**

Introduction

**

Planning for retirement is as crucial as setting sail on a sea voyage. Without a carefully charted course, you risk drifting aimlessly or even crashing ashore. The “best retirement plan” is your compass, guiding you towards a secure and fulfilling post-work life. It’s a roadmap that outlines your financial goals, investment strategies, and lifestyle choices to ensure you reach your desired destination.

**

Defining Retirement Plans

**

Retirement plans are financial vehicles designed to help you accumulate wealth for your golden years. There are various types to choose from, each with its unique features and tax implications. Traditional 401(k)s and IRAs offer tax-deferred growth, while Roth 401(k)s and IRAs allow tax-free withdrawals in retirement. Annuities, on the other hand, provide a guaranteed stream of income for life.

**

Choosing the Best Retirement Plan

**

The best retirement plan for you depends on your individual circumstances, including age, income, risk tolerance, and retirement goals. Consider your earning potential, expected expenses in retirement, and healthcare needs. Assess your risk tolerance to determine how much volatility you’re comfortable with in your investments. Remember, the key is to find a plan that aligns with your financial goals and provides you with peace of mind.

**

Understanding Tax Considerations

**

Taxes play a significant role in retirement planning. Traditional 401(k) and IRA contributions are made on a pre-tax basis, reducing your current taxable income. However, you’ll pay taxes on withdrawals in retirement. Roth accounts offer tax-free growth and withdrawals, but contributions are made on an after-tax basis. Understanding the tax consequences of different retirement plans is crucial to maximize your savings.

**

Common Mistakes to Avoid

**

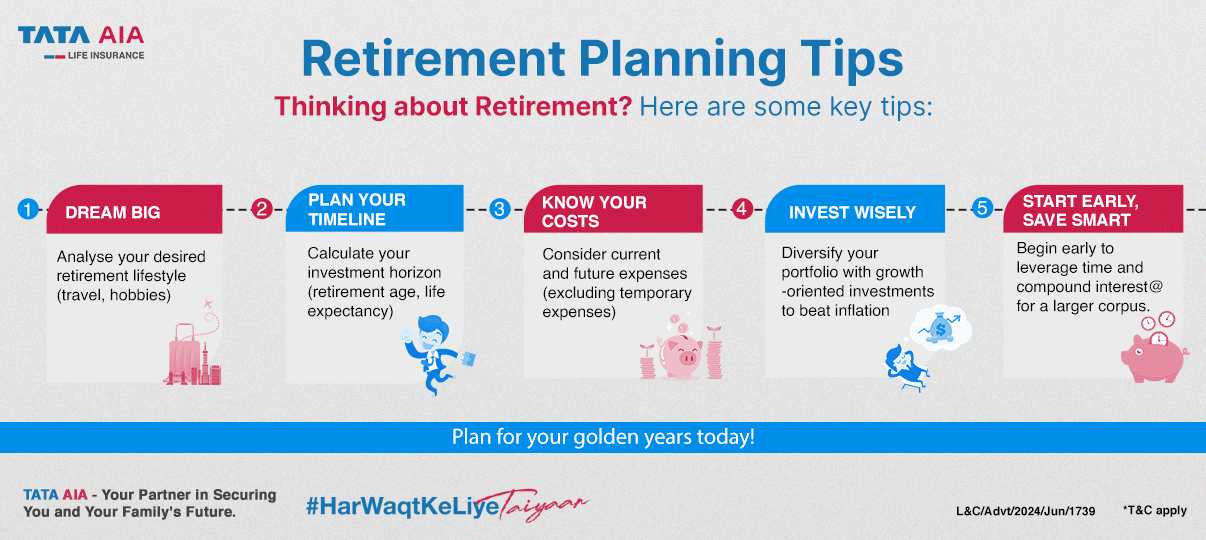

Many people make mistakes that can derail their retirement plans. Procrastinating on saving, failing to diversify investments, and not monitoring progress are some common pitfalls. To avoid these missteps, start saving as early as possible, spread your assets across various investments, and review your plan regularly to ensure it’s still on track.

**The Best Retirement Plan: A Comprehensive Guide to Securing Your Golden Years**

Retirement is a crucial life stage that deserves careful planning. Choosing the right retirement plan can make a significant difference in your financial well-being during your golden years. The Employee Retirement Income Security Act (ERISA) governs retirement plans in the United States, providing a framework to safeguard retirement savings.

**Factors to Consider**

When selecting a retirement plan, several factors warrant consideration:

1. Income:

* Estimate your anticipated retirement income from various sources, including Social Security, pensions, and personal savings. Consider your current income and expected retirement expenses to determine the gap you need to fill.

2. Age and Stage:

* Age is a critical factor that influences retirement planning. Younger individuals have a longer investment horizon, allowing for more aggressive portfolios. Older individuals may prefer less risky investments to preserve their savings.

* Consider your life stage, retirement timeline, and health expectations.

3. Risk Tolerance:

* Assess your ability to withstand market fluctuations. Some investments have higher potential returns but also carry greater risk. Determine your comfort level with risk and choose investments that align with it.

4. Investment Goals:

* Define your specific retirement goals, such as preserving capital, generating income, or growing wealth. Your investment strategy should align with these objectives.

5. Retirement Expenses:

* Estimate your projected living expenses during retirement, including healthcare costs, housing, transportation, and leisure activities. This will help you determine the amount of savings you need to accumulate.

**The 401(k) Plan: A Solid Option for Many**

Among the various retirement plans available, the 401(k) plan remains a popular choice. Offered by many employers, 401(k) plans allow you to save for retirement through payroll deductions. Contributions are made on a pre-tax basis, reducing your current income taxes. Withdrawals in retirement are taxed as ordinary income.

Key considerations for the 401(k) plan:

* **Employer Matching Contributions:** Many employers offer matching contributions, essentially providing free money to boost your retirement savings.

* **Tax Advantages:** Contributions reduce your current taxable income, and earnings grow tax-deferred until withdrawal.

* **Investment Options:** Most 401(k) plans offer a range of investment choices, allowing you to tailor your portfolio to your risk tolerance and goals.

* **Contribution Limits:** Annual contribution limits are set by the Internal Revenue Service (IRS) and adjusted for inflation. In 2023, the limit is $22,500 for employees under 50 and $30,000 for those 50 or older.

* **Early Withdrawal Penalties:** Withdrawals before age 59½ may incur a 10% penalty tax. However, there are certain exceptions, such as qualified hardship withdrawals.

Remember, selecting the best retirement plan is a personal decision. Consider your individual circumstances, financial situation, and long-term goals to make an informed choice that will help you enjoy a financially secure retirement.

**Best Retirement Plan: A Comprehensive Guide to Secure Your Golden Years**

The best retirement plan is the one that fits your unique needs and circumstances like a glove. With a plethora of options available, choosing the right one can be daunting. This article will break down the different types of retirement plans, providing you with the essential information to make an informed decision.

**Types of Retirement Plans**

**401(k) Plans**

401(k) plans, offered by many employers, allow you to save a portion of your paycheck into a tax-advantaged account. Contributions are deducted from your paycheck pre-tax, reducing your current taxable income. The money grows tax-deferred, meaning you don’t pay taxes on the gains until you withdraw them in retirement. Additionally, many employers offer matching contributions, a veritable golden handshake that boosts your savings even further.

**IRAs (Individual Retirement Accounts)**

IRAs are personal retirement savings accounts that can be opened by anyone, regardless of employment status. There are two main types: traditional IRAs and Roth IRAs. Traditional IRAs offer tax-deferred growth, while Roth IRAs allow withdrawals tax-free in retirement if certain conditions are met. Whether you choose a traditional or Roth IRA hinges on your current income and retirement tax expectations.

**Annuities**

Annuities are insurance contracts that provide a steady stream of income in retirement. With immediate annuities, you make a lump-sum payment and receive payments starting right away. Deferred annuities allow you to invest your money and grow it tax-deferred, with payments starting at a later date you specify. Annuities can be a valuable supplement to other retirement savings plans, ensuring a consistent income in your golden years.

**Additional Considerations**

Besides these core types of retirement plans, there are other factors to consider when making your choice. For instance, it’s essential to determine how much risk you’re comfortable taking, as investments within retirement accounts can fluctuate in value. Moreover, you’ll need to factor in fees associated with each plan and how they might impact your overall savings.

**Conclusion**

Choosing the best retirement plan is a pivotal decision that will impact your financial future. By understanding the different types of plans available and considering your individual circumstances, you can create a retirement savings strategy tailored to your needs. Remember, the sooner you start saving, the more time your money has to grow, giving you peace of mind in retirement.

**Best Retirement Plan: A Comprehensive Guide to Securing Your Golden Years**

Retirement planning is a crucial step towards securing your financial future. With so many options available, choosing the best retirement plan can be a daunting task. But don’t fret, folks! We’ve got your back. This article will delve into everything you need to know about retirement plans, from contribution limits to tax implications. Let’s dive right in!

**Contribution Limits and Tax Implications**

Okay, amigos, let’s talk money. Retirement plans have different limits on how much you can stash away each year. These limits are updated annually, so it’s a good idea to keep an eye on the latest regulations.

For 2023, the contribution limit for traditional and Roth IRAs is $6,500 ($7,500 if you’re 50 or older). But hold on there, partner! You might qualify for additional catch-up contributions if you’re behind schedule. So, don’t be shy, ask your friendly financial advisor or check the IRS website for details.

As for taxes, traditional IRAs offer tax-deferred growth. That means you won’t pay taxes on your contributions or earnings until you withdraw them in retirement. Roth IRAs, on the other hand, are taxed upfront, but you get to enjoy tax-free withdrawals down the road. It’s like a trade-off between paying taxes now or later. The best choice for you depends on your individual situation.

Best Retirement Plan: A Roadmap to Financial Security

Securing your financial future involves planning for retirement, and the best retirement plan serves as a roadmap to a comfortable and worry-free post-work life. But with a myriad of options available, choosing the right plan can be a daunting task. This comprehensive guide will help you navigate the world of retirement plans and make informed decisions about your financial well-being.

Investment Options

The heart of any retirement plan lies in its investment options. These options determine how your money grows over time and ultimately impact your retirement income. Here’s a closer look at the most common investment choices:

Stocks

As part-ownership in publicly traded companies, stocks offer the potential for high returns but also carry significant risk. They can be volatile and may fluctuate substantially in value, making them suitable for investors with a higher tolerance for risk and a long investment horizon.

Bonds

Bonds are essentially loans to governments or corporations. They provide investors with a fixed interest payment over a specified period and repay the principal upon maturity. Bonds are generally less risky than stocks but also offer lower potential returns.

Mutual Funds

Mutual funds provide a convenient way to diversify your investments by pooling your money with other investors to invest in a basket of stocks, bonds, or a combination of both. They come with a variety of risk profiles and investment objectives, allowing you to choose a fund that aligns with your needs and risk tolerance.

Target-Date Funds

Target-date funds are a type of mutual fund designed to simplify retirement planning. They automatically adjust their investment allocation based on your age and estimated retirement date, becoming more conservative over time.

Annuities

Annuities provide a guaranteed stream of income for a specified period or for life. They are often purchased as a way to ensure a steady income during retirement, but they come with lower potential growth compared to other investment options.

**The Ultimate Guide to Choosing the Best Retirement Plan**

Whether you’re just starting out in your career or nearing the finish line, planning for retirement is essential. With so many options available, selecting the right plan can be daunting. This comprehensive guide will help you navigate the complexities and choose the retirement plan that best suits your needs.

Choosing the Right Plan

The first step in planning for retirement is to assess your individual circumstances. Consider your age, income, risk tolerance, and long-term financial goals. It’s like building a house; you need a solid foundation to support your future. Different plans have different advantages and limitations, so it’s crucial to choose one that aligns with your specific situation.

Types of Retirement Plans

There are two main types of retirement plans: defined benefit plans and defined contribution plans. Defined benefit plans guarantee a fixed monthly income in retirement, regardless of investment performance. Defined contribution plans, such as 401(k)s and IRAs, allow you to contribute a certain amount of money each year and accumulate savings over time. Which type of plan is best for you depends on your comfort level with risk and your financial goals.

Employer-Sponsored Plans

Many employers offer retirement plans to their employees, including 401(k)s and 403(b)s. These plans typically offer tax advantages and matching contributions from your employer, making them a smart choice for saving for retirement. Employer-sponsored plans can also provide access to investment options and financial advice, which can be invaluable resources.

IRAs and Roth IRAs

Individual Retirement Accounts (IRAs) and Roth IRAs are personal savings accounts that allow you to contribute after-tax dollars and grow your investments tax-free. Roth IRAs have income limits, but withdrawals in retirement are tax-free. Traditional IRAs have no income limits, but withdrawals are taxed as income. Deciding between a Roth IRA and a traditional IRA depends on your income and future tax bracket.

Annuities

Annuities are contracts with insurance companies that provide a guaranteed stream of income in retirement. They offer a level of certainty that other investments may not, but they also come with higher fees and less flexibility. Annuities can be a good option for those who prioritize security and predictability in retirement.

The Best Retirement Plan: A Personal Choice

The best retirement plan for you is the one that aligns with your unique circumstances and financial goals. Consider your age, income, risk tolerance, and future plans when making your decision. Remember, retirement planning is a lifelong journey, and you can make adjustments along the way to ensure that your savings are on track. Start planning now, and you’ll be well on your way to a secure and fulfilling retirement.

What’s the Best Retirement Plan?

Planning for retirement is one of the most important things you can do to secure your financial future. But with so many different retirement plans to choose from, it can be tough to know which one is right for you.

**401(k) plans** are employer-sponsored retirement plans that allow you to save money on a pre-tax basis. This means that your contributions are taken out of your paycheck before taxes are calculated, so you pay less in taxes now. 401(k) plans also offer a variety of investment options, so you can choose the ones that are right for your risk tolerance and financial goals.

**IRAs** are individual retirement accounts that you can open on your own. IRAs offer similar tax benefits to 401(k) plans, but you may have more investment options with an IRA. There are two main types of IRAs: traditional IRAs and Roth IRAs. Traditional IRAs offer tax-deductible contributions, but your withdrawals are taxed as income. Roth IRAs offer after-tax contributions, but your withdrawals are tax-free.

**Annuities** are financial products that provide you with a guaranteed income stream for life. Annuities can be a good option for people who want to ensure that they will have a steady income in retirement. However, annuities can be expensive, and they may not offer the same flexibility as other retirement plans.

**Rental properties** can be a good way to generate passive income in retirement. However, rental properties can also be a lot of work. You will need to find tenants, collect rent, and maintain the property.

**Dividend-paying stocks** can provide you with a regular income stream in retirement. However, dividend-paying stocks can also be volatile. The price of the stock can fluctuate, and the company may decide to reduce or eliminate its dividend at any time.

Conclusion

The best retirement plan for you will depend on your individual circumstances and financial goals. Talk to a financial advisor to get help choosing the right plan for you.

No responses yet