What Is A 403(B) Retirement Plan?

403(b) retirement plans are a popular way for employees of public schools and certain other tax-exempt organizations to save for retirement. These plans offer a number of tax advantages, including the ability to make pre-tax contributions and to defer paying taxes on the earnings until you withdraw the money in retirement.

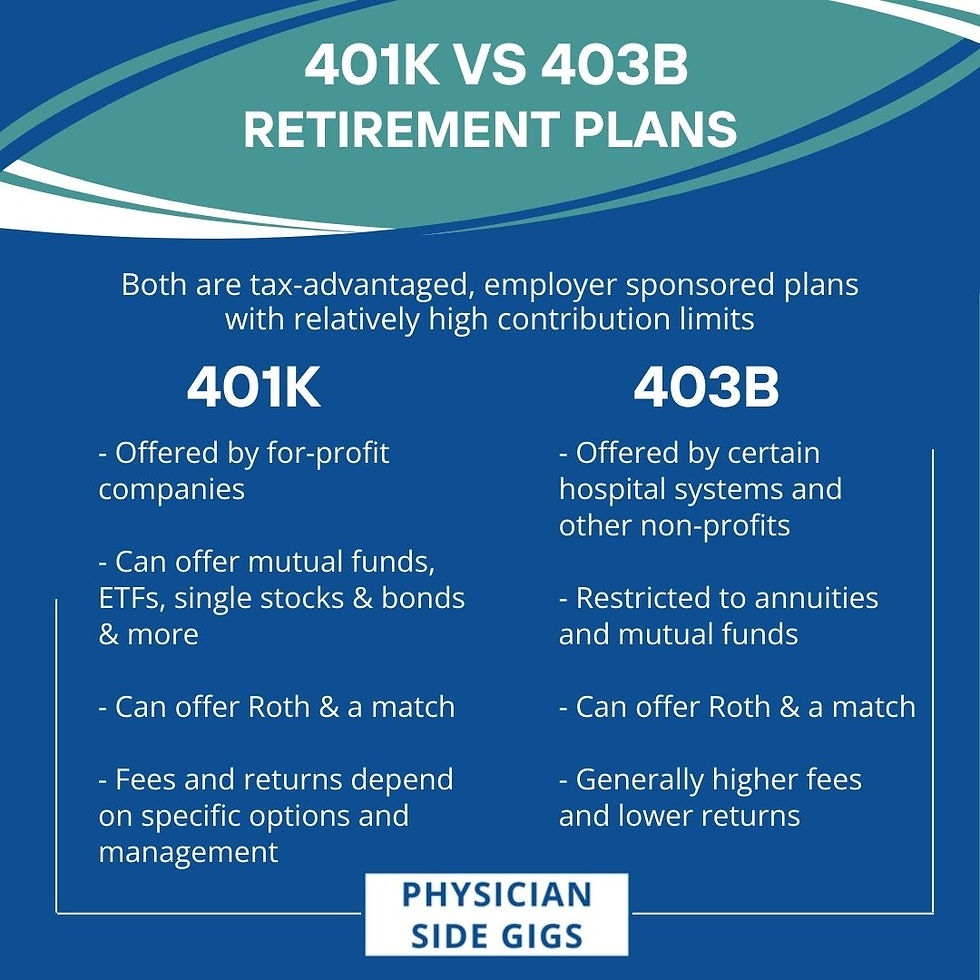

403(b) plans are similar to 401(k) plans, but there are some key differences. With a 403(b) plan, you can only contribute your own money, while with a 401(k) plan, your employer may also contribute money. In addition, 403(b) plans have higher contribution limits than 401(k) plans.

If you are an employee of a public school or other tax-exempt organization, you should consider contributing to a 403(b) plan. These plans offer a number of benefits that can help you save for retirement.

403(b) Retirement Plan: A Guide to Saving for Retirement

If you’re employed by a public school, a tax-exempt organization, or certain other qualifying employers, you may be eligible to contribute to a 403(b) retirement plan. A 403(b) plan is similar to a 401(k) plan, but it’s specifically designed for employees of public education organizations and certain other tax-exempt employers. It offers a number of benefits, including tax-deferred growth, catch-up contributions, and the potential for an employer match.

Benefits of a 403(b) Plan

403(b) plans offer a number of benefits that can help you save for retirement. These benefits include:

Tax-deferred growth: Contributions to a 403(b) plan are made on a pre-tax basis, which means that they are not subject to income tax until you withdraw them in retirement. This can result in significant tax savings over time, especially if you are in a high tax bracket.

Catch-up contributions: If you are 50 or older, you can make catch-up contributions to your 403(b) plan. These contributions allow you to save more money for retirement and help you to catch up if you have fallen behind on your savings.

Potential for an employer match: Many employers offer a matching contribution to their employees’ 403(b) plans. This is essentially free money that can help you to save even more for retirement. You can ask your employer if they offer a 403(b) plan and if they provide matching.

Other benefits: 403(b) plans also offer a number of other benefits, such as the ability to make rollovers from other retirement accounts and the ability to take loans from your account. These benefits can make a 403(b) plan a valuable tool for saving for retirement.

If you are eligible to contribute to a 403(b) plan, it’s a great way to save for retirement. The tax-deferred growth, catch-up contributions, and potential for an employer match can all help you to save more money for your future. Just be sure to talk to your employer about the specific details of their 403(b) plan before you start contributing.

Understanding the 403(b) Retirement Plan

Are you looking for a retirement savings plan that offers tax-advantaged growth? Look no further than the 403(b) plan, specifically designed for employees of public schools and certain tax-exempt organizations. With its flexible contribution options and potential for long-term growth, a 403(b) plan can be a valuable tool for securing your financial future.

Contribution Limits

The Internal Revenue Service (IRS) sets annual contribution limits for 403(b) plans, ensuring that participants contribute within reasonable boundaries. In 2023, the annual contribution limit stands at $22,500. Additionally, participants age 50 and above are eligible for a catch-up contribution limit of $7,500, bringing the total allowable contribution to $30,000.

Investment Options

403(b) plans offer a wide range of investment options, allowing participants to tailor their portfolio to their individual risk tolerance and financial goals. Options typically include mutual funds, annuities, and target-date funds. Mutual funds provide diversification and access to various asset classes, while annuities offer guaranteed income streams in retirement. Target-date funds automatically adjust the investment mix as participants approach retirement, gradually shifting from higher-risk investments to more conservative ones.

Tax Advantages

403(b) plans offer significant tax advantages, making them an attractive savings vehicle for retirement. Contributions made to a 403(b) are typically tax-deductible, reducing your current income tax liability. Earnings on investments made within the plan grow tax-deferred, further compounding your savings potential. However, upon withdrawal in retirement, distributions are subject to income tax.

403(b) Retirement Plans Explained

Are you looking for a tax-advantaged way to save for retirement? If so, you may want to consider a 403(b) retirement plan. 403(b) plans are similar to 401(k) plans, but they are available to employees of public schools and certain other tax-exempt organizations. 403(b) plans offer a variety of investment options, making them a great option for anyone looking to save for retirement.

Eligibility

To be eligible for a 403(b) plan, you must be an employee of a public school or certain other tax-exempt organizations. This includes teachers, administrators, and other employees of public schools, as well as employees of colleges and universities, hospitals, and other non-profit organizations.

Contributions

Contributions to a 403(b) plan can be made on a pre-tax or post-tax basis. Pre-tax contributions are deducted from your salary before taxes are taken out. This reduces your current taxable income, which can save you money on taxes. Post-tax contributions are not deducted from your salary before taxes are taken out, but they may still be eligible for a tax deduction when you file your taxes.

Investment Options

403(b) plans offer a variety of investment options, including mutual funds, annuities, and target-date funds. Mutual funds are a type of investment that pools money from many investors and invests it in a variety of stocks, bonds, or other assets. Annuities are a type of investment that provides a guaranteed income stream for a period of time. Target-date funds are a type of investment that automatically adjusts your asset allocation as you get closer to retirement. You can choose the investment options that are right for you based on your risk tolerance and investment goals.

Benefits

403(b) plans offer a number of benefits, including tax-deferred growth, potential tax savings, and the ability to save for retirement. Tax-deferred growth means that your investment earnings are not taxed until you withdraw them from the plan. This can help your money grow faster over time. 403(b) plans also offer potential tax savings. Contributions to a 403(b) plan can be made on a pre-tax basis, which reduces your current taxable income. This can save you money on taxes now and in the future.

Withdrawals

When you retire, you can withdraw money from your 403(b) plan. Withdrawals from a 403(b) plan are taxed as ordinary income. However, you may be able to avoid paying taxes on your withdrawals if you meet certain requirements. For example, you can avoid paying taxes on withdrawals if you are 59½ or older and you have left your job.

403(b) Retirement Plans: A Comprehensive Guide

403(b) retirement plans, offered by public schools and certain other tax-exempt organizations, are designed to help employees save for retirement. These plans offer tax benefits and investment options similar to 401(k) plans. In this article, we’ll delve into the details of 403(b) plans, including their benefits, contribution limits, and withdrawal rules.

Investment Options

403(b) plans offer a wide range of investment options, including mutual funds, annuities, and target-date funds. Participants can choose investments that align with their risk tolerance and retirement goals. Some plans also offer employer-matching contributions, which can significantly boost retirement savings.

Contribution Limits

The contribution limits for 403(b) plans are adjusted annually by the IRS. For 2023, the annual contribution limit is $22,500. Participants who are age 50 or older can make catch-up contributions of up to $7,500. These limits help ensure that participants can save enough for retirement without overfunding their accounts.

Withdrawals

Withdrawals from 403(b) plans are generally subject to income tax and may also be subject to a 10% early withdrawal penalty if taken before age 59½. However, there are exceptions to these rules. For example, penalty-free withdrawals can be made for certain expenses, such as qualified medical expenses or higher education costs. It’s important to carefully consider the tax implications of withdrawals before making any decisions.

Tax Benefits

403(b) plans offer tax benefits that can help participants save more for retirement. Contributions to 403(b) plans are made pre-tax, which reduces taxable income. Earnings on investments within the plan also grow tax-deferred until withdrawn. This tax-advantaged growth can significantly increase retirement savings over time.

Conclusion

403(b) retirement plans are a valuable tool for public school employees and other eligible participants to save for retirement. These plans offer tax benefits, investment options, and contribution limits that can help participants achieve their financial goals. By understanding the details of 403(b) plans, participants can make informed decisions about how to use these plans to maximize their retirement savings.

What Is a 403(b) Retirement Plan?

A 403(b) retirement plan is a tax-advantaged savings plan for employees of public schools and certain other tax-exempt organizations. Contributions to a 403(b) plan are made on a pre-tax basis, meaning they are deducted from your paycheck before taxes are calculated. This reduces your current taxable income, and the earnings on your investments grow tax-free until you withdraw them in retirement.

Comparison to Other Retirement Plans

403(b) plans are similar to 401(k) plans, but there are some key differences. First, 403(b) plans are only available to employees of public schools and certain other tax-exempt organizations. Second, 403(b) plans have different contribution limits than 401(k) plans. The annual contribution limit for a 403(b) plan is $19,500 in 2023, plus an additional $6,500 catch-up contribution for individuals age 50 or older.

How to Contribute to a 403(b) Plan

You can contribute to a 403(b) plan through your employer. Your employer will typically offer a variety of investment options, and you can choose how to allocate your contributions among these options. You can also choose how much you want to contribute each year, up to the annual contribution limit.

Tax Benefits of a 403(b) Plan

Contributions to a 403(b) plan are made on a pre-tax basis, which means they are deducted from your paycheck before taxes are calculated. This reduces your current taxable income, and the earnings on your investments grow tax-free until you withdraw them in retirement. When you do withdraw money from your 403(b) plan in retirement, it will be taxed as ordinary income.

Investment Options for a 403(b) Plan

Your employer will typically offer a variety of investment options for your 403(b) plan. These options may include mutual funds, stocks, bonds, and annuities. You can choose how to allocate your contributions among these options based on your investment goals and risk tolerance.

Withdrawal Options for a 403(b) Plan

You can start taking withdrawals from your 403(b) plan once you reach age 59½. However, if you withdraw money before age 59½, you will have to pay a 10% early withdrawal penalty, in addition to any income taxes that you owe. There are some exceptions to the early withdrawal penalty, such as if you withdraw money to pay for qualified medical expenses or higher education costs.

No responses yet