.

What is a Cryptocurrency Wallet?

Imagine cryptocurrency wallets as the digital equivalent of your physical wallets, only they’re designed to store, send, and receive virtual currencies instead of cash. These wallets are essentially software programs that interact with the blockchain, the underlying technology that powers cryptocurrencies like Bitcoin and Ethereum. Just as you would keep your money safe in a physical wallet, cryptocurrency wallets protect your digital assets.

Think of cryptocurrency wallets as your personal vaults in the vast digital realm of cryptocurrencies. They provide a secure way to store your digital coins, allowing you to manage your crypto portfolio with ease. Whether you’re a seasoned crypto enthusiast or a novice just starting to explore this exciting world, understanding cryptocurrency wallets is crucial for navigating the realm of digital currencies.

Cryptocurrency wallets come in various forms, each with its own unique set of features and security measures. Some wallets are software programs that you can install on your computer or mobile device, while others are online services that you can access through a web browser. The choice of wallet depends on your individual needs and preferences.

Cryptocurrency Wallets: A Comprehensive Guide to Storing Your Digital Assets

In the realm of digital currency, where anonymity and accessibility reign supreme, cryptocurrency wallets serve as the gatekeepers to your precious digital holdings. Just like a physical wallet safeguards your cash and cards, these virtual counterparts protect your cryptocurrencies from theft or loss. But unlike traditional wallets, cryptocurrency wallets come in two distinct flavors: hot wallets and cold wallets.

Types of Cryptocurrency Wallets

Hot Wallets: The Always-On Gatekeepers

Hot wallets, as the name suggests, are software applications or web-based services that remain constantly connected to the internet. This connection grants you the convenience of sending, receiving, and trading cryptocurrencies with ease. However, this constant connectivity comes at a price. Because hot wallets are always online, they are more susceptible to hacking and cyberattacks.

Hot wallets typically take the form of mobile apps or browser extensions. Their user-friendly interfaces make them ideal for beginners who prioritize accessibility. Examples of popular hot wallets include MetaMask, Coinbase Wallet, and Exodus.

Cold Wallets: The Offline Fortresses

On the other hand, cold wallets prioritize security above all else. Cold wallets are physical devices that store your cryptocurrencies offline, completely disconnected from the internet. This offline nature makes them virtually impervious to hacking attacks. Cold wallets are typically more expensive than hot wallets, but they offer peace of mind for those who value the utmost security for their digital assets.

Popular cold wallet options include hardware wallets, which resemble USB drives, and paper wallets, which provide a physical record of your private keys. Hardware wallets like Trezor and Ledger Nano X are known for their advanced security features, while paper wallets are a cost-effective solution for long-term storage.

What Is a Cryptocurrency Wallet?

In the realm of cryptocurrencies, a digital wallet is like a safe deposit box for your virtual assets. It stores the private keys that grant you access to and control over your cryptocurrencies, much like a traditional wallet holds your physical cash. To cut a long story short, a cryptocurrency wallet is your gateway to sending, receiving, and managing your digital currency.

Overview of Cryptocurrency Wallets

Like traditional wallets come in various forms, cryptocurrency wallets also exist in different types. Broadly, we can categorize them into two main groups: hot wallets and cold wallets. Let’s delve into the details of each type to help you make an informed decision about which one suits your needs best.

Hot Wallets

Hot wallets get their name from their online nature. These wallets are accessible from any device with an internet connection, making them highly convenient for daily transactions and quick access to your crypto funds. However, this convenience comes at a potential cost – hot wallets are generally considered less secure than cold wallets due to their online presence, which makes them vulnerable to hacking and online threats.

Advantages of Hot Wallets

-

Ubiquitous Accessibility: Hot wallets shine when it comes to convenience, allowing you to access your crypto from any internet-connected device. No need to carry around physical wallets or worry about losing them.

-

Expeditious Transactions: Hot wallets enable swift and seamless transactions. Whether you’re buying a cup of coffee or sending funds to a friend, hot wallets make it a breeze.

-

Integration with Exchanges: Many hot wallets integrate seamlessly with cryptocurrency exchanges, providing a one-stop shop for trading, storing, and managing your digital assets.

-

Beginner-Friendly: Hot wallets are often designed with user-friendliness in mind, making them a great choice for those new to the world of cryptocurrencies.

Disadvantages of Hot Wallets

-

Security Concerns: As mentioned earlier, hot wallets are susceptible to online threats such as hacking and phishing attacks, which can compromise your funds.

-

Lack of Control: With hot wallets, you often rely on third-party providers to safeguard your private keys. This means you don’t have complete control over your funds, unlike with cold wallets.

-

Vulnerability to Malware: Hot wallets can be vulnerable to malware infections, which can potentially steal your private keys and drain your crypto assets.

-

Limited Storage Capacity: Some hot wallets may have limitations on the amount of cryptocurrency you can store, which can be a hindrance for those with substantial holdings.

What is a Cryptocurrency Wallet and How Does it Work?

In the ever-evolving realm of cryptocurrency, storing your digital assets securely is of utmost importance. Enter cryptocurrency wallets, the gatekeepers of your virtual wealth. Picture a digital vault, safeguarding your precious crypto coins from the clutches of cyber threats. These wallets come in various forms, each with its unique set of features and security measures, empowering you to choose the one that best aligns with your needs.

The Hot and Cold of Cryptocurrency Wallets

Cryptocurrency wallets can be broadly categorized into two primary types: hot wallets and cold wallets. Hot wallets, like nimble acrobats, connect to the internet, granting you swift access to your funds. They’re convenient and readily accessible, akin to keeping your cash in a wallet you carry with you daily. However, with great convenience comes potential risk, as hot wallets are more susceptible to hacking attempts due to their online presence.

On the other hand, cold wallets are the epitome of security, resembling impenetrable fortresses guarding your crypto treasures. Stored offline, they remain disconnected from the internet’s treacherous waters, effectively shielding your assets from malicious actors. It’s like tucking your money away in a safe deposit box – secure but not as readily accessible as a hot wallet.

Cold Wallets: Unwavering Guardians of Your Crypto

Cold wallets come in a variety of forms, each offering a unique blend of security and user experience. Hardware wallets, akin to miniature computers, provide unmatched protection by storing your private keys offline. They act as a physical barrier between your crypto and potential threats, much like a stalwart knight safeguarding a castle.

Paper wallets, on the other hand, are like the crypto equivalent of ancient scrolls. They consist of a piece of paper containing your public and private keys, which you can store in a secure location, far from prying eyes. It’s a simple and cost-effective solution, but it requires meticulous care to avoid losing or damaging the paper – a delicate dance akin to preserving a precious artifact.

Multi-signature wallets, the epitome of teamwork, require multiple parties to authorize transactions, enhancing security by distributing the power. Picture a group of trusted individuals, each holding a piece of the puzzle, ensuring that no single entity can compromise your funds.

Deterministic wallets, like meticulous accountants, generate a unique set of keys for each transaction, adding an extra layer of protection. It’s like using a brand-new key every time you open a door, significantly reducing the risk of unauthorized access.

Finally, hierarchical deterministic wallets, the masterminds of key management, employ a sophisticated algorithm to generate a hierarchy of keys, providing robust security and ease of use. Think of it as a complex symphony of keys, each playing a specific role in safeguarding your crypto assets.

Cryptocurrency Wallet: A Guide to Securely Stashing Your Digital Assets

In the digital realm of cryptocurrencies, a wallet is your gateway to storing, sending, and receiving your precious digital coins. Just like a physical wallet holds your hard-earned cash, a cryptocurrency wallet safeguards your virtual wealth. But with the sheer number of wallets out there, finding the right one can feel like navigating a crypto maze. Here’s a comprehensive guide to help you choose the perfect digital vault for your cryptocurrency fortune:

Choosing a Cryptocurrency Wallet

Security is paramount when it comes to cryptocurrency wallets. After all, you don’t want your digital treasures falling into the wrong hands. Look for wallets that employ robust encryption, two-factor authentication, and other advanced security measures to keep your assets safe and sound.

Ease of Use

Navigating a cryptocurrency wallet shouldn’t be a rocket science expedition. Choose a wallet that offers an intuitive user interface, clear instructions, and a seamless experience. It should be easy to set up, manage, and conduct transactions without any unnecessary headaches.

Supported Currencies

Not all wallets support the same cryptocurrencies. If you’re a bitcoin enthusiast or a fan of altcoins, make sure the wallet you choose supports the currencies you’re interested in. Check the list of supported coins before committing to a specific wallet.

Security Features

Security is the cornerstone of any good cryptocurrency wallet. Here are a few key features to look for:

- Encryption: Encryption ensures that your private keys and other sensitive data are kept confidential, even if the wallet is compromised.

- Two-factor authentication (2FA): 2FA adds an extra layer of security by requiring a second form of authentication, such as a code sent to your phone, when you log in or make a transaction.

- Multi-signature: Multi-signature wallets require multiple private keys to authorize a transaction, making them more secure than wallets that rely on a single key.

- Hardware wallets: Hardware wallets are physical devices that store your private keys offline, making them virtually immune to hacking.

Types of Cryptocurrency Wallets

There are different types of cryptocurrency wallets, each with its own advantages and disadvantages:

-

Software wallets: Software wallets are installed on your computer or mobile device.

-

Hardware wallets: Hardware wallets are physical devices that store your private keys offline.

-

Paper wallets: Paper wallets are simply pieces of paper that contain your public and private keys.

-

Web wallets: Web wallets are hosted online by a third party.

Cryptocurrency Wallets: A Comprehensive Guide for Navigating the Cryptoverse

In today’s digital age, where cryptocurrencies like Bitcoin and Ethereum have become mainstream, the need for secure and reliable cryptocurrency wallets is paramount. Just like your physical wallet holds your cash and cards, a cryptocurrency wallet serves as a digital vault for your virtual assets.

What is a Cryptocurrency Wallet?

A cryptocurrency wallet, in essence, is a software program that stores the public and private keys necessary to access and manage your cryptocurrencies. Think of it as a digital vault where you keep your precious digital coins safe and secure.

Using a Cryptocurrency Wallet

To use a cryptocurrency wallet, you’ll first need to create an account with a reputable provider. Once your account is set up, you’ll generate a unique wallet address, which is similar to your bank account number. This address will be used to send and receive cryptocurrencies.

Types of Cryptocurrency Wallets

There are different types of cryptocurrency wallets available, each with its own advantages and disadvantages. Here’s a brief overview:

- Hardware wallets: These are physical devices that store your private keys offline, providing an extra layer of security.

- Software wallets: These are software applications that you can install on your computer or mobile device. They offer convenience and accessibility but may be more vulnerable to hacking.

- Paper wallets: These are physical documents that contain your public and private keys. While they offer the highest level of security, they can be easily lost or damaged.

Cryptocurrency Wallets and Their Security Features

The security of your cryptocurrency wallet is paramount. Here are some key features to look for:

- Two-factor authentication (2FA): This adds an extra layer of security by requiring you to enter a code from your phone or email when logging in.

- Encryption: Your wallet should encrypt your private keys using strong algorithms to prevent unauthorized access.

- Multi-signature support: This feature requires multiple signatures to authorize transactions, making it even more secure.

- Regular software updates: Stay on top of software updates to patch any potential vulnerabilities.

- Reputable provider: Only use wallets from reputable companies with a proven track record.

Choosing the Right Cryptocurrency Wallet for You

Selecting the right cryptocurrency wallet depends on your individual needs and preferences.

- Security: If security is your utmost priority, consider a hardware wallet or a paper wallet.

- Convenience: Software wallets offer convenience and ease of use, making them suitable for everyday transactions.

- Storage capacity: Determine how many different cryptocurrencies and tokens you plan to store.

- Accessibility: Choose a wallet that’s accessible on the devices you regularly use.

- Reputation: Do your research and read reviews to find a wallet with a strong reputation for security and customer support.

Remember, the cryptocurrency wallet you choose is the gateway to your digital assets. Take the time to compare different options and make an informed decision.

Cryptocurrency Wallet: A Comprehensive Guide to Securing Your Digital Assets

In the realm of digital currencies, cryptocurrency wallets serve as the gatekeepers to your digital wealth. These virtual vaults offer a secure haven for your hard-earned crypto assets, shielding them from prying eyes and malicious intent.

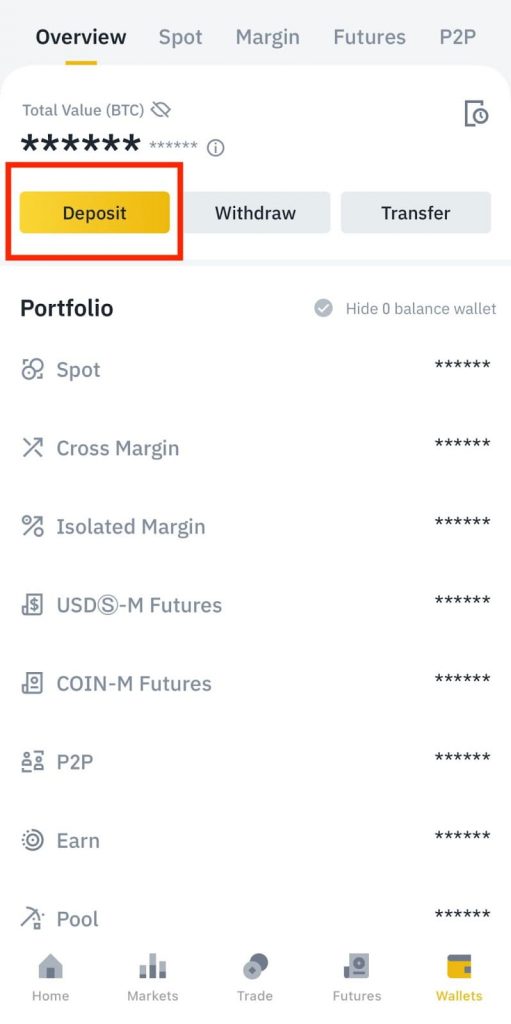

Storing Cryptocurrency in a Wallet

Once you’ve created your digital wallet, the next step is to deposit your cryptocurrency into it. This process is similar to sending funds to a traditional bank account. Simply locate your wallet address, which is a unique string of characters associated with your account, and send the desired amount of cryptocurrency to that address.

Types of Cryptocurrency Wallets

There are various types of cryptocurrency wallets available, each with its own set of features and security measures. Hardware wallets, like Ledger and Trezor, are renowned for their offline storage, providing an extra layer of protection against cyber threats.

Choosing the Right Wallet for You

Finding the perfect cryptocurrency wallet depends on your individual needs and preferences. Consider factors such as the types of cryptocurrencies you hold, the level of security you require, and the convenience you desire.

Essential Security Tips

Protecting your cryptocurrency wallet is paramount. Employ strong, unique passwords, enable two-factor authentication, and regularly update your wallet software. Moreover, be vigilant against phishing scams and never share your private keys or seed phrase with anyone.

Common Misconceptions

Many misconceptions surround cryptocurrency wallets. Some believe that leaving crypto assets on exchanges is safe, but this exposes you to potential platform vulnerabilities. Others think that all wallets are the same, but there are significant differences in security and functionality.

The Importance of Education

Educating yourself about cryptocurrency wallets is crucial for protecting your digital assets. Learn about the different types of wallets, best practices for storing crypto, and common security risks. With knowledge as your shield, you can navigate the world of cryptocurrency with confidence.

Conclusion

Cryptocurrency wallets are essential tools for securing and managing your digital wealth. By understanding the different types and choosing the right one for your needs, you can rest assured that your assets are safe from harm. Remember, knowledge is power, so continue to educate yourself and stay vigilant in protecting your cryptocurrency investments.

The Essential Guide to Cryptocurrency Wallets

In the realm of digital currency, a cryptocurrency wallet reigns supreme as a digital vault safeguarding your precious crypto assets. These wallets, much like their physical counterparts, are indispensable tools for managing, sending, and receiving cryptocurrencies. With a plethora of options available, choosing the right wallet can be as daunting as navigating a labyrinth. This comprehensive guide will demystify the world of cryptocurrency wallets, providing you with an in-depth understanding of their workings and empowering you to make an informed choice.

Sending and Receiving Cryptocurrency

Transferring cryptocurrency is as simple as sending a text message (minus the LOLs and emojis!). To dispatch your crypto, simply input the recipient’s wallet address and specify the amount you wish to send. Conversely, receiving cryptocurrency follows a similar process: just share your wallet address with the generous benefactor. It’s like playing a game of digital hot potato, except instead of a potato, you’re juggling precious digital coins.

Types of Cryptocurrency Wallets

Cryptocurrency wallets come in a kaleidoscope of types, each catering to specific needs. Software wallets, akin to apps on your phone, reside on your computer or mobile device, offering convenience at your fingertips. Hardware wallets, on the other hand, are physical devices that safeguard your crypto offline, akin to a miniaturized Fort Knox for your digital fortune.

Security Considerations

The world of cryptocurrency is not immune to the perils that lurk in the digital realm. To safeguard your hard-earned crypto, vigilance is paramount. Strong passwords, two-factor authentication, and a healthy dose of skepticism are your essential weapons in this digital battleground.

Choosing the Right Cryptocurrency Wallet

Selecting the ideal cryptocurrency wallet is akin to choosing a trusty steed – it must align with your unique needs and preferences. Consider your usage habits, the types of cryptocurrencies you hold, and the level of security you seek. Each wallet offers its own set of features and quirks, so explore your options with the care of a seasoned treasure hunter.

Popular Cryptocurrency Wallets

In the vast crypto-wallet universe, certain names shine brighter than others. MetaMask, with its user-friendliness and integration with popular browsers, is a top choice. Trust Wallet boasts a robust suite of features, catering to both beginners and seasoned crypto enthusiasts. Trezor and Ledger are renowned hardware wallets, offering unparalleled security for those who treasure their digital wealth.

Cryptocurrency Wallets: The Guardians of Your Digital Assets

In the rapidly evolving realm of cryptocurrency, safeguarding your valuable digital assets is paramount. Enter the cryptocurrency wallet, a virtual stronghold tasked with protecting your coins and tokens from prying eyes. Just as you wouldn’t trust a poorly secured physical wallet with your cash, choosing the right cryptocurrency wallet is crucial for keeping your investments safe.

Defining Cryptocurrency Wallets

A cryptocurrency wallet is essentially a software application or hardware device that stores your private and public keys. These keys are digital signatures that allow you to interact with the blockchain, the decentralized ledger that underlies cryptocurrencies like Bitcoin. Your public key acts as your account number, while your private key unlocks your funds and enables transactions.

Hot Wallets vs. Cold Wallets: A Tale of Security

When choosing a cryptocurrency wallet, you’ll encounter two main types: hot wallets and cold wallets. Hot wallets are software-based and connected to the internet, providing easy access to your funds. However, this convenience comes at a cost – hot wallets are more susceptible to hacking and theft.

Cold wallets, on the other hand, are physical devices that store your private keys offline. They are not connected to the internet, making them significantly more secure but also less convenient to use.

Choosing the Right Wallet for Your Needs

The best cryptocurrency wallet for you depends on your individual needs and preferences. If you value convenience and plan to frequently trade cryptocurrencies, a hot wallet may be suitable. However, if you’re storing large amounts of coins and security is paramount, a cold wallet is a safer option.

Security Considerations for Cryptocurrency Wallets

"Protecting your cryptocurrency wallet is like guarding the crown jewels," says expert cryptographer Dr. Emily Carter. "It’s essential to implement robust security measures to keep your investments safe."

- Strong Passwords: Create complex passwords that include a mix of uppercase, lowercase, numbers, and symbols. Avoid reusing passwords across multiple platforms.

- Two-Factor Authentication (2FA): Enable 2FA to require an additional verification code when logging in to your wallet or making transactions. This adds an extra layer of protection against unauthorized access.

- Safeguarding Seed Phrases: Keep your wallet’s seed phrase (a backup of your private keys) secret and secure. Do not store it digitally or share it with anyone.

- Avoid Public Wi-Fi: Public Wi-Fi networks can be insecure, making them a playground for hackers. Only access your cryptocurrency wallet on secure and trusted networks.

- Keep Software Up-to-Date: Regularly update your wallet software and operating system to patch security vulnerabilities.

- Beware of Phishing Scams: Phishing emails and websites can trick you into revealing your private keys. Be cautious of suspicious links and emails, and always verify the authenticity of a website before entering your credentials.

- Monitor Unusual Activity: Keep an eye on your wallet transactions and contact your wallet provider immediately if you notice any suspicious activity.

- Consider Hardware Wallets: For maximum security, consider using a hardware wallet that stores your private keys offline. This provides a physical barrier against online attacks.

- Multi-Signature Wallets: Multi-signature wallets require multiple signatures to authorize transactions, providing an extra layer of protection against unauthorized access.

No responses yet