**401(k) Retirement Plan Calculator: Your Roadmap to Financial Security**

Introduction

Retirement planning can be daunting, but it doesn’t have to be. A 401(k) retirement plan calculator is an invaluable tool that can provide you with a clear picture of your financial future. With just a few clicks, you can get an estimate of how much money you can save for retirement based on your current income, contributions, and investment returns. Let us take a deep dive into the world of 401(k) retirement plan calculators and explore how they can empower you to achieve your retirement goals.

Demystifying the 401(k) Retirement Plan Calculator

A 401(k) retirement plan calculator is a mathematical model that uses a set of assumptions to estimate your future retirement savings. These assumptions include:

- Your current age and income

- Your expected retirement age

- Your estimated annual contributions

- Your projected rate of return on investments

The calculator uses these inputs to generate a series of possible outcomes. It shows you how much money you could accumulate in your 401(k) at different contribution levels and investment returns. This information can help you make informed decisions about your retirement savings strategy.

The Benefits of Using a 401(k) Retirement Plan Calculator

Using a 401(k) retirement plan calculator offers several significant benefits:

- Gain clarity about your retirement goals: The calculator provides you with a realistic estimate of how much money you can save for retirement. This knowledge empowers you to set realistic goals and make informed decisions.

- Test different scenarios: The calculator allows you to experiment with different variables such as retirement age, contribution amounts, and investment strategies. This flexibility helps you find the optimal combination to meet your individual needs.

- Identify potential shortfalls: If the calculator’s projections indicate that you may fall short of your retirement goals, it can serve as a wake-up call. You can then adjust your savings strategy to increase your contributions or explore alternative investment options.

- Motivate you to save more: Seeing the potential growth of your retirement savings can be a powerful motivator to save more money today. The calculator can help you visualize the long-term benefits of saving and encourage you to make the necessary sacrifices.

How to Use a 401(k) Retirement Plan Calculator

Using a 401(k) retirement plan calculator is straightforward. Simply follow these steps:

- Gather your financial information, including your income, current savings, and retirement goals.

- Visit a reputable website that offers a 401(k) retirement plan calculator. Fidelity, Vanguard, and T. Rowe Price are some popular options.

- Enter your information into the calculator and adjust the settings to reflect your specific situation and preferences.

- Review the results and make adjustments as needed until you find a solution that meets your goals.

Conclusion

A 401(k) retirement plan calculator is a powerful tool that can help you navigate the complexities of retirement planning. By providing you with a clear picture of your future financial possibilities, it empowers you to make informed decisions and take control of your retirement destiny. Take advantage of this valuable resource today and set yourself up for a secure and prosperous future.

**401(k) Retirement Plan Calculator: How to Project Your Retirement Savings**

Making sure you’re financially secure in your golden years doesn’t have to be a roll of the dice. With a 401(k) retirement plan calculator, you can get a clear picture of your retirement savings goals and make informed decisions about your contributions. Simply provide the calculator with a few key pieces of information, such as your current age, income, and desired retirement age, and it will spit back an estimate of how much you’ll have saved by the time you’re ready to hang up your hat.

Benefits of Using a 401(k) Calculator

There are several major benefits to using a 401(k) retirement calculator. First, it can help you set realistic savings goals. By inputting different contribution amounts and retirement ages into the calculator, you can see how they impact your projected savings. This can help you avoid setting goals that are too ambitious or too conservative.

Second, a 401(k) calculator can help you make informed decisions about your contributions. The calculator can show you how different contribution amounts will affect your tax liability and your projected savings. This information can help you decide how much to contribute to your 401(k) each year.

Third, a 401(k) calculator can help you track your progress towards your retirement goals. By periodically inputting your current savings and contribution amounts into the calculator, you can see how close you are to reaching your goals. This feedback can help you stay on track and make necessary adjustments to your savings plan.

Finally, a 401(k) calculator can help you reduce the stress and uncertainty associated with retirement planning. By providing you with a clear picture of your projected savings, a 401(k) calculator can give you peace of mind and help you feel more confident about your financial future.

Features of a 401(k) Calculator

Most 401(k) calculators offer a range of features to help you plan for retirement. These features may include:

– The ability to input your current age, income, and desired retirement age

– The ability to input your current 401(k) balance and contribution amounts

– The ability to adjust your contribution amounts and retirement age to see how they impact your projected savings

– The ability to view your projected savings in both nominal and inflation-adjusted dollars

– The ability to save and share your calculations

Unlock Your Retirement Savings Potential with Our 401(k) Calculator

Navigating the complexities of retirement planning can be daunting, but our 401(k) calculator simplifies the process. With just a few clicks, you can estimate your retirement savings and make informed decisions about your financial future.

How to Use a 401(k) Calculator

Maximize your 401(k) savings by following these easy steps: Enter your current age, income, desired retirement age, and expected investment returns. Don’t forget to include your contribution rate, which represents the percentage of your income you wish to contribute. The calculator will churn the numbers and provide a personalized projection of your retirement savings, taking into account the magic of compound interest.

Factors to Consider

Before using a 401(k) calculator, consider these key factors: Your current financial situation, including income, expenses, and debts, plays a pivotal role. Additionally, your risk tolerance and investment horizon should influence your decision-making. Remember that retirement planning is a long-term game, and a calculator can help you stay on track.

Benefits of Using A Retirement Calculator

Beyond providing a snapshot of your future savings, a 401(k) calculator offers valuable insights. It can help you: Visualize your retirement goals, identify potential shortfalls, and make informed adjustments to your savings strategy. By empowering you with knowledge, a calculator ensures that your retirement plan is tailored to your unique circumstances.

Contribution Limits

Stay informed about the annual contribution limits set by the Internal Revenue Service (IRS). These limits are subject to change, so it’s essential to stay up-to-date. The current limit for 2023 is $22,500, with an additional catch-up contribution of $7,500 for individuals aged 50 or older. Maximizing your contributions within these limits can significantly boost your retirement savings.

Investment Options

The investment options offered by your 401(k) plan can vary. Common choices include mutual funds, target-date funds, and company stock. Each option has its own risk and return profile, so it’s important to carefully consider your options and diversify your investments to spread risk. A financial advisor can provide personalized guidance and help you make informed investment decisions.

**401(k) Retirement Plan Calculator: Estimating Your Future Nest Egg**

Planning for retirement can be a daunting task, but a 401(k) calculator makes it easy to estimate how much you’ll save if you keep up your current savings plan. These calculators take into account a range of factors, including contributions, investment returns, and taxes. Let’s get started and see what your retirement savings future might look like.

**Input Your Information**

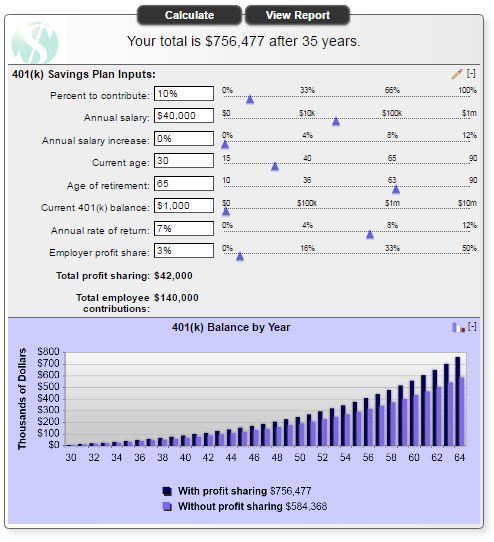

To use a 401(k) calculator, you’ll need to input information about your current savings, investment goals, and expected retirement age. It also considers variables like your current salary, expected annual salary increase, and contribution amounts. After inputting your details, the calculator will crunch the numbers and provide an estimate of your total savings at retirement.

**Interpreting the Results**

The calculator will estimate your total savings at retirement, taking into account factors such as contributions, investment returns, and taxes. The results can help you determine if you’re on track to meet your retirement goals. If you’re not on track, you can adjust your savings or investment strategy accordingly.

**Consider the Assumptions**

The results of a 401(k) calculator are based on the assumptions you input. For example, if you assume a certain rate of investment return but the actual return is lower, your savings may be lower than the calculator estimate. It’s important to consider the assumptions in the calculator and make sure they align with your expectations.

**Other Factors to Consider**

In addition to the factors considered by a 401(k) calculator, there are other things to keep in mind when planning for retirement. These include healthcare costs, taxes, and inflation. By considering all of these factors, you can ensure that you’re prepared for a comfortable retirement.

**Conclusion**

A 401(k) calculator can be a valuable tool for planning your retirement. While the results are based on assumptions and may not be exact, they can help you make informed decisions about your savings. Remember to consider other factors that may affect your retirement and adjust your plan accordingly.

401(k) Retirement Plan Calculator

Planning for retirement can be a daunting task, but it’s one of the most important things you can do to secure your financial future. According to the U.S. Department of Labor, only about half of American workers have access to a retirement plan through their employer. If you’re one of the lucky ones who does, then you should take advantage of this valuable benefit. A 401(k) retirement plan calculator can help you determine how much you need to save for retirement and how much you can expect to have when you retire. These calculators are easy to use and can be found online or through your employer’s human resources department.

How to Use a 401(k) Retirement Plan Calculator

Most 401(k) retirement plan calculators will ask you for the following information:

* Your current age

* Your desired retirement age

* Your current income

* Your expected retirement income

* Your expected rate of return

* Your current 401(k) balance

* The amount you plan to contribute to your 401(k) each year

Once you have entered all of the required information, the calculator will generate a report that will show you how much money you can expect to have in your 401(k) at retirement. The report will also show you how much you need to save each year to reach your retirement goals.

Limitations of 401(k) Retirement Plan Calculators

It’s important to keep in mind that 401(k) retirement plan calculators are only estimates. The actual amount of money you have in your 401(k) at retirement will depend on a number of factors, including the performance of the stock market, your investment choices, and your life expectancy. However, these calculators can be a valuable tool for helping you plan for retirement and make informed decisions about your savings.

Benefits of Using a 401(k) Retirement Plan Calculator

There are several benefits to using a 401(k) retirement plan calculator:

* It can help you determine how much you need to save for retirement. This is important because it can help you avoid running out of money in retirement.

* It can help you make informed decisions about your investments. The calculator can show you how different investment choices will affect your retirement savings.

* It can help you stay on track with your retirement goals. The calculator can help you monitor your progress and make adjustments as needed.

* It can give you peace of mind. Knowing that you are on track for retirement can give you peace of mind and help you sleep better at night.

Conclusion

If you’re not already using a 401(k) retirement plan calculator, then you should start today. These calculators are a valuable tool that can help you plan for your future and secure your financial independence.

No responses yet