Life Insurance Policy Retirement Plan: A Comprehensive Guide

Are you looking for a way to supplement your retirement savings and provide for your family’s future? If so, a life insurance policy retirement plan may be the right choice for you. This type of plan uses a life insurance policy to build cash value that can be used to fund your retirement. Retirement is a serious concern for many Americans, and for good reason: The average American has less than $20,000 saved for retirement. For many, Social Security benefits won’t be enough to cover their living expenses in retirement, so it’s important to start saving now. Insureds in good health can use life insurance policies as a retirement plan. These policies offer many benefits, such as tax-free growth and death benefits for your beneficiaries.

What is a Life Insurance Policy Retirement Plan?

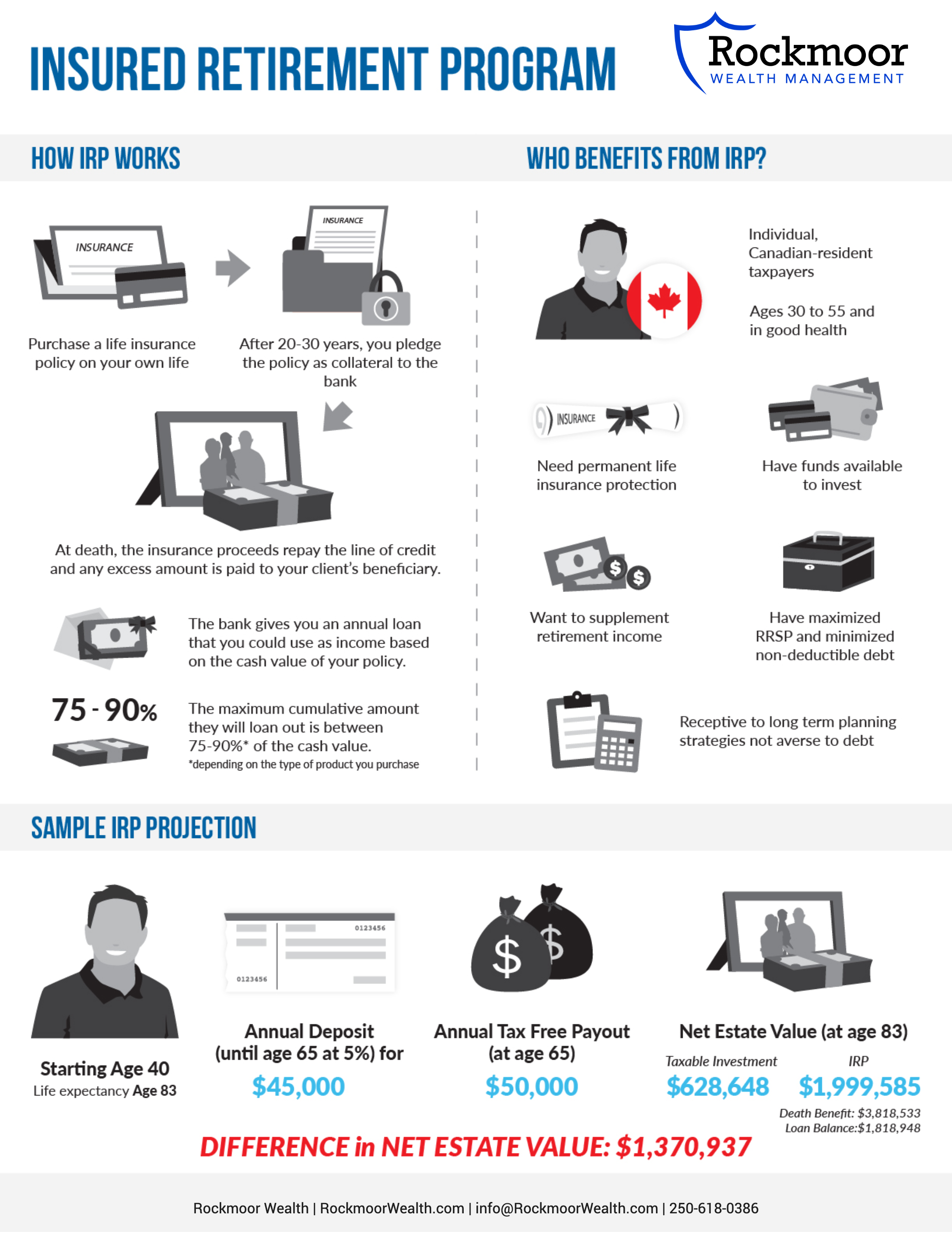

A life insurance policy retirement plan is a financial planning strategy that involves using a life insurance policy to build cash value that can be used to supplement your retirement income. The policy is typically a whole life or universal life policy, which means that the cash value grows tax-deferred. As the cash value grows, you can borrow against it or withdraw it tax-free to help pay for retirement expenses. Here’s how the plan works:

- You purchase a whole life or universal life insurance policy with a high cash value component.

- You pay premiums into the policy each year.

- The cash value of the policy grows tax-deferred.

- You can borrow against or withdraw the cash value tax-free to help pay for retirement expenses.

- Upon your death, the death benefit is paid out to your beneficiaries.

Benefits of a Life Insurance Policy Retirement Plan

There are several benefits to using a life insurance policy as a retirement planning tool. These benefits include:

- Tax-deferred growth: The cash value of a life insurance policy grows tax-deferred, which means that you don’t have to pay taxes on the earnings until you withdraw them.

- Tax-free withdrawals: You can withdraw the cash value of a life insurance policy tax-free to help pay for retirement expenses.

- Death benefit: Upon your death, the death benefit of the policy is paid out to your beneficiaries.

- Flexibility: You can borrow against or withdraw the cash value of a life insurance policy at any time, without having to surrender the policy.

Considerations for a Life Insurance Policy Retirement Plan

There are also some considerations to keep in mind if you are considering using a life insurance policy as a retirement planning tool. These considerations include:

- Cost: Life insurance policies can be expensive, so it is important to factor in the cost of the premiums when making your decision.

- Complexity: Life insurance policies can be complex, so it is important to work with an insurance agent who can help you understand the policy and make sure it is right for you.

- Opportunity cost: If you use a life insurance policy to fund your retirement, you will be giving up the opportunity to invest in other retirement savings vehicles, such as stocks or bonds.

Is a Life Insurance Policy Retirement Plan Right for You?

Whether or not a life insurance policy retirement plan is right for you depends on your individual circumstances. If you are in good health and have a long life expectancy, you may be able to save a significant amount of money by using a life insurance policy as a retirement planning tool. However, if you are in poor health or have a short life expectancy, you may not be able to save as much money with this type of plan. Ultimately, the decision of whether or not to use a life insurance policy as a retirement planning tool is a personal one.

**Life Insurance Policy Retirement Plan: A Retirement Savings Strategy with a Safety Net**

Retirement planning can be a daunting task, but it’s crucial for ensuring a secure financial future. One often overlooked option is a life insurance policy retirement plan. This strategy combines the benefits of life insurance with the potential for tax-advantaged growth and supplemental income.

Benefits of Using Life Insurance for Retirement

**Tax-Advantaged Growth:**

Life insurance policies offer tax advantages that can enhance the growth of your retirement savings. Premiums paid into a cash-value policy accumulate on a tax-deferred basis. This means that you won’t pay taxes on the earnings until you withdraw them, allowing your savings to compound faster.

**Death Benefit Protection:**

In addition to providing a tax-advantaged savings vehicle, life insurance offers peace of mind by protecting your loved ones financially in the event of your death. The death benefit provides a lump sum to your beneficiaries, helping to cover final expenses, pay off debts, or maintain your family’s standard of living.

**Potential for Supplemental Income:**

Depending on the type of life insurance policy you choose, you may have the option to access your savings before retirement. Through policy loans or withdrawals, you can tap into a portion of your cash value to supplement your retirement income or cover unexpected expenses.

**Life Insurance Policy Retirement Plan: A Guide to Securing Your Financial Future**

Planning for retirement can be a daunting task, but it’s one of the most important steps you can take for yourself and your family. One way to ensure your financial security in those golden years is by incorporating a life insurance policy into your retirement plan.

**Choosing the Right Life Insurance Policy**

Selecting the right life insurance policy for your retirement is crucial. Here are some key factors to consider:

* **Coverage Amount:** Determine the amount of coverage you need to cover expenses such as funeral costs, outstanding debts, and income replacement. Consider your age, health, family responsibilities, and retirement savings goals.

* **Premium Payments:** Decide how much you can afford to pay for premiums on a regular basis. Premiums typically vary based on your age, health, and coverage amount.

* **Policy Duration:** Choose a policy that aligns with your retirement timeframe. Whole life insurance policies provide lifelong coverage, while term life insurance policies cover you for a specific period.

* **Riders:** Consider adding riders to your policy for additional coverage, such as a rider for terminal illness or disability. These can provide peace of mind and protect you against unexpected events.

* **Tax Implications:** Life insurance policies offer certain tax advantages. For instance, the cash value component of a whole life policy can grow tax-deferred, and the death benefit is generally tax-free to your beneficiaries.

**Benefits of a Life Insurance Policy Retirement Plan**

Integrating a life insurance policy into your retirement plan offers numerous benefits:

* **Financial Security for Beneficiaries:** The death benefit can provide financial support to your loved ones in the event of your passing.

* **Tax-Advantageous Savings:** Permanent life insurance policies offer tax-deferred growth on the cash value component.

* **Loan Options:** Some policies allow you to borrow against the cash value, providing access to funds during retirement.

* **Long-Term Care Coverage:** Certain riders can cover long-term care expenses if you become incapacitated.

* **Peace of Mind:** Knowing that your family will be financially protected in the future can give you peace of mind and allow you to enjoy your retirement years.

In conclusion, a life insurance policy retirement plan can be a valuable tool for securing your financial future. By carefully considering the factors discussed above, you can choose a policy that meets your specific needs and goals. Remember, planning for retirement is an ongoing process, and your life insurance policy should be reviewed and adjusted as your circumstances change.

**Life Insurance Policy Retirement Plan: A Comprehensive Guide**

Life insurance isn’t just about providing financial protection for your loved ones. It can also be a valuable tool for retirement planning. A life insurance policy retirement plan—or policyholder cash value loans—allows you to borrow against the cash value of your policy, tax-free, to supplement your retirement income. But, like any financial strategy, it has its own set of considerations, especially when it comes to taxes.

## Tax Considerations

The tax treatment of life insurance policies for retirement purposes is complex. Here’s a breakdown of the key tax implications to keep in mind:

**Tax-Free Growth of Cash Value:** The cash value of your life insurance policy grows tax-free. This means that any earnings on your investments within the policy are not subject to income tax. This is a major advantage of using life insurance for retirement savings.

**Tax-Free Loans:** You can borrow against the cash value of your policy without paying any income tax on the loan amount. This can be an excellent source of tax-free retirement income. However, it’s important to note that if you do not repay the loan, it will reduce the death benefit of your policy.

**Potential Income Tax Liability on Withdrawals:** If you withdraw money from your policy, it may be subject to income tax. This is because withdrawals are considered income. The amount of tax you pay will depend on your tax bracket. This can be a significant consideration when planning your retirement income strategy.

**Estate Tax:** Life insurance proceeds are generally not subject to estate tax. This means that your beneficiaries will receive the death benefit tax-free. However, if you have borrowed against the cash value of your policy, the amount of the loan may be subject to estate tax. This is something to consider when planning your estate.

**Impact on Social Security Benefits:** If you take out policyholder cash value loans, they could reduce your Social Security retirement or disability benefits. The Social Security Administration considers policyholder cash value loans as income, which can affect the amount of benefits you receive.

Before using life insurance as part of your retirement plan, it’s crucial to consult with a financial advisor and tax professional. They can help you understand all the tax implications and determine if this strategy is right for you.

**Life Insurance Policy Retirement Plan: A Comprehensive Guide**

Are you searching for strategies to enhance your retirement income? A life insurance policy retirement plan could be an intriguing choice. This innovative approach leverages the benefits of both life insurance coverage and retirement savings. However, before making a decision, it’s essential to explore alternative retirement planning options to ensure you make the best choice for your situation.

**How Does a Life Insurance Policy Retirement Plan Work?**

A life insurance policy retirement plan involves using the death benefit of a life insurance policy as a source of retirement income. Here’s how it works:

1. **Purchase a life insurance policy:** Choose a policy with a death benefit that aligns with your retirement savings goals.

2. **Designate a beneficiary:** Typically, your spouse or other loved ones would receive the death benefit upon your passing.

3. **Use the policy’s cash value:** Over time, the policy accumulates cash value that can be withdrawn or borrowed against for retirement purposes.

**Benefits of a Life Insurance Policy Retirement Plan**

* **Death benefit protection:** Provides financial security for your family in case of your untimely demise.

* **Tax-deferred growth:** The cash value grows tax-deferred, which can significantly boost your retirement savings.

* **Potential to supplement retirement income:** The death benefit and cash value can be used to supplement your retirement savings.

* **Flexibility:** You can withdraw or borrow against the cash value as needed, offering flexibility in retirement planning.

**Considerations and Drawbacks**

* **Premiums:** Life insurance policies require ongoing premium payments, which may impact your budget.

* **Surrender fees:** Withdrawals or loans may incur surrender fees, reducing the policy’s value.

* **Policy limitations:** The death benefit and cash value are determined at the time of policy purchase and may not meet future retirement needs.

* **Investment risk:** The cash value is subject to market fluctuations, which could potentially impact its value.

Alternatives to Life Insurance for Retirement

In addition to life insurance policies, several other retirement planning options are available, including:

**Annuities**

Annuities provide a guaranteed stream of income for a set period or the rest of your life. They offer stability but have limited flexibility and can be complex to understand.

**IRAs (Individual Retirement Accounts)**

IRAs allow for tax-advantaged retirement savings through contributions and tax-deferred growth. However, they have contribution limits and may incur penalties for early withdrawals.

**401(k)s (Employer-Sponsored Retirement Plans)**

401(k)s offer tax-advantaged savings through employer contributions and allow for higher contribution limits than IRAs. They typically have investment options but may have employer restrictions.

**Personal Savings**

Traditional savings accounts, such as high-yield savings accounts or certificates of deposit, offer modest returns but provide a conservative option for retirement planning.

**Real Estate**

Investing in real estate can generate rental income and potentially appreciate in value over time. However, it involves ongoing expenses and can be illiquid.

**When to Consider a Life Insurance Policy Retirement Plan**

A life insurance policy retirement plan may be an appropriate choice if:

* You want additional death benefit protection for your family.

* You prioritize tax-deferred growth for retirement savings.

* You desire flexibility in accessing your retirement funds.

**Conclusion**

Retirement planning is crucial for financial security in your golden years. A life insurance policy retirement plan can provide a valuable combination of death benefit protection and retirement savings growth. However, it’s essential to carefully consider your individual circumstances and explore alternative retirement planning options to make an informed decision that suits your unique needs.

Life Insurance Policy Retirement Plan

Retirement planning often involves juggling multiple financial instruments to ensure financial security in later years. One such instrument that deserves consideration is a life insurance policy. While primarily designed to provide financial protection for loved ones in the event of the policyholder’s demise, life insurance can also play a strategic role in retirement planning.

Policy Types and Options

When exploring life insurance for retirement, there are two main policy types to consider: term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. Permanent life insurance, on the other hand, offers lifelong coverage and includes a cash value component that grows over time.

Cash Value Accumulation

The cash value component of permanent life insurance policies accumulates on a tax-deferred basis. This means that policyholders can withdraw or borrow against the cash value without incurring immediate income taxes. This feature can be particularly valuable during retirement when tax-efficient income sources are crucial.

Death Benefit and Estate Planning

The death benefit of a life insurance policy provides a lump sum payment to designated beneficiaries upon the policyholder’s death. This can help cover expenses such as funeral costs, outstanding debts, or estate taxes. Additionally, life insurance can be used as a tool for estate planning, ensuring that assets are distributed according to the policyholder’s wishes.

Tax Implications

The tax implications of life insurance policies vary depending on the policy type and how the policy is used. In general, the death benefit is tax-free to beneficiaries. However, withdrawals from the cash value component of permanent life insurance policies may be subject to income tax.

Considerations for Retirement Planning

When considering life insurance as a retirement planning tool, several factors should be taken into account. These include the policyholder’s age, health, and financial goals. Additionally, it’s important to carefully review the policy details, including the premiums, coverage amounts, and cash value growth potential.

Conclusion

While life insurance is not a traditional retirement savings vehicle, it can serve as a valuable adjunct to a comprehensive financial plan. By carefully evaluating the policy types, cash value accumulation potential, tax implications, and other considerations, individuals can determine whether a life insurance policy aligns with their retirement goals. It’s always advisable to consult with a qualified financial professional to explore the options and make informed decisions.

No responses yet