Introduction

Financial mistakes are as common as the common cold. They can happen to anyone, regardless of age, income, or education level. But just because financial mistakes are common doesn’t mean they’re not serious. In fact, financial mistakes can have a devastating impact on your life, costing you thousands of dollars and years of stress.

That’s why it’s so important to know how to recover from financial mistakes. If you’ve made a financial mistake, don’t panic. There are steps you can take to get back on track. Here’s what you need to do:

1. Admit you’ve made a mistake

The first step to recovering from a financial mistake is to admit that you’ve made one. This can be difficult, especially if you’re feeling ashamed or embarrassed. But it’s important to be honest with yourself about what happened. Once you’ve admitted that you’ve made a mistake, you can start to take steps to fix it.

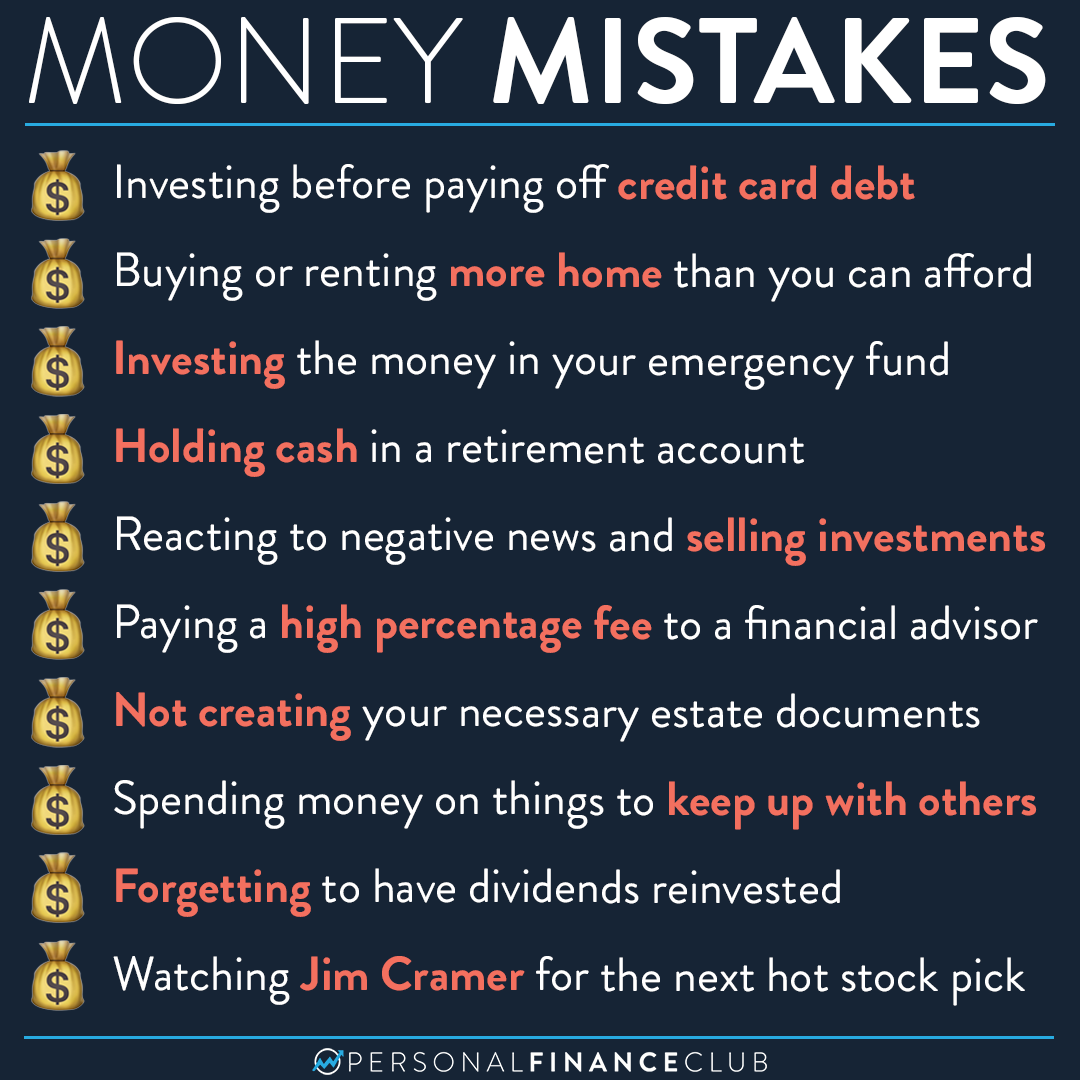

There are many ways to make financial mistakes: Overspending, taking on too much debt, investing unwisely, making poor financial decisions. Regardless of how you got there, the first step to recovery is admitting you’re in a financial hole. This might sound simple, but it can actually be quite difficult. We often try to hide our financial mistakes from ourselves and others, out of shame or embarrassment. But, until you admit you have a problem, you can’t start to fix it.

It can help to talk to a financial advisor, a credit counselor, or even a trusted friend or family member. Talking about your financial mistakes can help you to see them more clearly and to develop a plan to fix them.

2. Learn from your mistakes

Once you’ve admitted that you’ve made a financial mistake, it’s important to learn from it. This means understanding what went wrong and how you can avoid making the same mistake in the future.

There are a few ways to learn from your financial mistakes:

* **Talk to a financial advisor.** A financial advisor can help you to understand what went wrong and to develop a plan to avoid making the same mistake in the future.

* **Read books and articles about personal finance.** There are a lot of great resources available to help you learn about personal finance. Reading books and articles can help you to improve your financial literacy and to make better financial decisions in the future.

* **Take a personal finance class.** There are many personal finance classes available, both online and in person. Taking a class can help you to learn about personal finance and to develop a plan to avoid making the same mistake in the future.

3. Make a plan to fix your mistakes

Once you’ve learned from your financial mistakes, it’s time to make a plan to fix them. This may involve paying off debt, saving money, or investing wisely.

The best way to make a plan to fix your financial mistakes is to talk to a financial advisor. A financial advisor can help you to create a budget, develop a debt repayment plan, and make investment decisions.

4. Stick to your plan

Once you’ve made a plan to fix your financial mistakes, it’s important to stick to it. This may require some sacrifice, but it’s worth it in the long run.

There are a few things you can do to help you stick to your plan:

* **Set realistic goals.** Don’t try to do too much too soon. Start by setting small, achievable goals.

* **Break your goals down into smaller steps.** This will make them seem less daunting.

* **Get support from others.** Talk to your family, friends, or a financial advisor for support.

* **Reward yourself for your progress.** This will help you to stay motivated.

5. Don’t give up

Recovering from financial mistakes can take time and effort. Don’t give up if you don’t see results immediately. Just keep working at it and you will eventually reach your goals.

**How to Bounce Back from Financial Blunders**

We all make mistakes from time to time, but when it comes to our finances, those slip-ups can have serious consequences. If you find yourself in a financial bind, don’t despair. Here’s a roadmap to help you assess the damage, take control of your situation, and start rebuilding your financial footing.

Assess the Damage

The first step is to figure out how much money you’ve lost and what caused the mistake. This may involve reviewing bank statements, credit card bills, and other financial documents. Take your time and be thorough. The more you understand about the situation, the better equipped you’ll be to make a plan for recovery.

Uncover the Root of the Problem

Once you know how much damage has been done, it’s time to dig into the cause of the problem. Was it a single, impulsive purchase? A series of poor budgeting decisions? Or perhaps you fell victim to a scam? Understanding the root of the issue will help you avoid making similar mistakes in the future.

Take Ownership of Your Actions

It can be tempting to blame external factors for our financial mishaps. But the truth is, we’re ultimately responsible for our own money. Trying to shift the blame will only hinder your recovery. Instead, take ownership of your actions and learn from your mistakes.

Create a Realistic Plan

Now that you’ve assessed the situation and identified the root of the problem, it’s time to create a plan for recovery. Be realistic about your goals and don’t try to do too much too soon. Start by setting small, achievable goals. As you make progress, you can gradually increase your goals.

Seek Support If Needed

If you’re struggling to manage your finances on your own, don’t hesitate to seek professional help. There are many resources available, such as credit counseling agencies, financial planners, and non-profit organizations. They can provide you with guidance, support, and accountability.

Remember, recovering from financial mistakes takes time and effort. But by following these steps, you can get back on track and achieve financial well-being.

How to Recover From Financial Blunders

When someone experiences financial setbacks, it might feel like being lost in a maze with no way out. But fear not, for recovery is possible! Here’s a step-by-step guide to help you navigate the path to financial recovery.

Own It

The first step towards recovery is to acknowledge the mistakes you’ve made. Instead of wallowing in guilt or blaming others, take responsibility for your actions. Remember, everyone makes mistakes. The important thing is to learn from them and move forward.

Make a Plan

It’s time to put pen to paper and create a roadmap for your recovery. Start by creating a budget that outlines your income and expenses. Then, develop a plan to pay off your debts and rebuild your savings. Don’t be afraid to seek professional help from a financial advisor if needed.

Minimize Expenses

Now, it’s time to tighten your belt and reduce unnecessary spending. Look for areas where you can cut back, such as dining out, entertainment, or subscriptions. Remember, every penny saved is a step closer to recovery.

Increase Income

Alongside reducing expenses, explore ways to increase your income. Consider taking on a side hustle, asking for a raise, or starting a small business. Every extra dollar you bring in will accelerate your recovery.

Stay Positive

The road to recovery can be bumpy at times. But don’t let setbacks discourage you. Remember, it’s a marathon, not a sprint. Stay positive, keep learning, and don’t give up on your financial goals.

How to Recover from Financial Mistakes

The road to financial recovery can be long and winding, but it is possible to bounce back from financial mistakes. If you’re determined to get your finances back on track, here are a few steps you can take:

Create a budget

The first step to financial recovery is to create a budget. This will help you track your income and expenses, and identify areas where you can cut back. Start by listing all of your sources of income. Then, track your expenses for a month or two, so you can see where your money is going. Once you have a clear picture of your financial situation, you can start to make changes.

Reduce your expenses

Once you know where your money is going, you can start to reduce your expenses. One way to do this is to cut out unnecessary spending. Do you really need that daily latte? Could you cook more meals at home instead of eating out? Take a close look at your expenses and see where you can trim the fat.

Increase your income

If you’re struggling to make ends meet, you may need to find ways to increase your income. This could mean getting a second job, starting a side hustle, or asking for a raise at your current job. If you’re willing to put in the extra work, you can boost your income and get your finances back on track.

Seek professional help

If you’re struggling to manage your finances on your own, consider seeking help from a credit counselor or financial advisor. These professionals can help you create a budget, reduce your expenses, and increase your income. They can also provide you with emotional support and guidance as you work towards financial recovery.

Don’t give up!

Financial recovery can be a long and challenging process, but it is possible to achieve. If you’re committed to making changes, you will eventually reach your financial goals. Don’t give up on yourself! Keep working hard and eventually, you will achieve financial freedom.

How to Bounce Back from Financial Blunders

Money woes are a part of life, but they don’t have to derail your financial future. If you’ve made some financial missteps, don’t despair. Here’s a roadmap to help you recover and get back on track.

Change Your Mindset

The first step towards financial recovery is changing your mindset. Stop beating yourself up for past mistakes and focus on the future. Instead of dwelling on your financial misfortunes, adopt a positive and proactive attitude. Realize that everyone makes mistakes. It’s not about being perfect; it’s about learning from your errors and moving forward. Remember, it’s not always about how much money you make, but how you manage it.

Assess the Damage

Take stock of your financial situation. Gather all your bills, statements, and documents to get a clear picture of your debts, expenses, and assets. Knowing where you stand financially is crucial for developing a plan to get back on your feet.

Create a Realistic Budget

A budget is a crucial tool for managing your finances. Note down every penny you earn and spend. Use this information to create a budget that outlines how you will allocate your income to essential expenses, debt repayment, and savings. Stick to your budget as closely as possible to track your progress and avoid overspending.

Prioritize Debts

If you have multiple debts, prioritize them based on their interest rates and balances. Focus on paying off high-interest debts first to save money on interest charges. Consider consolidating your debts into a single loan with a lower interest rate to simplify your repayment process.

Increase Your Income

Boosting your income can significantly accelerate your debt repayment. Explore ways to earn extra money through a part-time job, freelance work, or online platforms. Increasing your income will provide you with more flexibility to pay off debts faster and save for the future. Consider selling unwanted items, downsizing your living expenses, or negotiating lower interest rates on your debts to free up more cash for debt repayment.

Seek Professional Help if Needed

If you find yourself struggling to manage your finances on your own, don’t hesitate to seek professional help. A financial advisor or credit counselor can provide personalized guidance and support to help you develop a customized plan for debt repayment and financial recovery. They can also negotiate with creditors on your behalf and provide valuable advice to improve your financial situation.

Conclusion

Recovering from financial mistakes takes time and effort, but it is possible. By following these steps, you can regain control of your finances, pay off debts, and build a brighter financial future. Remember, setbacks are part of life, and the key is to learn from them and move forward with a positive and determined attitude.

No responses yet