Top Ten Financial Mistakes

Financial mistakes happen to the best of us. But making the same ones over and over again can cost you dearly. Here are ten of the most common financial mistakes to avoid. If you’re making any of these mistakes, it’s time to change your ways. Your future self will thank you.

1. Not having a budget

A budget is a plan for how you’re going to spend your money. It’s like a roadmap for your finances. Without a budget, you’re more likely to overspend and get into debt. Creating a budget is easy. Just track your income and expenses for a month or two. Once you know where your money is going, you can start making a plan for how to spend it better. And there are plenty of free budgeting apps and tools available to help you get started.

Once you have a budget, stick to it as much as possible. If you find yourself overspending, figure out where you can cut back. And remember, a budget is not set in stone. You can adjust it as needed to meet your changing needs.

Not having a budget is like driving a car without a map. You might end up where you want to go, but it’s going to be a lot harder and you’re more likely to get lost along the way.

Here are some tips for creating a budget:

- Track your income and expenses for a month or two.

- Categorize your expenses (e.g., housing, food, transportation).

- Set financial goals.

- Create a budget that allows you to reach your goals.

- Review your budget regularly and make adjustments as needed.

Creating and sticking to a budget is one of the most important things you can do to manage your finances. If you’re not sure where to start, there are plenty of resources available to help you. But don’t put it off any longer. Start budgeting today and take control of your financial future.

Top 10 Financial Mistakes That Can Derail Your Financial Future

In today’s fast-paced world, personal finance is more important than ever. Avoiding these common financial pitfalls can set you on the path to financial stability and ultimately, financial freedom.

1. Not having a budget

A budget is essential for tracking your income and expenses, and making sure you’re not spending more than you earn. Think of it as a roadmap for your financial journey. Creating a budget is like taking control of the steering wheel of your finances. It helps you allocate your hard-earned money wisely, prioritize your financial goals, and avoid unnecessary debt.

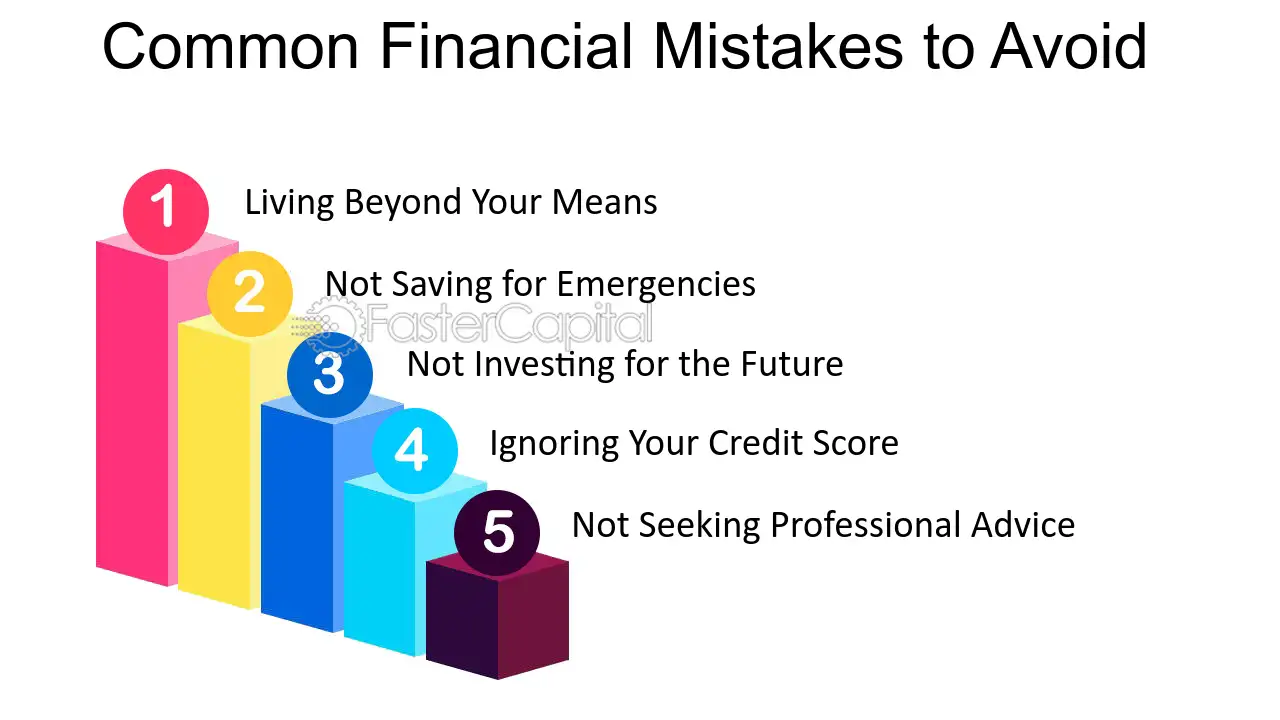

2. Living beyond your means

If you’re constantly spending more than you earn, you’re setting yourself up for a financial disaster. It’s like trying to fill a bottomless pit – it’s simply not sustainable. Living beyond your means can lead to mounting debt, sleepless nights, and a constant feeling of financial insecurity. Just like a house of cards, your financial foundation can crumble if you continue to live beyond your limits.

Is your lifestyle outpacing your income? Are you regularly dipping into your savings or relying on credit cards to make ends meet? If so, it’s time to take a hard look at your spending habits and make some necessary adjustments. Remember, financial stability is built one step at a time. Start by tracking your expenses, identifying areas where you can cut back, and gradually reducing your debt. It may not be easy, but it’s definitely worth it in the long run.

Imagine your finances as a car – a budget is like the steering wheel, keeping you on track. But if you’re spending more than you earn, it’s like driving with the brakes on – you’re not going to get very far. Just as a mechanic can help you fix a broken car, a financial advisor can guide you towards financial stability. Don’t be afraid to seek professional help if you’re struggling to manage your finances.

Just like a healthy diet and regular exercise contribute to physical well-being, responsible financial habits lead to financial fitness. Embrace budgeting, live within your means, and watch your financial worries melt away. Remember, financial freedom is not a destination, it’s a journey. Start today and take the first step towards a brighter financial future.

9. Ignoring Credit Card Debt

It’s no secret that credit card debt can be a major financial burden. What starts as a small balance can quickly spiral out of control, especially if you’re only making minimum payments. If you’re carrying a balance on your credit card, it’s crucial to make a plan to pay it off as quickly as possible. This may involve cutting back on expenses, consolidating your debt, or negotiating a lower interest rate with your credit card company.

8. Not Having Enough Insurance

Insurance is an essential part of any financial plan. It provides protection against unexpected events that could devastate your finances, such as a car accident, a medical emergency, or a disability. Having adequate insurance coverage can give you peace of mind and prevent you from losing everything you’ve worked hard for. Make sure you review your insurance needs regularly and make adjustments as needed.

7. Not Investing

Investing is one of the most important ways to grow your wealth over time. By investing in stocks, bonds, or mutual funds, you can take advantage of the power of compound interest and potentially earn a significant return on your investment. The earlier you start investing, the more time your money has to grow, so don’t wait to get started. There are many different investment options available, so talk to a financial advisor to find the ones that are right for you.

6. Not Having a Budget

A budget is a powerful tool that can help you track your income and expenses, identify areas where you can save money, and make better financial decisions. Having a budget will allow you to make sure that you’re living within your means and not overspending. There are many different budgeting methods available, so find one that works for you and stick to it.

5. Not Saving for Retirement

When you’re young, retirement may seem like a long way off. But it’s never too early to start saving. The sooner you start, the more time your money has to grow. Even if you can only contribute a small amount each month, it will add up over time. There are many different retirement savings options available, so talk to a financial advisor to find the one that’s right for you.

Top Ten Financial Mistakes That Can Derail Your Financial Future

Making financial mistakes is a part of life, but some mistakes can have long-term consequences that can derail your financial future. Avoiding these common financial pitfalls can help you reach your financial goals faster and with less stress.

3. Not Investing

Investing is one of the most important things you can do to grow your wealth over time. However, many people make the mistake of not investing at all, or not investing enough. There are many different ways to invest, so find one that fits your risk tolerance and financial goals. Even small investments can add up over time, so don’t be afraid to start small.

4. Spending More Than You Earn

One of the biggest financial mistakes people make is spending more than they earn. This can lead to debt, which can be a huge drain on your finances. If you’re struggling to make ends meet, take a close look at your spending habits and see where you can cut back. There are many ways to save money, so don’t be afraid to get creative.

5. Not Having an Emergency Fund

An emergency fund is a savings account that you can tap into if you have an unexpected expense, such as a medical emergency or a car repair. Having an emergency fund can help you avoid going into debt or having to sell your assets to cover costs. Aim to save at least three to six months’ worth of living expenses in your emergency fund.

Top Ten Financial Mistakes: What Not to Do With Your Money

When it comes to personal finance, there are a few common mistakes that people make over and over again. These mistakes can cost you money, time, and stress. If you want to improve your financial situation, it’s important to avoid these common pitfalls.

5. Failing to Plan for Retirement

Retirement may seem like a long way off, but it’s never too early to start planning. It’s like planting a tree: the sooner you get started, the bigger and stronger it will be when you need it most. The benefits of planning ahead are undeniable: you’ll have more time to save, your investments will have more time to grow, and you’ll be less likely to have to rely on Social Security or other government programs in your golden years.

The key to successful retirement planning is to create a budget and stick to it. Figure out how much money you need to save each month, and set up automatic transfers from your checking account to your retirement account. Even if it’s just a small amount, every dollar you save now will add up over time.

In addition to saving, you should also start thinking about how you’re going to invest your retirement savings. There are a variety of investment options available, so it’s important to do your research and find the ones that are right for you. A financial advisor can help you create an investment portfolio that meets your specific needs and goals.

Retirement planning may seem daunting, but it’s one of the most important things you can do for your financial future. By taking the time to plan ahead, you’ll be able to enjoy a secure and comfortable retirement.

Top Ten Financial Mistakes You Can’t Afford to Make

Money makes the world go ’round, but managing it wisely can be a daunting task. From reckless spending to poor investment decisions, there are countless financial pitfalls that can derail your financial well-being. To help you avoid these costly mistakes, let’s delve into the top ten financial blunders you should steer clear of.

1. Living Beyond Your Means

Stretching your budget to the breaking point is a recipe for financial disaster. When you spend more than you earn, you accumulate debt that can snowball into an overwhelming burden. Live within your means, create a realistic budget, and stick to it like glue.

2. Not Saving for the Future

Putting off saving for retirement or emergencies is a common mistake that can haunt you in the future. Start saving as early as possible, even if it’s just a small amount. Compound interest will work its magic over time, and you’ll be grateful you did when you need a financial cushion.

3. Taking on Too Much Debt

Debt is a double-edged sword. While it can help you finance major purchases, excessive debt can cripple your finances. Don’t fall into the trap of accumulating high-interest credit card debt or taking out loans you can’t afford to repay. Only borrow when necessary and pay down your debts aggressively.

4. Ignoring Insurance

Insurance is the financial safety net that protects you from unforeseen events. Whether it’s health insurance, homeowner’s insurance, or car insurance, having adequate coverage can save you a lot of heartache and financial loss down the road. Don’t skimp on insurance; it’s worth every penny.

5. Investing Without a Plan

Investing is a smart way to grow your wealth, but it’s crucial to do it wisely. Don’t invest haphazardly; take the time to create an investment plan that aligns with your financial goals, risk tolerance, and time horizon. Research your investments thoroughly and seek professional advice if needed.

6. Failing to Plan for Retirement

Retirement may seem distant, but it’s never too early to start planning. The earlier you start saving and investing for retirement, the more time your money has to grow. Don’t rely solely on Social Security; make sure you’re setting aside enough money to live comfortably in your golden years. Consider contributing to a 401(k), IRA, or other retirement savings account.

Imagine retiring without enough savings to cover your expenses. It’s like driving a car without gas—you’ll eventually run out of steam and be stranded. Don’t let this happen to you. Plan for retirement now, so you can enjoy a secure and fulfilling chapter in your life.

Compound interest is like a financial snowball. The more you save and invest early on, the bigger it grows over time. It’s the secret sauce that can turn a small investment into a substantial nest egg. Don’t underestimate its power.

Think of your retirement savings as a long-term marathon, not a sprint. The key is to start early and stay consistent with your contributions. Even small amounts can add up significantly over time, thanks to compounding interest.

So, heed the advice of financial experts: plan for retirement now. The future you will thank you for it.

**Top 10 Financial Mistakes That Could Cost You Big**

Money matters can be a minefield, and it’s easy to make mistakes that can have a lasting impact on your financial well-being. Here are some of the most common financial pitfalls to avoid:

6. Not planning for taxes

Taxes are inevitable, but that doesn’t mean you have to hand over more than your fair share. Proper tax planning can help you minimize your tax liability and keep more of your hard-earned money. Take advantage of all the tax deductions and credits you’re entitled to, and consider consulting with a tax professional to optimize your savings. Remember, a little bit of planning can go a long way when it comes to reducing your tax burden.

7. Neglecting retirement savings

Retirement may seem like a distant reality, but the sooner you start saving, the better off you’ll be. Compound interest is your friend, so every dollar you invest today has the potential to grow exponentially over time. Consider setting up a 401(k) or IRA and contributing as much as you can afford. The earlier you start saving, the more time your money has to compound and the less you’ll have to worry about in your golden years.

Think of retirement savings like planting a tree. If you plant a small sapling now, it will grow into a mighty oak over time. But if you wait until the last minute to plant a tree, it will be a struggle to enjoy its shade before the sun sets on your working life.

Another important aspect of retirement planning is diversifying your investments. Don’t put all your eggs in one basket. Spread your money across a variety of asset classes, such as stocks, bonds, and real estate, to reduce your risk and maximize your returns. Remember, the key to successful investing is to stay the course, even during market downturns. Just like a boat that weathers the storm, your diversified portfolio will help you navigate the financial ups and downs and emerge stronger on the other side.

Don’t be afraid to seek professional advice if you need help with retirement planning. A financial advisor can help you create a personalized plan that meets your specific needs and goals. Just as a doctor can help you stay healthy, a financial advisor can help you achieve financial well-being.

Top Ten Financial Mistakes That Could Cost You a Fortune

Money troubles can come in all shapes and sizes, and they can happen to anyone. But there are some financial mistakes that are so common, they’ve become almost like a rite of passage. If you’re not careful, these mistakes could cost you a lot of money – so it’s important to be aware of them and to take steps to avoid them.

In this article, we’ll take a look at ten of the most common financial mistakes people make. We’ll also provide some tips on how to avoid these mistakes and how to get back on track if you’ve already made them.

7. Not getting professional advice

If you’re not sure how to manage your finances, don’t be afraid to seek professional advice from a financial advisor. A good financial advisor can help you create a budget, save for retirement. evaluate your investments and make other important financial decisions.

8. Spending more than you earn

This is one of the most common financial mistakes people make. When you spend more than you earn, you’re essentially digging yourself into a hole that can be difficult to get out of. If you find yourself constantly struggling to make ends meet, it’s time to take a hard look at your spending habits and see where you can cut back.

There are many ways to reduce your expenses, such as cutting back on unnecessary spending, negotiating lower bills, and finding ways to increase your income. If you’re not sure where to start, a financial advisor can help you create a budget and get your spending under control.

Not only will reducing your spending help you get out of debt, but it will also free up some extra money that you can save or invest. And that can help you reach your financial goals faster.

So, if you’re serious about getting your finances in order, make a commitment to spending less than you earn. It’s not always easy, but it’s definitely worth it.

Top 10 Financial Mistakes That Could Cost You Big

Oops, not again! You know that sinking feeling when you suddenly realize you’ve made a big money mistake? Here’s a list of the top ten financial blunders to avoid that could leave a hole in your pocket. Don’t let these common pitfalls trip you up on your path to financial well-being.

8. Not Being Disciplined

Financial discipline is the backbone of achieving your financial goals. It’s not just about having a budget; it’s about sticking to it, rain or shine. Impulse spending is the enemy of saving and investing. It’s like a mischievous little gremlin that tempts you to splurge on things you don’t really need. Control that gremlin by creating a budget and sticking to it like glue.

9. Not Having Enough Emergency Savings

Imagine being caught in a financial rainstorm without an umbrella. That’s what happens when you don’t have an emergency fund. It’s like a financial safety net that can protect you from unexpected expenses, like a leaky roof or a flat tire. Aim for a minimum of three to six months’ worth of living expenses. It’s not easy, but it’s worth the peace of mind. Think of it as your financial parachute—just in case your financial plane hits a bumpy patch.

10. Not Investing Wisely

Investing is like planting a money tree. It takes time and patience to reap the rewards. But if you don’t plant those seeds, you’ll never have a tree to harvest. Start small and gradually increase your investments as you become more comfortable. Don’t put all your eggs in one basket; diversify your investments to spread the risk. Remember, the stock market is like a roller coaster—it has its ups and downs. Don’t panic when the market takes a dive; it’s a natural part of the ride. Just stay invested and let time do its magic.

Top 10 Financial Mistakes That Can Cost You Big Time

Financial planning is crucial for securing a stable and prosperous future, but it’s not always smooth sailing. Along the way, we make mistakes that can potentially derail our financial goals. To help you navigate the complexities of money management, we’ve compiled a list of the top ten financial pitfalls to watch out for.

10. Ignoring Retirement Savings

Retirement may seem like a distant reality, but the earlier you start saving, the more time your money has to grow. Neglecting to set aside funds for retirement can lead to financial hardship in your golden years. Just as a seed planted today can become a mighty tree tomorrow, so too can small retirement contributions compound over time, providing a comfortable nest egg for your future self.

9. Not Learning from Your Mistakes

Mistakes are inevitable in life, financial or otherwise. The key is to learn from them and move forward wiser. If you find yourself making the same financial blunders repeatedly, it’s time to re-evaluate your strategies and seek professional advice if necessary. Remember, even the most seasoned investors have made their share of missteps. The important thing is not to let them define your financial future.

8. Impulse Buying

The allure of instant gratification can lead us to make impulsive purchases that we later regret. Before you swipe your card, take a moment to consider if the item is truly worth the cost. Ask yourself if you’ve researched other options and whether it aligns with your financial goals. A moment of thought can prevent a lifetime of financial headaches.

7. Neglecting an Emergency Fund

Life is full of surprises, and not all of them are pleasant. An unexpected job loss, medical emergency, or home repair can put a significant strain on your finances. Having an emergency fund in place can provide a financial cushion during these trying times, helping you weather the storm without incurring debt.

6. Mismanaging Debt

Debt can be a double-edged sword. While it can be a necessary tool for major purchases like a home or education, uncontrolled debt can quickly spiral out of control. Make sure you understand the terms of your loans, avoid unnecessary borrowing, and prioritize paying off high-interest debt first. Remember, debt is like a heavy backpack; the longer you carry it, the more it weighs you down.

5. Not Having Adequate Insurance

A comprehensive insurance plan is your financial safety net. From health insurance to property insurance, having the right coverage can protect you from unexpected events that could wipe out your savings. Think of insurance as an umbrella on a rainy day; it keeps you dry when the storms of life come knocking.

4. Investing Without a Plan

Investing is a powerful tool for building wealth, but only if it’s done strategically. Don’t jump into the stock market blindly. Take the time to educate yourself, set clear financial goals, and diversify your investments. Remember, the stock market is like a roller coaster; it has its ups and downs, so don’t let it make you lose your head.

3. Not Seeking Professional Advice

Financial planning can be complex, and there’s no shame in seeking professional help. A certified financial planner can provide personalized advice, help you create a workable budget, and guide you towards your financial goals. Think of a financial planner as your financial GPS; they help you navigate the complexities of money management and keep you on track.

2. Living Beyond Your Means

Keeping up with the Joneses can be a dangerous game. Trying to live a lifestyle that’s beyond your means can lead to excessive debt and financial ruin. Create a budget that aligns with your income and stick to it. Remember, financial freedom comes from living within your limits, not exceeding them.

1. Not Budgeting

A budget is your financial roadmap. It tells you where your money is going and helps you make informed decisions about your spending. Without a budget, it’s easy to overspend and get into debt. Create a budget that works for you and track your expenses regularly. Think of a budget as your financial compass; it keeps you on the right financial path and prevents you from getting lost in a sea of debt.

The Top Ten Financial Blunders: A Recipe for Disaster

Mistakes happen. But when it comes to our finances, some errors can have long-lasting consequences. These financial faux pas could derail our dreams, tarnish our credit, and leave us financially vulnerable. It’s time to pull back the curtain on the top ten financial mistakes and learn from the missteps of others. Armed with this knowledge, we can navigate the financial landscape with greater confidence and avoid the pitfalls that have ensnared so many before us.

10: Not Having a Plan

A financial plan is the roadmap to our financial future. It sets the destination, maps out the route, and tracks our progress. Without a plan, we’re like ships adrift at sea, vulnerable to financial storms. A well-crafted financial plan will guide us towards our goals, whether it’s retiring comfortably, buying a dream home, or securing our children’s education.

9: Too Much Debt

Debt can be a double-edged sword. Used wisely, it can help us achieve our financial goals. But when debt spirals out of control, it can suffocate our finances. High-interest credit card balances, excessive student loans, and mortgages that stretch our limits can weigh us down like an anchor. To avoid this financial quicksand, we must use debt judiciously and always remember that debt is a loan that must be repaid with interest.

8: Impulse Spending

That new gadget or designer handbag may seem irresistible, but impulse spending can wreak havoc on our finances. When we give in to the temptation to buy without thinking, we often end up with things we don’t need and regrets that linger. To curb impulse spending, we must create a budget, stick to it, and avoid those enticing “buy now, pay later” schemes that can lead us down a slippery slope.

7: Lack of Emergency Fund

Life is full of unexpected expenses. A job loss, a medical emergency, or a car repair can throw our finances into chaos if we’re not prepared. An emergency fund is a financial safety net that can protect us from these unforeseen events. Aim to save at least three to six months’ worth of living expenses to weather financial storms without sinking into debt.

6: Poor Investment Decisions

Investing is a powerful tool to grow our wealth, but it’s important to approach it with knowledge and caution. Diving into investments without understanding the risks can lead to disastrous losses. Before we invest, we must educate ourselves, seek professional advice when needed, and diversify our portfolio to spread the risk. Remember, investing is a long-term game, and we should avoid chasing quick profits that often come with high risks.

5: Neglecting Retirement Savings

Retirement may seem like a distant reality, but it’s never too early to start saving. The power of compound interest can turn even small contributions into a substantial nest egg over time. Whether it’s through a 401(k), IRA, or other retirement accounts, make saving for our golden years a priority. Remember, retirement is not a vacation but a new chapter in our lives that requires financial security.

4: Failing to Protect Ourselves

Life is unpredictable, and we can’t afford to be caught off guard. Insurance provides a financial cushion against life’s uncertainties. Health insurance, disability insurance, and life insurance can protect us from the financial fallout of illness, accidents, or the loss of a loved one. By investing in insurance, we’re safeguarding our financial future and giving ourselves peace of mind.

3: Procrastinating on Financial Goals

Procrastination is the enemy of financial success. Putting off important financial tasks, such as creating a budget, investing, or seeking professional advice, can cost us dearly in the long run. We must break away from the temptation to delay and take action today to secure our financial future. Remember, time is money, and the sooner we start, the more time our money has to grow.

2: Emotional Spending

Emotions can cloud our financial judgment. When we’re feeling down, we may splurge on a shopping spree or indulge in expensive hobbies to boost our mood. Similarly, when we’re feeling euphoric, we may make impulsive purchases or invest recklessly. It’s crucial to separate our emotions from our finances and make financial decisions based on logic and reason. Emotional spending can lead us down a path of financial ruin.

1: Financial Illiteracy

Financial illiteracy is a major obstacle to financial success. If we don’t understand basic financial concepts, we’re more likely to make poor financial decisions that can haunt us for years to come. Financial literacy empowers us to manage our money effectively, make informed investment choices, and plan for the future. Ongoing financial education is key to unlocking our financial potential. Remember, knowledge is power, especially when it comes to our finances. By understanding the rules of the financial game, we can make informed decisions that will lead us to a brighter financial future.

No responses yet