401(k) Retirement Plans: A Comprehensive Guide

In the grand scheme of things, retirement may seem like a distant dream. But when it comes to planning for your golden years, there’s no time like the present. And one of the most effective ways to secure your financial future is through a 401(k) retirement plan. Let’s delve into what this tax-advantaged savings vehicle entails and how it can help you achieve a comfortable retirement.

401(k) Retirement Plans: The Basics

A 401(k) plan is an employer-sponsored retirement savings account that allows you to set aside a portion of your pre-tax income for retirement. Instead of paying taxes on this money now, you’ll pay them when you withdraw it during retirement. Additionally, many employers offer matching contributions, essentially doubling the money you squirrel away for the future.

One key benefit of 401(k) plans is their tax advantages. Contributions are deducted from your paycheck before income taxes are calculated, reducing your taxable income in the current year. Plus, any investment earnings grow tax-deferred, meaning you won’t owe taxes on them until you withdraw the money.

However, it’s important to remember that 401(k) plans come with some limitations. Withdrawals made before age 59½ are subject to a 10% early withdrawal penalty in addition to income taxes. Some plans also impose annual contribution limits, so it’s essential to check with your employer about the specific details of your plan.

If you’re looking to save for retirement, a 401(k) plan is an excellent place to start. Not only will it help you save money on taxes now, but it will also allow your investments to grow tax-free, setting you up for a secure financial future.

401(k) Retirement Plans: A Comprehensive Guide

401(k) retirement plans are employer-sponsored investment accounts that allow you to save for retirement on a tax-advantaged basis. They offer several benefits, including significant tax savings, employer matching contributions, and investment flexibility to help you reach your long-term financial goals.

Benefits of 401(k) Plans

401(k) plans provide numerous advantages that can make a significant difference in your retirement savings:

Tax Savings

Contributions to traditional 401(k) plans are made pre-tax, reducing your current taxable income and the amount of tax you owe. This means more money in your pocket now and even more savings for your future. Additionally, investment earnings grow tax-deferred until you withdraw them in retirement, further boosting your nest egg.

Employer Matching Contributions

Many employers offer matching contributions to employee 401(k) plans, which is free money that can significantly enhance your retirement savings. For example, if you contribute $1,000 to your 401(k) and your employer matches 50%, you’ll receive an additional $500 from your employer for free. It’s like finding money on the side of the road!

Investment Flexibility

401(k) plans offer a wide range of investment options, including stocks, bonds, mutual funds, and target-date funds that automatically adjust your investments based on your age and retirement date. This flexibility allows you to customize your portfolio to meet your individual risk tolerance and financial goals. It’s like having a financial Swiss Army knife in your pocket.

**401(k) Retirement Plans: A Comprehensive Guide**

401(k) retirement plans are a popular way to save for retirement. They offer tax advantages and can help you grow your savings over time. If you’re considering a 401(k) plan, here’s everything you need to know.

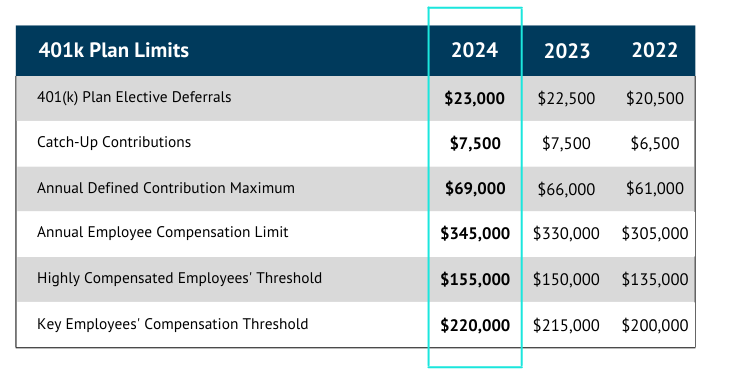

Contribution Limits

The amount you can contribute to a 401(k) plan is limited by the IRS each year. For 2023, the contribution limit is $22,500, with an additional $7,500 catch-up contribution for those age 50 and over. In addition, employers may also make matching contributions to your account, which can further boost your savings.

Employer Matching

Many employers offer matching contributions to their employees’ 401(k) plans. This means that they will contribute a certain amount of money to your account for every dollar you contribute, up to a certain limit. Employer matching contributions are a great way to boost your savings, so it’s important to take advantage of them if your employer offers them.

Vesting

When you contribute to a 401(k) plan, your contributions are not immediately vested. This means that if you leave your job before you are fully vested, you may not be able to take all of your money with you. The vesting schedule for your 401(k) plan will determine how much of your money you are vested in each year. Once you are fully vested, you will be able to take all of your money with you if you leave your job.

Investment Options

401(k) plans typically offer a variety of investment options, such as stocks, bonds, and mutual funds. The investment options available to you will depend on the plan offered by your employer. It’s important to choose investment options that are appropriate for your age, risk tolerance, and investment goals.

Withdrawals

You can start taking withdrawals from your 401(k) plan when you reach age 59½. However, if you withdraw money before age 59½, you may have to pay a 10% early withdrawal penalty. There are some exceptions to the early withdrawal penalty, such as if you are using the money to pay for certain medical expenses or if you are taking a loan from your 401(k) plan.

**401(k) Retirement Plans: A Comprehensive Guide for Savvy Investors**

Planning for retirement can seem like a daunting task, but a 401(k) plan can be a powerful tool to help you secure your financial future. In this article, we’ll delve into the ins and outs of 401(k) retirement plans, providing you with vital information to make informed decisions about your retirement savings.

**Investment Options for Your Future Nest Egg**

Investment Options

Most 401(k) plans provide a wide array of investment options, including stocks, bonds, and mutual funds. This menu of choices allows you to tailor your investments to suit your risk tolerance and retirement goals. If you’re not sure where to start, consider consulting with a financial advisor or reviewing your plan’s online resources.

**Contribution Limits and Tax Breaks**

401(k) plans offer significant tax benefits. Contributions to your account are deducted from your paycheck before taxes, meaning you pay less income tax now. Additionally, any investment earnings grow tax-deferred, which can really make a difference over the long term.

**Contribution Limits**

There are annual limits on how much you can contribute to your 401(k) plan. For 2023, the limit is $22,500 for those under 50 and $30,000 for those 50 and older.

**Employer Matching**

Many employers offer matching contributions to their employees’ 401(k) plans. This is essentially free money! If your employer offers matching funds, be sure to take advantage of them. It’s like getting a raise, but for your retirement savings.

**Vesting and Withdrawals**

Vesting

Vesting refers to the process of earning ownership of your retirement contributions. When you first start contributing to a 401(k) plan, your employer may match your contributions but you won’t necessarily own those matching funds right away. Over time, you’ll gradually vest in your employer’s matching contributions. The vesting schedule varies from plan to plan, so check with your plan administrator for details.

Withdrawals

Withdrawals from your 401(k) account are generally not allowed until you reach age 59½. Early withdrawals may be subject to a 10% penalty tax, in addition to income taxes. However, there are some exceptions to this rule, such as withdrawals for medical expenses or higher education.

**Advice for Optimizing Your Retirement Savings**

Now that you have a better understanding of 401(k) retirement plans, here are a few tips to help you make the most of your savings:

By following these tips, you can harness the power of 401(k) retirement plans to build a secure and comfortable future for yourself and your loved ones.

401(k) Retirement Plans: A Comprehensive Guide

When it comes to retirement planning, 401(k) plans are a popular choice for many Americans. These employer-sponsored retirement savings plans offer tax advantages and potential investment growth, making them a valuable tool for securing your financial future. In this article, we’ll delve into the key aspects of 401(k) plans, including vesting, eligibility, contribution limits, and more.

Eligibility

To participate in a 401(k) plan, you must be a W-2 employee who has worked at the sponsoring company for a certain period of time, typically a year or less. Part-time employees may also be eligible, depending on the plan’s rules. If you’re not yet eligible, talk to your employer to find out when you will be.

Contribution Limits

The amount you can contribute to your 401(k) plan is limited by the Internal Revenue Service (IRS). For 2023, the employee contribution limit is $22,500, and the catch-up contribution limit for those age 50 and older is $7,500. Employers may also choose to make matching contributions, which can significantly boost your retirement savings.

Investment Options

Most 401(k) plans offer a range of investment options, including mutual funds, stocks, bonds, and target-date funds. It’s important to choose investments that align with your risk tolerance and retirement goals. If you’re unsure of what to invest in, consider consulting with a financial advisor.

Vesting

Vesting refers to the ownership of your retirement plan assets. Employers can set vesting schedules that determine when you gain full ownership of your contributions and any employer matching contributions. Vesting periods can range from zero to several years. Once you’re fully vested, you have the right to take your money with you if you leave the company.

Vesting schedules vary widely among employers. Some plans offer immediate vesting, meaning you own your contributions and employer matches from day one. Others have gradual vesting schedules, where you gain ownership of your contributions over time, often based on years of service. For example, you might vest 25% of your employer matching contributions each year, until you reach 100% vesting after four years.

It’s important to understand your plan’s vesting schedule. If you leave the company before you’re fully vested, you may forfeit some or all of your employer matching contributions. This could have a significant impact on your retirement savings.

If you’re considering changing jobs, it’s a good idea to check your 401(k) plan’s vesting schedule. If you’re not yet fully vested, you may want to consider staying with the company a bit longer to avoid losing out on potential retirement savings.

Withdrawals

In general, you can’t withdraw money from your 401(k) plan without penalty until you reach age 59 1/2. However, there are a few exceptions to this rule, such as hardship withdrawals and loans. If you do withdraw money before age 59 1/2, you’ll pay income tax on the withdrawal amount, plus a 10% penalty. You can avoid the 10% penalty if you withdraw money for certain qualified expenses, such as medical expenses or higher education expenses.

401(k) Retirement Plans: A Guide to Saving for the Future

401(k) retirement plans are employer-sponsored savings plans that allow employees to save for retirement through automatic payroll deductions. These plans are a valuable way to save for the future and can help you reach your retirement goals.

Benefits of 401(k) Plans

401(k) plans offer a number of benefits, including:

-

Tax benefits: Contributions to a 401(k) plan are made on a pre-tax basis, which means that they reduce your current taxable income. This can save you a significant amount of money on income taxes.

-

Employer contributions: Many employers match employee contributions to a 401(k) plan. This is a great way to get free money towards your retirement savings.

-

Investment options: 401(k) plans offer a variety of investment options, so you can choose the ones that best fit your needs.

Withdrawals

Withdrawals from 401(k) plans are generally subject to income tax and may incur early withdrawal penalties if made before age 59½. Some exceptions apply, such as hardship withdrawals or withdrawals to pay for certain medical expenses.

Hardship Withdrawals

Hardship withdrawals are allowed if you have a financial emergency, such as a medical emergency or a job loss. To qualify for a hardship withdrawal, you must be able to prove that you have a financial need and that you have no other resources to cover the expense.

Medical Expense Withdrawals

You can also withdraw money from your 401(k) plan to pay for certain medical expenses. These expenses include those that are not covered by insurance, such as orthodontics or cosmetic surgery.

Other Withdrawals

You can also withdraw money from your 401(k) plan for other reasons, such as to buy a house or to pay for college tuition. However, these withdrawals will be subject to income tax and early withdrawal penalties.

Taxes on Withdrawals

Withdrawals from 401(k) plans are taxed as ordinary income. This means that you will pay the same tax rate on your withdrawals as you do on your regular income. However, there are some exceptions to this rule. For example, if you withdraw money from your 401(k) plan after age 59½, you will not have to pay the 10% early withdrawal penalty.

Early Withdrawal Penalties

If you withdraw money from your 401(k) plan before age 59½, you will have to pay a 10% early withdrawal penalty. This penalty is in addition to the income tax that you will have to pay on the withdrawal.

There are some exceptions to this penalty, such as if you withdraw money from your 401(k) plan to pay for certain medical expenses or to avoid foreclosure on your home.

Other Considerations

There are a few other things to consider when withdrawing money from your 401(k) plan.

- Your age: If you are under age 59½, you will have to pay an early withdrawal penalty if you withdraw money from your 401(k) plan.

- Your tax bracket: The tax bracket that you are in will determine how much income tax you will have to pay on your withdrawals.

- Your investment goals: You should consider your investment goals when withdrawing money from your 401(k) plan. For example, if you are planning to retire soon, you may want to withdraw your money in a series of payments rather than all at once.

Conclusion

401(k) plans are a valuable tool for saving for retirement. By understanding the rules and regulations governing these plans, you can make informed decisions about your retirement savings.

No responses yet