Traditional IRAs (tax-deductible contributions) and Roth IRAs (tax-free withdrawals).

* **Annuities:** Contracts with insurance companies that provide guaranteed income streams in retirement.

**Additional Considerations**

* **Contribution Limits:** Plans have maximum contribution limits, so it’s important to understand these limits when planning your retirement savings.

* **Early Withdrawal Penalties:** Withdrawing funds from retirement accounts before the age of 59½ may subject you to penalties.

* **Retirement Age:** Determine at what age you plan to retire and choose a plan that aligns with your timeline.

**Choosing the Right Plan for You**

The best retirement plan for you depends on your individual circumstances and financial goals. By carefully considering the factors discussed above, you can make an informed decision that will help you secure a comfortable and secure retirement.

**Best Retirement Plans for Individuals: Securing Your Golden Years**

Retirement may seem like a distant future, but planning for it is crucial to ensure a secure and comfortable life during our twilight years. With a myriad of retirement plans available, choosing the right one can be daunting. Here’s a comprehensive guide to help you navigate the options and maximize your retirement savings.

Maximize Your Retirement Contributions

Regularly contributing to your chosen retirement plan is the cornerstone of a successful retirement strategy. If your employer offers matching contributions, be sure to participate. These contributions are essentially free money, and they significantly boost your retirement savings over time. Consider contributing the maximum allowable amount each year to maximize your future retirement income.

Understanding Different Retirement Plans

There are two main types of retirement plans: defined benefit plans and defined contribution plans. Defined benefit plans, such as pensions, guarantee a fixed monthly income in retirement. However, they are becoming increasingly rare. Defined contribution plans, on the other hand, are more common. These plans, such as 401(k)s and IRAs, offer a tax-deferred or tax-free investment option.

401(k) Plans

401(k) plans are employer-sponsored retirement plans that allow you to contribute pre-tax dollars from your paycheck. This lowers your taxable income today and allows your savings to grow tax-deferred until retirement. Many employers offer matching contributions, making 401(k) plans a great way to maximize your retirement savings.

IRAs

IRAs are individual retirement accounts that allow you to save for retirement independent of an employer. There are two main types of IRAs: traditional IRAs and Roth IRAs. Traditional IRAs offer tax-deferred growth, while Roth IRAs offer tax-free withdrawals in retirement. Which type of IRA is right for you depends on your current and expected future tax bracket.

Choosing the Right Plan

The best retirement plan for you depends on your individual circumstances. Consider your age, income, tax bracket, and risk tolerance. A financial advisor can help you assess your needs and recommend the best plan for your situation.

**Conclusion:**

Retirement planning is an essential part of securing a comfortable future. By understanding the different types of retirement plans and maximizing your contributions, you can increase your chances of enjoying a financially secure retirement. Remember, the key is to start saving early and consistently. As the saying goes, “A penny saved today is a dollar earned tomorrow.”

Best Retirement Plans for Individuals

Planning for retirement is a crucial financial goal that requires careful consideration. Choosing the right retirement plan can significantly impact your financial security during your golden years. This article explores some of the best retirement plans available to individuals, providing valuable insights to help you make informed decisions about your future.

Employer-Sponsored Plans

Employer-sponsored retirement plans, such as 401(k)s and 403(b)s, offer several advantages. Contributions are made pre-tax, reducing your current taxable income. Additionally, many employers offer matching contributions, essentially free money that can boost your retirement savings. Employer-sponsored plans often have lower fees than other retirement accounts, making them a cost-effective option.

Individual Retirement Accounts (IRAs)

IRAs are retirement savings accounts that individuals can establish and manage themselves. Traditional IRAs offer tax-deferred growth, meaning you pay taxes on withdrawals during retirement. Roth IRAs are funded with after-tax dollars, but withdrawals in retirement are tax-free. IRAs provide flexibility and control over your investments, allowing you to choose from a wide range of options.

Annuities

Annuities are contracts with insurance companies that provide a guaranteed income stream during retirement. The premiums you pay today are converted into a series of payments that begin at a predetermined age. Annuities can provide peace of mind by ensuring a steady income source regardless of market conditions. However, they typically have higher fees than other retirement plans.

Long-Term Investment Strategy

invest in a diversified portfolio of assets within retirement plans to weather market fluctuations and maximize potential returns. A well-diversified portfolio includes stocks, bonds, real estate, and alternative investments, each with varying risk and return potential. By spreading your investments across different asset classes, you can reduce the impact of any one asset’s volatility and enhance your overall returns over the long term.

Tax Implications

The tax implications of different retirement plans can significantly impact your financial outcomes. Traditional IRAs and 401(k)s offer tax-deferred growth, but withdrawals in retirement are taxed as ordinary income. Roth IRAs offer tax-free growth and withdrawals, but contributions are made with after-tax dollars. Annuities are taxed differently depending on the type of annuity and the timing of withdrawals. It’s essential to consider the tax implications of each plan before making a decision.

Estate Planning

Be sure to incorporate your retirement plans into your estate plans. It’s a smart move if you want to ensure the assets you’ve worked hard for are properly distributed after you die. And it can help minimize tax liabilities for your loved ones. Who wouldn’t want that, right?

Roth IRA Contributions

A Roth IRA is a retirement savings account with some fantastic tax benefits. Here’s the real kicker: If you meet certain requirements, when you retire, you can withdraw your earnings tax-free. That’s a major financial win right there. You can contribute up to the annual contribution limit ($6,500 in 2023, $7,500 if you’re 50 or older) on a post-tax basis. But trust me, it’ll be worth it when you don’t have to hand over a chunk of your hard-earned cash to the government later on.

Traditional IRAs and 401(k)s

These are other popular retirement savings options. You likely already know about these. With Traditional IRAs, you can deduct your contributions from your taxable income now, which can mean a lower tax bill right away. But when you retire and withdraw that money, it will be taxed as income. As for 401(k)s, they’re employer-sponsored retirement plans that let you contribute pre-tax dollars. That’s always a nice perk.

Annuities

An annuity is a contract with an insurance company that provides you with a steady stream of income during retirement. It’s like a pension, but you’re buying it with your money instead of getting it from an employer. Annuities can be a good way to guarantee yourself a retirement income, but they’re less flexible than some other options.

Life Insurance

Life insurance isn’t just about protecting your family financially if you die young. Certain types of life insurance policies can also be used as retirement savings vehicles. Some policies let you borrow against their cash value, and you won’t have to pay taxes on the loan. If that’s not your jam, you can also withdraw money from the policy’s cash value, but you’ll have to pay income tax on the withdrawal.

Real Estate

Real estate can be an excellent investment, and it can also be a way to save for retirement. One common approach is to buy a rental property. The rent you collect can help cover your mortgage payments and build equity. When you retire, you can sell the property and use the proceeds to fund your retirement.

No responses yet