401(k) Retirement Plan: A Guide to a Secure Retirement

Preparing for retirement might seem like a daunting task, but it doesn’t have to be. A 401(k) retirement plan is one of the most advantageous tools available to help you accumulate wealth for your golden years. What exactly is a 401(k), and how can it benefit you? This comprehensive guide will provide all the essential information you need to make informed decisions about your retirement savings.

A 401(k) retirement plan is a tax-advantaged savings account offered by employers in the United States. It allows employees to contribute a portion of their pre-tax income to the plan, reducing their current taxable income. These contributions grow tax-deferred, meaning you don’t pay taxes on the earnings until you withdraw them in retirement.

Benefits of a 401(k) Retirement Plan

Participating in a 401(k) plan offers a multitude of benefits that make it a highly attractive option for retirement savings. The tax advantages alone can lead to significant savings over time, as you defer paying taxes on both your contributions and the investment earnings.

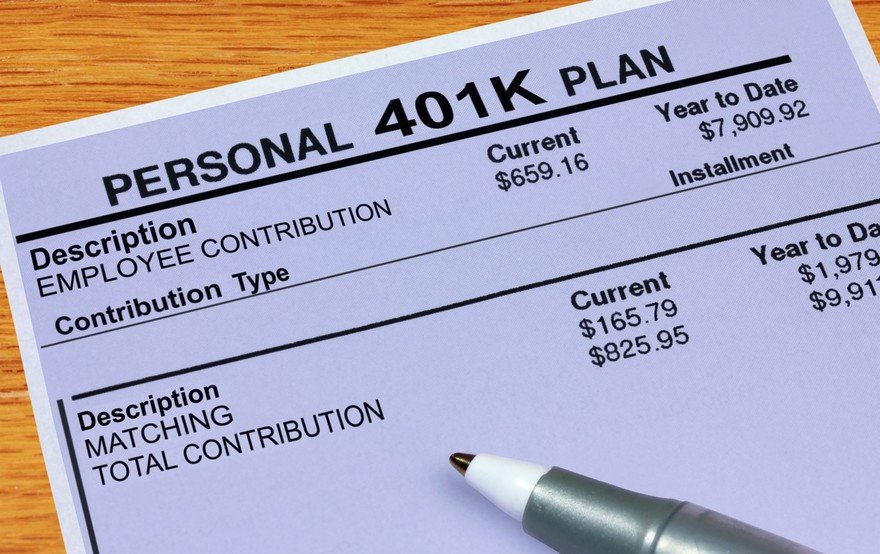

Many employers also offer matching contributions to their employees’ 401(k) plans. This essentially means free money that can boost your retirement savings even further. For example, if your employer matches 50% of your contributions up to 6% of your salary, and you contribute 6%, you’ll receive an additional 3% from your employer.

Eligibility and Contributions

Eligibility for a 401(k) plan typically depends on your employment status. In most cases, you must be a regular employee of a company that offers the plan and have worked there for a certain period of time. There are some exceptions for self-employed individuals and small business owners.

The amount you can contribute to your 401(k) is subject to annual limits set by the Internal Revenue Service (IRS). For 2023, the contribution limit for 401(k) plans is $22,500. Individuals age 50 and older can make catch-up contributions of up to $7,500 per year.

Investment Options

Once you’re enrolled in a 401(k) plan, you’ll have a range of investment options to choose from. These options may include mutual funds, target-date funds, exchange-traded funds (ETFs), and company stock. Each option has its own risk profile and potential returns, so it’s important to carefully consider your investment goals and risk tolerance when making your selections.

If you’re not sure which investment options are right for you, consider consulting with a financial advisor who can provide guidance based on your individual circumstances.

Withdrawals and Taxes

When you reach retirement age, you can begin taking withdrawals from your 401(k) account. Withdrawals are typically taxed as ordinary income, so it’s important to consider your tax bracket when planning your retirement income strategy.

There are some exceptions to the ordinary income tax rule. For example, if youwithdrawals before age 59½, you may have to pay a 10% early withdrawal penalty. However, there are exceptions to this penalty, such as withdrawals for qualified medical expenses or higher education costs.

It’s important to note that 401(k) plans are subject to a variety of rules and regulations set by the IRS. It’s always advisable to consult with a financial advisor or tax professional to ensure that you understand the implications of these rules and to make the most of your 401(k) savings.

**401(k) Retirement Plan: A Comprehensive Guide to Saving for the Future**

In the realm of retirement planning, the 401(k) reigns supreme as a cornerstone of financial security. This employer-sponsored retirement savings plan empowers individuals to set aside a portion of their income on a pre-tax basis, minimizing current tax liability while amassing funds for their golden years. But what exactly makes a 401(k) so alluring? Let’s delve into the ins and outs of this indispensable retirement tool.

Eligibility

Eligibility for 401(k) plans is generally based on age and service requirements. The Employee Retirement Income Security Act (ERISA) mandates that employers with over 100 eligible employees must offer a 401(k) plan. To be eligible, you typically need to be at least 21 years old and have worked for the company for at least one year. However, some employers may have different eligibility requirements, such as a higher minimum age or service period. Just like a diligent gardener assessing the ripeness of a tomato, it’s wise to check with your employer to determine the specific 401(k) eligibility criteria at your workplace.

Employer Contributions

Many employers offer matching contributions to their employees’ 401(k) plans, essentially sweetening the deal. These contributions are usually based on a percentage of the employee’s salary and can significantly boost retirement savings over time. For instance, if an employer offers a 50% match up to 6% of salary, and an employee contributes 6% of their salary, the employer would contribute an additional 3% to the employee’s 401(k) account, doubling the employee’s contribution! It’s like having a financial fairy godmother sprinkling magical contributions into your retirement fund.

Contribution Limits

The Internal Revenue Service (IRS) sets limits on how much you can contribute to your 401(k) each year. For 2023, the contribution limit is $22,500, with an additional catch-up contribution of $7,500 for individuals age 50 or older. These limits are adjusted annually for inflation, so be sure to check with the IRS for the most up-to-date information. Exceeding the contribution limits can lead to penalties, so it’s best to keep your contributions within the prescribed boundaries.

Investment Options

401(k) plans typically offer a variety of investment options, allowing you to tailor your portfolio to your risk tolerance and investment goals. These options may include mutual funds, target-date funds, bonds, and even company stock. As you approach retirement, you may wish to adjust your investment mix to become more conservative, safeguarding your hard-earned savings. Remember, the stock market can be a bit like a rollercoaster ride, with its ups and downs, so it’s wise to diversify your investments and not put all your eggs in one basket.

Tax Benefits

One of the key advantages of a 401(k) plan is the tax benefits it provides. Contributions are made on a pre-tax basis, which means they are deducted from your income before taxes are calculated. This not only reduces your current tax bill but also allows your investments to grow tax-deferred until you withdraw them in retirement. When you do withdraw them, they will be taxed at your then-current income tax rate, which is likely to be lower than your current tax rate since you’ll probably be in a lower tax bracket. It’s like a financial Jedi mind trick, saving you money now and in the future.

Conclusion

The 401(k) retirement plan is an indispensable tool for planning a secure and comfortable retirement. By taking advantage of eligibility, employer contributions, contribution limits, investment options, and tax benefits, you can set yourself up for financial success down the road. Remember, retirement may seem like a distant shore, but like a wise mariner, it’s never too early to start charting your course towards financial freedom.

**401(k) Retirement Plan: Everything You Need to Know**

Retirement planning is a crucial aspect of financial security, and a 401(k) plan can be a powerful tool for building a nest egg. This tax-advantaged retirement account allows employees and employers to contribute money that grows tax-deferred until it’s withdrawn in retirement.

Contribution Limits

The amount of money you can contribute to a 401(k) plan is limited each year. For 2023, employees can contribute up to $22,500 to their 401(k) plans, while employers can contribute an additional $6,500. For those aged 50 and older, catch-up contributions are allowed, with an additional $7,500 allowed for 2023.

Employee Eligibility

Generally, all employees who are at least 21 years old and have worked for their employer for at least one year are eligible to participate in a 401(k) plan. However, some plans may have different eligibility requirements, such as requiring employees to work a certain number of hours per week or to be full-time employees.

Employer Matching Contributions

Many employers offer matching contributions to their employees’ 401(k) plans. This means that the employer will contribute a certain amount of money to the employee’s account for every dollar that the employee contributes, up to a certain limit. Employer matching contributions can be a great way to boost your retirement savings.

What Is a 401(k) Retirement Plan, Really?

If you’re like most Americans, you’re probably not saving enough for retirement. In fact, according to a recent study by the National Institute on Retirement Security, the average American has just $12,000 saved for retirement. That’s not nearly enough to cover the costs of a comfortable retirement.

One of the best ways to save for retirement is through a 401(k) plan. A 401(k) plan is a retirement savings plan that allows you to save money on a tax-advantaged basis. This means that you can contribute money to your 401(k) plan before taxes are taken out of your paycheck. The money in your 401(k) plan grows tax-free until you retire, when you can withdraw it and pay taxes on it at that time.

There are many different types of 401(k) plans available, so it’s important to compare them and choose the one that’s right for you. Some of the most common types of 401(k) plans include:

- Traditional 401(k) plans: This is the most common type of 401(k) plan. With a traditional 401(k) plan, you contribute money to your account on a pre-tax basis. This means that the money is deducted from your paycheck before taxes are taken out, which reduces your taxable income.

- Roth 401(k) plans: A Roth 401(k) plan is similar to a traditional 401(k) plan, but with a Roth 401(k) plan, you contribute money to your account on an after-tax basis. This means that the money is deducted from your paycheck after taxes have been taken out, which does not reduce your taxable income. However, the money in a Roth 401(k) plan grows tax-free, and you can withdraw it tax-free in retirement.

Investment Options

401(k) plans offer a variety of investment options, including:

- Mutual funds: Mutual funds are a type of investment that pools money from many investors and invests it in a variety of stocks, bonds, or other assets. Mutual funds are a good option for investors who want to diversify their portfolio and don’t want to have to manage their investments themselves.

- Stocks: Stocks are a type of investment that represents ownership in a company. When you buy a stock, you are buying a small piece of that company. Stocks can be a good investment for long-term growth, but they can also be volatile, so it’s important to diversify your portfolio and not put all of your eggs in one basket.

- Bonds: Bonds are a type of loan that you make to a company or government. When you buy a bond, you are lending money to that entity and they agree to pay you back the money with interest over time. Bonds are a good option for investors who want a more stable investment with a lower risk of losing money.

- Target-date funds: Target-date funds are a type of mutual fund that is designed to automatically adjust your asset allocation as you get closer to retirement. Target-date funds are a good option for investors who don’t want to have to manage their investments themselves and want a fund that will automatically adjust to their risk tolerance and investment goals.

- Index funds: Index funds are a type of mutual fund that tracks the performance of a specific market index, such as the S&P 500. Index funds are a good option for investors who want a low-cost way to invest in the stock market and don’t want to have to pick individual stocks.

**401(k) Retirement Plan: A Comprehensive Guide to Saving for the Future**

A 401(k) plan is a tax-advantaged retirement savings account offered through an employer. It’s a great way to save for retirement and reduce your current tax bill. Here’s everything you need to know about 401(k) plans:

Taxes

Contributions to traditional 401(k) plans are made on a pre-tax basis, meaning they are deducted from your paycheck before taxes are calculated. This reduces your current taxable income. The money grows tax-deferred until you withdraw it in retirement. At that time, it will be taxed as ordinary income.

Roth 401(k) plans, on the other hand, are funded with after-tax dollars. This means you don’t get a tax break upfront, but the withdrawals are tax-free in retirement.

Contribution Limits

The maximum amount you can contribute to a 401(k) plan in 2023 is $22,500. If you’re age 50 or older, you can make catch-up contributions of up to $7,500 per year.

Employer Matching

Many employers offer matching contributions to their employees’ 401(k) plans. This is essentially free money, so it’s important to take advantage of it if your employer offers it.

Vesting

When you contribute to a 401(k) plan, your money is initially considered “non-vested.” This means that if you leave your job before you’ve been there for a certain number of years, you may not be able to take all of your money with you. However, most employers will vest your money over time, typically after three to five years of service.

Withdrawals

You can withdraw money from your 401(k) plan without penalty after you turn age 59½. However, if you withdraw money before age 59½, you’ll have to pay a 10% penalty tax, in addition to the regular income tax. There are some exceptions to this rule, such as if you’re withdrawing money for qualified medical expenses or a down payment on a home.

401(k) plans are a great way to save for retirement. They offer tax advantages, employer matching, and the potential for long-term growth. If you’re not already contributing to a 401(k) plan, talk to your employer about how you can get started.

401(k) Retirement Plan: A Comprehensive Guide to Secure Your Future

A 401(k) retirement plan is an employer-sponsored savings plan that allows employees to contribute a portion of their paycheck on a pre-tax basis. These contributions are invested in a variety of options, such as stocks, bonds, and mutual funds, and grow tax-deferred until withdrawn in retirement.

Withdrawals

Withdrawals from 401(k) plans are generally subject to income tax and may incur additional penalties if taken before age 59½. However, there are a few exceptions to this rule, such as withdrawals for qualified expenses such as medical costs or higher education.

Roth 401(k)s

Roth 401(k)s are a type of 401(k) plan that offers tax-free withdrawals in retirement. Contributions to a Roth 401(k) are made on an after-tax basis, meaning that they are not eligible for a tax deduction in the year they are made. However, once the money is withdrawn in retirement, it is not subject to any further taxation.

Rollovers

401(k) funds can be rolled over into another 401(k) plan or an individual retirement account (IRA) when you leave your job. This allows you to keep your retirement savings growing tax-deferred, even if you change jobs multiple times.

Loans

401(k) plans may offer loans to participants, allowing them to borrow against their retirement savings. These loans typically have low interest rates, but they must be repaid within a certain amount of time or the loan will be considered a withdrawal and subject to income tax and penalties.

Plan Limits

The amount that you can contribute to a 401(k) plan is limited each year. For 2023, the limit is $22,500 for employees under age 50 and $30,000 for employees age 50 and older. Employers are also allowed to make matching contributions to their employees’ 401(k) plans, up to a certain limit.

Employer Match

Many employers offer a matching contribution to their employees’ 401(k) plans. This is essentially free money that you can use to grow your retirement savings. If your employer offers a matching contribution, it is important to contribute at least enough to receive the full match.

Vesting

When you contribute to a 401(k) plan, the money is not initially vested, meaning that it does not belong to you until you have met certain requirements. Vesting schedules can vary, but most plans require employees to be vested in their 401(k) savings after a certain number of years of service.

Conclusion

A 401(k) retirement plan is a powerful tool that can help you save for a secure financial future. By understanding the basics of 401(k) plans, you can make informed decisions about how to use this valuable savings vehicle to reach your retirement goals.

401(k) Retirement Plan: A Comprehensive Investment for Your Future

In the landscape of retirement planning, 401(k) plans stand out as potent tools. Crafted to cater to both employees and employers, they wield a formidable array of benefits, fueling aspirations of a secure financial future. As you embark on navigating this realm, let’s delve into the intricacies of 401(k) plans, unraveling their advantages and the prudent steps for harnessing their power.

Advantages

-

Tax Savings: 401(k) plans extend generous tax benefits. Contributions are deducted from your paycheck before taxes, reducing your taxable income and potentially lowering your tax bill.

-

Investment Growth Potential: 401(k) plans offer a plethora of investment options, allowing you to tailor your portfolio to align with your risk tolerance and financial goals. By leveraging the power of compound interest, your investments have the potential to grow exponentially over time.

-

Employer Contributions: Many employers generously contribute to their employees’ 401(k) plans, effectively boosting your retirement savings without dipping into your own pocket. These contributions can significantly augment your nest egg and accelerate your path towards financial security.

-

Variety of Investment Options: 401(k) plans often provide a diverse range of investment options, including stocks, bonds, mutual funds, and real estate. This flexibility empowers you to craft a diversified portfolio tailored to your individual preferences and financial objectives.

-

Employer Matching Contributions: Some employers offer matching contributions, where they match a portion of your contributions up to a certain limit. These matching contributions represent free money that can supercharge your retirement savings.

-

Low Fees: Many 401(k) plans come with low administrative and investment fees, translating into more of your hard-earned money working for you over the long term.

-

Convenience: 401(k) plans offer a hassle-free and convenient way to save for retirement. Contributions are deducted directly from your paycheck, removing the need for manual transfers or additional effort on your part.

401(k) Retirement Plan: A Comprehensive Guide

For many years, 401(k) retirement plans have been a cornerstone of financial planning for Americans, offering tax advantages and the potential for long-term wealth accumulation. However, it’s crucial to understand both the benefits and drawbacks of these plans before making any decisions. In this article, we’ll delve into the advantages and disadvantages of 401(k) plans, providing you with the information you need to make informed choices about your financial future.

Advantages

401(k) plans offer several key advantages:

- Tax Deferral: Contributions to a 401(k) are generally made on a pre-tax basis, reducing your current taxable income and potentially saving you a significant amount in taxes.

- Employer Matching Contributions: Many employers offer matching contributions to their employees’ 401(k) accounts, essentially giving you free money to save for retirement.

- Investment Options: 401(k) plans typically offer a range of investment options, allowing you to tailor your portfolio to your risk tolerance and financial goals.

Disadvantages

While 401(k) plans offer many benefits, there are also some disadvantages to consider:

- Contribution Limits: There are annual limits on the amount of money you can contribute to a 401(k). For 2023, the contribution limit is $22,500 ($30,000 if you’re 50 or older).

- Investment Risks: The investments in your 401(k) are subject to market fluctuations, and you could lose money if the market takes a downturn.

- Early Withdrawal Penalties: If you withdraw money from your 401(k) before reaching age 59½, you’ll typically have to pay a 10% early withdrawal penalty.

- 401(k) Loans: While you can take out a loan from your 401(k), it’s important to remember that this is borrowed money, and it must be repaid. If you leave your job or are unable to repay the loan, you could face tax penalties and other consequences.

- Employer Dependence: Your ability to contribute to a 401(k) depends on your employer offering such a plan. If your employer doesn’t offer a 401(k), you won’t be able to take advantage of its benefits.

- Hardship Withdrawals: You may be able to take a hardship withdrawal from your 401(k) to cover certain expenses, such as medical expenses or a down payment on a home. However, these withdrawals are subject to income tax and may be subject to a 10% early withdrawal penalty.

- Estate Planning: Inherited 401(k) assets are subject to required minimum distributions, which can affect estate planning strategies.

- Investment Fees: Some 401(k) plans have investment fees, which can reduce your potential returns over time. It’s important to understand the fees associated with your 401(k) plan before investing.

401(k) Retirement Plans: A Comprehensive Guide

401(k) plans are a popular retirement savings vehicle offered by many employers, allowing individuals to save for the future. Understanding the ins and outs of 401(k) plans is essential for anyone planning for their golden years. This article will delve into the intricacies of 401(k) retirement plans, equipping you with the knowledge you need to make informed decisions about your financial future.

How Do 401(k) Plans Work?

401(k) plans are employer-sponsored retirement savings plans that allow employees to make tax-advantaged contributions from their paychecks. Contributions are invested in a variety of investment options, such as stocks, bonds, and mutual funds, and grow tax-free until withdrawn in retirement.

Understanding Contribution Limits

The amount you can contribute to your 401(k) each year is limited by the Internal Revenue Service (IRS). For 2023, the annual contribution limit for employees under 50 is $22,500, while those 50 and older can contribute an additional “catch-up” contribution of $7,500.

Types of 401(k) Plans

There are two main types of 401(k) plans: traditional and Roth. Traditional 401(k) plans offer immediate tax savings on contributions, but withdrawals in retirement are taxed as income. Roth 401(k) plans, on the other hand, have no upfront tax savings, but withdrawals in retirement are tax-free.

Employer Matching Contributions

Many employers offer matching contributions to their employees’ 401(k) plans. This is essentially free money, so it’s important to maximize your employer’s matching contributions. Find out how much your employer matches and adjust your contributions accordingly.

Investment Options

401(k) plans typically offer a range of investment options, including stocks, bonds, mutual funds, and target-date funds. Choosing the right investment mix depends on your age, risk tolerance, and retirement goals. Consider working with a financial advisor to determine the best investment strategy for you.

Vesting

Vesting refers to the period of time before you have ownership of your 401(k) contributions. Contributions may be subject to a vesting schedule, which means you won’t have full ownership of them until a certain number of years of service have passed.

Withdrawals

Withdrawals from 401(k) plans are generally subject to income tax. However, there are some exceptions, such as withdrawals for qualified expenses like medical bills or higher education. Early withdrawals (before age 59½) may also be subject to a 10% penalty.

Loans

Some 401(k) plans allow participants to borrow from their account for emergencies. However, it’s important to repay these loans promptly, as unpaid loans may be considered a taxable withdrawal.

Conclusion

401(k) plans are a valuable retirement savings tool that can help you accumulate wealth for the future. However, it’s important to familiarize yourself with the details of your plan before enrolling. By understanding the contribution limits, investment options, and withdrawal rules, you can make informed decisions about your retirement savings.

No responses yet