Defined Benefit Retirement Plan

Retirement can be a daunting prospect, but it doesn’t have to be. With a little planning, you can ensure that you have enough money to live comfortably in your golden years. One option to consider is a defined benefit (DB) retirement plan. These plans are offered by employers and promise to pay a set monthly benefit to retirees, regardless of how the investments perform.

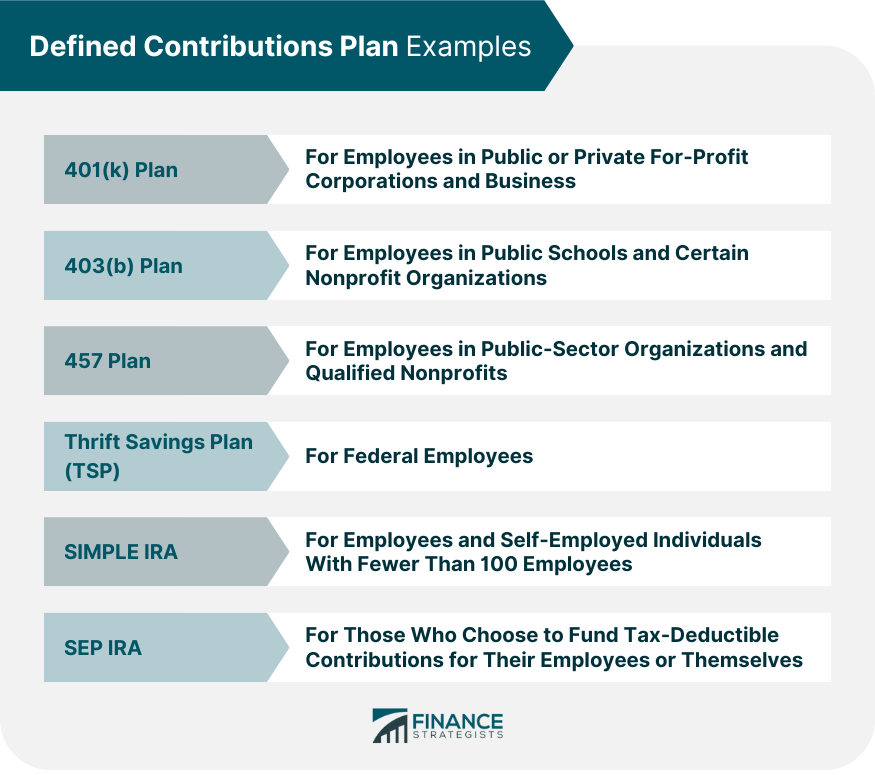

DB plans are different from defined contribution plans, such as 401(k)s and 403(b)s, where the employer contributes a set amount to the employee’s account each year, and the investment performance determines the value of the account at retirement. In a DB plan, the employer assumes all the risk of investment performance, and the employee is guaranteed a set benefit.

How Defined Benefit Retirement Plans Work

The amount of benefits you’ll receive from a DB plan is based on a formula that considers your salary, years of service, and age at retirement. The formula is set by the plan sponsor, usually the employer. Once you retire, you’ll receive a monthly benefit for the rest of your life, regardless of how long you live or how the investments perform.

DB plans are often considered to be more secure than defined contribution plans because the employer bears the investment risk. However, DB plans can also be more expensive for employers to offer, which is why they are becoming less common. If you’re lucky enough to have a DB plan offered by your employer, it’s important to understand how it works and how it can help you reach your retirement goals.

Benefits of Defined Benefit Retirement Plans

There are several benefits to participating in a DB plan, including:

- Guaranteed income for life

- No investment risk

- Potential tax savings

Drawbacks of Defined Benefit Retirement Plans

There are also some potential drawbacks to DB plans, including:

- Can be expensive for employers

- Benefits may be reduced if the plan is underfunded

- Less flexibility than defined contribution plans

Is a Defined Benefit Retirement Plan Right for You?

Whether or not a DB plan is right for you depends on your individual circumstances. If you’re looking for a guaranteed income for life and you’re not comfortable with investment risk, then a DB plan may be a good option for you. However, if you’re looking for more flexibility and control over your investments, then a defined contribution plan may be a better choice.

Defined Benefit Retirement Plans: A Guide for Employees

Defined benefit retirement plans are a type of retirement plan in which the employer promises to pay a specified benefit to the employee at retirement. This benefit is typically based on a formula that considers the employee’s years of service, salary, and age. Defined benefit plans are different from defined contribution plans, in which the employer contributes a set amount to the employee’s account each year and the employee bears the risk of investment performance.

How Does a Defined Benefit Retirement Plan Work?

The employer sets the amount of the benefit based on a formula that considers factors such as the employee’s years of service, salary, and age. For example, a common formula might be to provide a benefit equal to 1% of the employee’s final average salary for each year of service. So, an employee with 30 years of service and a final average salary of $50,000 would be entitled to a benefit of $15,000 per year.

The employer is responsible for funding the defined benefit plan and ensuring that there are sufficient assets to pay the promised benefits. This means that the employer bears the risk of investment performance. If the investments perform poorly, the employer may have to contribute more money to the plan to make up the shortfall. Conversely, if the investments perform well, the employer may be able to reduce its contributions.

Defined benefit plans are typically offered by large employers with stable workforces. This is because the employer must be able to make long-term commitments to its employees and because the plan can be complex to administer.

**Advantages of Defined Benefit Retirement Plans**

* Defined benefit plans provide employees with a guaranteed level of retirement income.

* Employees do not bear the risk of investment performance.

* Defined benefit plans can be a valuable tool for attracting and retaining employees.

**Disadvantages of Defined Benefit Retirement Plans**

* Defined benefit plans can be expensive for employers to fund.

* Employers bear the risk of investment performance.

* Defined benefit plans can be complex to administer.

**Is a Defined Benefit Retirement Plan Right for You?**

The decision of whether or not a defined benefit retirement plan is right for you depends on your individual circumstances. If you are a long-term employee with a stable job, then a defined benefit plan may be a good option for you. However, if you are a short-term employee or if you are not comfortable with the employer bearing the risk of investment performance, then a defined contribution plan may be a better option for you.

Defined Benefit Retirement Plans: A Promise of Future Income

Defined benefit retirement plans, also known as pensions, have been a staple of many workplaces, offering a guaranteed stream of income in retirement. Unlike 401(k) plans, where contributions and investment returns dictate the size of the retirement nest egg, defined benefit plans provide a fixed payment based on years of service and salary.

Who is Eligible for a Defined Benefit Retirement Plan?

Eligibility for a defined benefit retirement plan varies depending on the plan’s specific rules. However, there are some common factors that typically influence eligibility:

-

Job Title: Certain job titles, such as government employees, teachers, and unionized workers, are more likely to have access to defined benefit plans.

-

Length of Service: Employers may set a minimum number of years of service before employees become eligible for the plan.

-

Union Membership: Union contracts often negotiate defined benefit plans as part of the collective bargaining process.

Understanding Defined Benefit Retirement Plans

Defined benefit retirement plans are employer-sponsored plans that provide a predetermined monthly benefit to eligible employees upon retirement. The employer assumes the investment risk and the responsibility of ensuring that the plan is sufficiently funded to meet its obligations to participants.

Advantages and Disadvantages of Defined Benefit Retirement Plans

Advantages:

-

Guaranteed Income Stream: Defined benefit plans offer a guaranteed source of income in retirement, regardless of market fluctuations.

-

Employer Contribution: Employers typically make substantial contributions to these plans, reducing the financial burden on employees.

-

Tax Deferral: Contributions made by both employees and employers are tax-deferred, allowing for tax-free growth until retirement.

Disadvantages:

-

Employer Funding Risk: Employers bear the entire financial risk of funding the plan, which can be significant in times of market downturns.

-

Reduced Flexibility: Defined benefit plans typically offer less flexibility in investment choices and withdrawal options than other retirement accounts.

-

Pension Insurance: In some cases, defined benefit plans may be insured by the Pension Benefit Guaranty Corporation (PBGC), which provides a safety net for participants in the event of plan failure.

Defined Benefit Retirement Plans: Providing Guaranteed Income and Peace of Mind

Are you nearing retirement and concerned about the stability of your future income? A defined benefit retirement plan offers a solution, providing a guaranteed stream of income during your golden years, regardless of market volatility or economic downturns.

Unlike defined contribution plans, such as 401(k)s, where your retirement savings depend on market performance, a defined benefit plan ensures a predetermined benefit based on factors like your salary, years of service, and age at retirement. This stability can be a major source of comfort and peace of mind, allowing you to plan for the future with confidence.

Benefits of a Defined Benefit Retirement Plan

The primary benefit of a defined benefit retirement plan is the guarantee of a fixed income stream in retirement, regardless of market fluctuations. This can be a major advantage over defined contribution plans, which are subject to the ups and downs of the stock market. Additionally, defined benefit plans offer several other advantages:

1. **Reduced investment risk:** Since the plan is managed by a professional investment manager, you don’t have to worry about making investment decisions or managing your portfolio. This can be especially valuable if you’re not comfortable managing your own investments.

2. **Tax savings:** Contributions to a defined benefit plan are made pre-tax, which can reduce your current income taxes. Additionally, the investment earnings on your contributions grow tax-deferred, further increasing your potential retirement nest egg.

3. **Inflation protection:** Some defined benefit plans offer cost-of-living adjustments (COLAs), which can help protect your retirement income from inflation. This can be especially important if you’re planning to retire in the distant future, when inflation could erode the purchasing power of your income.

4. **Higher potential retirement income:** In general, defined benefit plans provide a higher potential retirement income than defined contribution plans. This is because the plan is designed to provide a lifetime of income, regardless of how long you live. In contrast, defined contribution plans are dependent on your investment returns, which can fluctuate over time and may not be sufficient to sustain you throughout your retirement years.

5. **Peace of mind:** Knowing that you have a guaranteed income stream in retirement can provide significant peace of mind. This can allow you to focus on enjoying your retirement years without worrying about how you’re going to pay the bills.

What is a defined benefit retirement plan?

A defined benefit retirement plan is a retirement plan that promises to pay a specific benefit to employees at retirement. The benefit is typically based on the employee’s years of service and salary.

Defined benefit retirement plans are becoming increasingly rare, as employers shift to defined contribution plans, such as 401(k) plans. However, defined benefit plans still offer some advantages over defined contribution plans.

Advantages of a defined benefit retirement plan

There are several advantages to a defined benefit retirement plan, including the following:

-

Provides a guaranteed benefit at retirement

-

May offer a higher benefit than a defined contribution plan

-

Can be more tax-advantaged than a defined contribution plan

Drawbacks of a defined benefit retirement plan

There are a few potential drawbacks of a defined benefit retirement plan, including the following:

1. Expensive for employers

Defined benefit retirement plans can be expensive for employers to maintain. This is because the employer is responsible for making up any shortfall in the plan’s funding.

2. Subject to funding shortfalls

Defined benefit retirement plans are subject to funding shortfalls. This can occur when the plan’s investments do not perform as expected or when the plan’s assumptions about employee turnover and retirement age are incorrect. Funding shortfalls can lead to the plan being terminated or to the benefits being reduced.

3. Limited investment choices

The investment choices in a defined benefit retirement plan are typically limited. This is because the plan’s investments must be conservative in order to ensure that the plan can meet its obligations to its participants.

4. Vesting requirements

Defined benefit retirement plans may have vesting requirements. This means that employees must work for a certain number of years before they are eligible to receive their full benefit.

5. Lack of portability

Defined benefit retirement plans are not portable. This means that employees cannot take their benefits with them if they leave their employer. Contributions to United States Federal plans can be transferred to another government plan such as FERS or CSRS. There have been discussions for the ability to roll over a non-federal governmental plan into a TSP.

- Vesting requirements reduce employee mobility.

- Employees are forced to stay with their current employer in order to avoid losing their retirement benefits.

- Creates a disincentive for employees to start their own businesses or explore other career opportunities.

- Restricts the ability of the workforce to adjust to changing economic conditions.

- Creates a less dynamic and less efficient labor market.

**Defined Benefit Retirement Plans: Understanding the Basics**

Defined benefit retirement plans are employer-sponsored plans that promise to pay a fixed monthly benefit to retirees based on their years of service and salary. These plans are becoming increasingly rare, as they can be expensive to maintain for employers. However, they still offer some unique advantages that can make them attractive to employees.

**How Defined Benefit Retirement Plans Work**

Defined benefit retirement plans are funded by the employer, with no contributions required from employees. The plan calculates a monthly benefit based on a formula that considers the employee’s years of service and final salary. This benefit is guaranteed to the employee, regardless of how long they live or how the investment market performs.

**Advantages of Defined Benefit Retirement Plans**

* **Guaranteed benefit:** Defined benefit retirement plans provide a guaranteed monthly benefit, which can provide peace of mind in retirement.

* **No investment risk:** The employer assumes all investment risk, so employees do not need to worry about losing their retirement savings.

* **Tax benefits:** Contributions to defined benefit retirement plans are tax-deferred, meaning they are not taxed until they are withdrawn in retirement.

**Disadvantages of Defined Benefit Retirement Plans**

* **Expense:** Defined benefit retirement plans can be expensive for employers to maintain, as they must make ongoing contributions to fund the promised benefits.

* **Limited investment options:** Employees do not have investment options in defined benefit retirement plans, so they have no control over the growth of their retirement savings.

* **Subject to funding shortfalls:** Defined benefit retirement plans can be underfunded if the employer does not make sufficient contributions, which can put retiree benefits at risk.

Alternatives to a Defined Benefit Retirement Plan

Other types of employer-sponsored retirement plans include defined contribution plans, such as 401(k) plans, and individual retirement accounts (IRAs).

**Defined Contribution Plans**

Defined contribution plans are employer-sponsored retirement plans that make regular contributions to employee accounts. The employee is responsible for choosing how to invest these contributions, and they can choose from a variety of funds that offer different levels of risk and return.

**Individual Retirement Accounts (IRAs)**

IRAs are individual retirement savings accounts that can be opened by anyone who has earned income. IRA contributions are tax-deferred, and earnings grow tax-free until they are withdrawn in retirement.

**Which Plan is Right for You?**

The best retirement plan for you will depend on your individual financial situation and goals. If you are looking for a guaranteed monthly benefit, a defined benefit retirement plan may be a good option. However, if you want more control over your investment options, a defined contribution plan or an IRA may be better choices.

No responses yet